The U.S. has been Canada’s largest trading partner for decades. All other nations account for a fraction of the volume, with roughly two-thirds of Canadian exports heading south, according to the World Integrated Trade Solution (WITS). Despite these strong economic ties, the relationship is prone to policy swings, tariffs, and unexpected disruptions. And when trade conditions shift, exporters often feel it first, long before those changes show up in economic reports or public policy debates.

That early impact comes down to how export businesses operate. Timelines are tight, margins are thin, and the ability to keep moving often depends on factors outside your control. A sudden delay at the border or a change in paperwork requirements can trigger a chain reaction: late deliveries, slowed receivables, and cash flow bottlenecks. The pressure is especially high in sectors like food and manufacturing, where supply chains are complex and payment cycles stretch longer than ever.

To manage that risk, many export businesses are turning to a time-tested solution that is surging in popularity: invoice factoring.

Volatility isn’t New, But it’s Getting Harder to Predict

Exporting to the U.S. has never been entirely smooth sailing. Even with formal agreements like NAFTA and the Canada–United States–Mexico Agreement (CUSMA), the rules of trade can shift with little warning. Tariffs can be imposed, lifted, or renegotiated depending on broader political agendas. At the same time, administrative backlogs and compliance changes create friction in day-to-day operations.

For Canadian exporters, that means navigating a system that often moves the goalposts. One month, your goods cross the border without issue. The next, a change in classification or country-of-origin rules, exposes your shipment to unexpected duties. Even when tariffs are temporary, the ripple effects, like strained buyer relationships or increased documentation, can last much longer.

Exporters Face Unique Challenges

Some of the most common pain points for exporters include:

- Border Delays: New inspection protocols, labour disruptions, or inconsistent paperwork requirements can stall deliveries and payment cycles.

- Currency Fluctuations: Shifts in the exchange rate affect the value of receivables, especially when payment timelines stretch beyond thirty or sixty days.

- Tariff Uncertainty: The threat or reintroduction of tariffs forces buyers to renegotiate, delay orders, or demand price concessions that impact your bottom line.

- Hesitant Buyers: When conditions feel unstable, U.S. customers often slow down purchases or push for extended terms, leaving your business waiting on cash that was already counted.

To stay competitive, exporters need financial tools that offer speed, flexibility, and stability, regardless of what happens at the border.

Certain Industries Feel the Strain First

While almost any business involved in cross-border trade is affected by volatility, some sectors are more exposed than others. These are typically industries with narrow timelines, high regulatory oversight, or long supply chains, where even a brief disruption can ripple across production, cash flow, and customer relationships.

Commonly impacted sectors include:

- Food and Beverage: Products are time-sensitive in the food industry, and they face strict inspection and documentation requirements at the border.

- Manufacturing: Long production cycles and dependency on imported components make delays and policy shifts especially costly for many manufacturing businesses.

- Energy: Cross-border infrastructure, fluctuating demand, and policy uncertainty, particularly around pipelines and emissions, can lead to stalled projects and unpredictable receivables in the energy industry.

- Consumer Goods: U.S. retail cycles drive demand, and shipment delays can cause missed windows, returned goods, or chargebacks.

- Wholesalers: Large order volumes and extended payment terms from U.S. buyers can create cash flow gaps that make it harder for wholesalers to replenish inventory or accept new accounts.

- Automotive Supply: Tight delivery windows and long receivables can leave automotive suppliers exposed when demand shifts or payments are delayed by U.S. buyers.

If your business operates in one of these sectors or relies on suppliers who do, the ability to access working capital quickly can make the difference between meeting demand and falling behind.

Strong Cash Flow Management is the First Line of Defense Against Trade Volatility

Trade volatility affects more than pricing or shipping; it also disrupts timing. When payments slow down, orders pause, or terms stretch longer than expected, cash flow suffers. And for export-driven businesses already operating on narrow margins, that can create serious operational strain.

Effective cash flow management reduces exposure to risk by keeping the business ready to respond. Exporters that plan ahead, forecast accurately, and control spending are more likely to stay operational when conditions shift. A strong cash flow strategy gives you the visibility and control needed to move confidently, even when your receivables do not.

Best Practices Help Keep Cash Flow Steady

- Build a Rolling Forecast: Update your cash flow projections regularly to reflect current payment timelines, shipping delays, or unexpected expenses. This helps you spot shortfalls before they affect operations.

- Match Payables to Receivables: Time your outgoing payments based on when income is expected. Prioritize critical costs and work with suppliers on flexible terms when needed.

- Keep a Cash Reserve: Even a modest buffer can buy time when payments are delayed. Reserves help cover payroll, supplier obligations, or shipping costs without borrowing.

- Monitor Customer Payment Patterns: Identify which customers consistently pay late or delay orders. For high-risk buyers, consider deposits, partial prepayments, or shorter terms.

- Review Your Funding Options in Advance: When a gap is unavoidable, having a plan, whether it involves a credit facility, line of credit, or factoring, can prevent a cash flow problem from becoming a delivery failure.

Ensure Your Cash Flow is Predictable in an Unpredictable Market with Factoring

Despite implementing strong cash flow management strategies, many exporters still find themselves with cash flow gaps, especially when there are shifts in trade policy. That’s where invoice factoring for export businesses comes in. It turns your unpaid invoices into cash instantly.

Factoring is a Straightforward Solution for Export Businesses

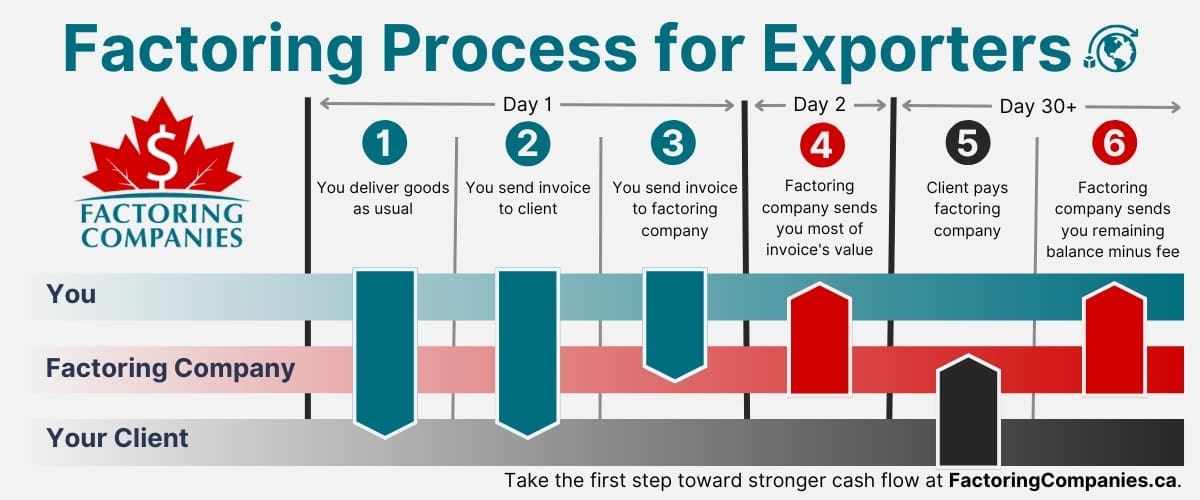

Unlike loans that can take weeks or months to pay out, factoring typically puts cash in your pocket within two business days, though some factoring companies also offer same-day payments. The process usually goes something like this:

- Invoice Issued: You deliver the product or service and invoice your customer as usual.

- Funds Advanced: A factoring company provides most of the invoice value, typically 80 to 90 percent.

- Customer Pays: Your customer pays the factoring company directly, according to the original payment terms.

- Remainder Released: Once the payment clears, you receive the remaining balance, minus a small factoring fee.

Factoring Helps Exporters Deliver, Even When Trade Stalls

When trade slows or payments are delayed, factoring gives your business the liquidity it needs to stay operational and responsive. The benefits are immediate, especially for exporters managing tight production schedules and growing customer demand.

Your Business Benefits from Factoring in Many Ways

Because factoring works differently than other funding solutions, it helps your business in ways they can’t.

- Fulfil Orders on Schedule: Keep goods flowing without waiting for previous invoices to clear.

- Meet Payroll and Overhead Costs: Maintain operations and staff continuity even when cash flow slows.

- Purchase Materials Without Delay: Avoid supply chain gaps by buying what you need when you need it.

- Take On New Customers Confidently: Accept larger or longer-term contracts without straining your budget.

- Avoid Borrowing or Adding Debt: Fund growth without dipping into lines of credit or taking on additional liabilities.

With factoring, exporters are not reacting to trade disruption; they are working through it. The ability to act quickly, fund operations in real time, and maintain delivery schedules can make the difference between losing business and building momentum.

Exporters Use Factoring as a Long-Term Strategy, Too

At first, factoring often starts as a response to a short-term cash crunch. But for many exporters, it quickly becomes a fixture of their financial strategy. Once you experience the flexibility that comes with steady cash flow, it becomes easier to forecast, grow, and take on new opportunities without hesitation.

Unlike loans or lines of credit, factoring grows with your revenue. As sales increase, so does your access to working capital, without taking on new debt or offering up additional collateral. That makes it especially useful in sectors where demand is seasonal or payment cycles are unpredictable.

Factoring Supports Growth Strategies for Export Businesses

Some exporters use factoring to support broader strategies, such as:

- Scaling Production: Investing in equipment, materials, or labour to meet demand without tying up personal capital.

- Negotiating Supplier Discounts: Taking advantage of early payment incentives to reduce overall costs.

- Entering New Markets: Funding pilot shipments or product launches without waiting for revenue to catch up.

When used strategically, factoring helps exporters avoid the trap of short-term thinking. It creates space to plan ahead, build resilience, and grow with confidence, even in unpredictable conditions.

Give Your Export Business the Flexibility it Needs with Factoring

In today’s trade environment, flexibility is everything. Exporters that maintain steady cash flow, adapt quickly, and deliver reliably are the ones that come out ahead, even when conditions are unstable. Invoice factoring is helping Canadian businesses do exactly that.

Factoring Companies Canada can connect you with a provider that understands your industry. Request a complimentary rate quote to get started.

FAQs on Factoring for Export Businesses

Are there funding options for Canadian exporters impacted by sudden tariffs?

Yes. Factoring is one of the fastest ways to access cash when tariffs create payment delays or reduce order volumes. It helps exporters avoid relying on credit or loans.

How do I keep my U.S. export business running if buyers delay payment because of tariffs?

Factoring allows you to get paid right away for invoices you've issued, so even if your U.S. buyers push out payment terms, your business can keep moving.

Can factoring help cover losses or price cuts due to new tariffs?

Factoring does not cover tariff costs directly, but it helps you stay liquid. That means you can absorb pricing adjustments, negotiate with buyers, or pivot quickly without cash flow interruptions.

What’s the fastest way for exporters to get paid when tariffs hit?

Factoring typically provides funding within one to two business days of invoicing. Some factoring companies even provide funding on the same day. This can help you respond to trade disruptions faster than traditional financing.

How can I get paid faster by U.S. customers as a Canadian exporter?

Factoring gives you early access to the funds tied up in your invoices, so you do not have to wait weeks or months for U.S. buyers to pay.

What can I do if border delays are holding up payments from the U.S.?

If shipments are delayed and payments are slow, factoring helps you stay cash flow positive by advancing funds as soon as you invoice.

Is there a way to fund production while waiting for U.S. buyers to pay?

Yes. With factoring, manufacturers and exporters can cover material and labour costs without waiting for payments to clear.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778