The Canadian invoice factoring industry is booming and slated to nearly double in size within the next five years, according to Grand View Research. That means if you’re thinking about switching factoring companies, your options are steadily increasing. In this guide, you’ll learn how to evaluate, exit, and transition smoothly without disrupting cash flow or client relationships.

What to Consider Before Switching Factoring Companies

If you’ve made it to this guide, you no doubt have real and valid reasons to make a change. However, switching factoring companies isn’t like changing a telecom provider or insurance company. There are tangible benefits to having a long-term relationship, and you may experience roadblocks along the way. While these should not be the sole determining factors in whether you switch, they’re things you must consider to ensure you’re making the best possible decision for your business in the long run and that you’re genuinely prepared for the road ahead.

Staying with Your Current Factoring Company is Sometimes Smarter

First, let’s take a look at some of the reasons it might actually be better to stay with your current factoring company, provided what you’re experiencing is just a rough patch and not an ongoing pattern of behaviour that cannot be fixed.

- Familiarity with Your Business: A factoring company that knows your cycles, customer behaviours, and invoicing quirks can fund more smoothly and make better judgment calls when something unusual happens.

- Established Trust with Your Clients: If your customers are already used to the remittance process, changing it introduces a new layer of communication and risk, especially if the new provider handles things differently.

- Less Administrative Overhead: Onboarding with a new factoring company takes time. You will need to review and negotiate a contract, go through due diligence, notify your customers, and possibly adjust your internal processes.

- Opportunity to Negotiate: If your concerns are around speed, support, or factoring costs, there may be room to negotiate. Many factors are willing to adjust terms or assign new account reps to keep a good client.

Challenges Businesses May Face When Switching

Switching factoring companies can be a smooth process without any roadblocks or hiccups. However, there are a lot of working parts involved in a switch, and it is quite likely that you’ll face some challenges along the way.

While we’ll explore how to address these challenges as we move through the steps involved in switching factoring companies, it’s essential to understand the nature of these issues so that you can build tailored solutions to address them.

- Contract Concerns: Many factoring agreements auto-renew and require written notice 60 or even 90 days in advance. If you miss that window, you could be locked in for another year or face early termination fees.

- PPSA Registrations: Due to province-specific guidelines, your factoring company likely filed a lien under the Personal Property Security Act (PPSA). Your new factor cannot fund until that lien is discharged.

- Customer Confusion: Clients who are used to paying your old factor may keep doing so, even after you’ve switched. That creates delays, reconciliation headaches, and potential service issues.

- Customer Contracts or Payor Agreements: Some customers, especially government agencies or large corporations, require you to update billing details in their vendor system. Delays in this process can affect payment timelines.

- Cash Flow Gaps: If there’s even a short delay between your last funding with your old factor and your first with the new one, your business could feel the crunch, especially if payroll or vendor payments are due.

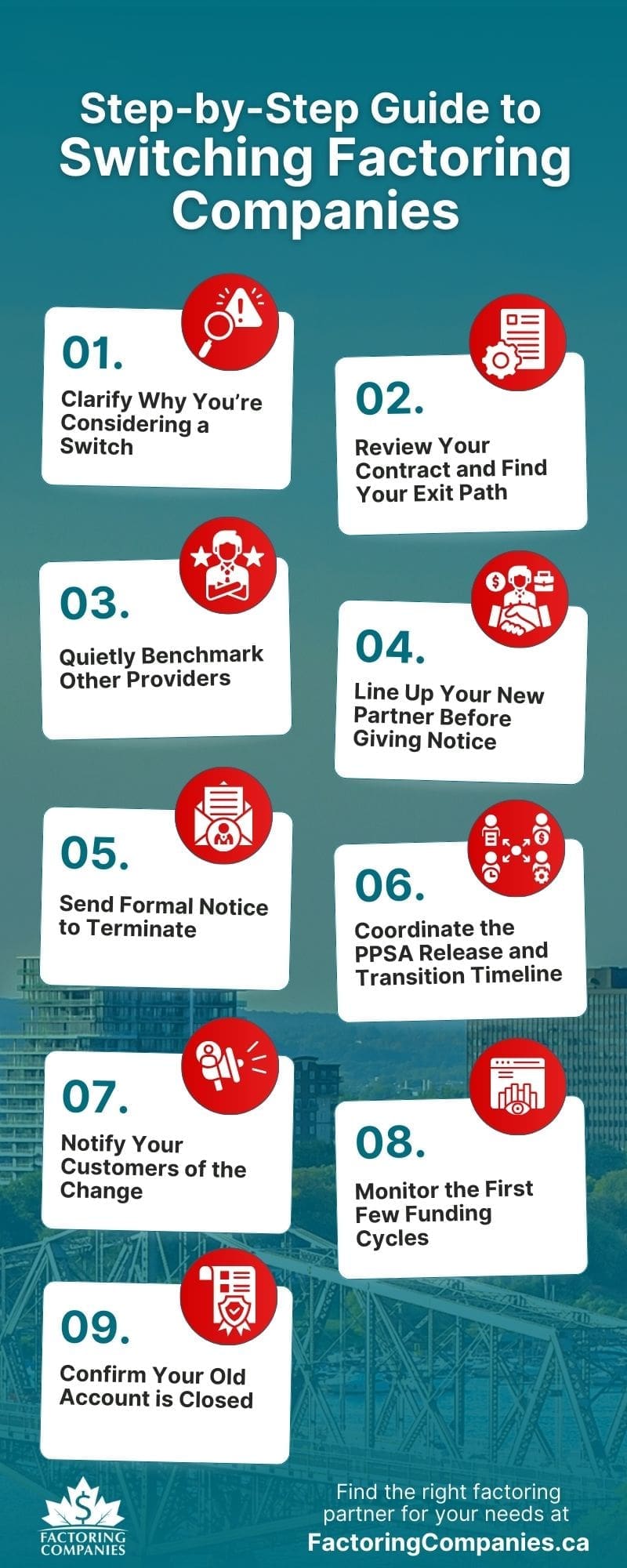

Step-by-Step Guide to Switching Factoring Companies

Now that we’ve covered the background, let’s dig into the specific steps involved in switching.

Step 1: Clarify Why You’re Considering a Switch

Before you set the wheels in motion, get specific about what’s driving your decision and whether you might be able to make things work with your current factoring company.

Common Reasons Businesses Consider Switching

- Slow Funding: Your invoices are being paid late, or the funds are being held longer than expected. Ask whether faster methods (like same-day wire or overnight ACH) are available before assuming this is baked in.

- Unclear or Rising Fees: If your effective rate keeps climbing or new fees keep appearing, request a full breakdown. It may be a sign of poor transparency or just poor communication.

- Inflexible Terms: Minimum volume requirements, long contracts, or mandatory full-receivables factoring might have worked before but may no longer suit your business.

- Poor Communication or Support: If your account manager is unresponsive or you never speak with the same person twice, that can erode confidence fast.

- Lack of Industry Expertise: If you’ve grown or shifted sectors, say from general freight to cross-border logistics, your factor may no longer be the best fit.

- Deceptive Practices or Breached Trust: If your factor has withheld information, mishandled customer payments, or breached contract terms, the relationship may be beyond repair.

How to Talk to Your Factoring Company About Your Concerns

If you’re considering a switch due to service issues, communication problems, or unexpected fees, it’s worth having a direct conversation with your factoring company before making a final decision. Many are willing to adjust terms or improve service to retain long-term clients.

Approach the discussion with clear examples, realistic expectations, and a collaborative tone. The points below can help you prepare.

- Document Specific Issues in Advance: Gather recent examples of missed funding timelines, unreturned messages, invoice errors, or fee discrepancies. This allows you to present concerns clearly without generalizations.

- Ask Whether Alternatives Are Available: Many factors offer faster payment methods, different point-of-contact options, or customized support structures. Ask whether your current setup can be adjusted to better meet your needs.

- Use Professional and Collaborative Language: Avoid ultimatums. Instead, frame the conversation around solving problems. A statement like, “We’ve noticed a few issues that are starting to affect operations. Before we explore other options, we wanted to ask if there’s room for adjustment,” shows your willingness to work together.

- Define What Would Make You Stay: Before the conversation, determine what changes would resolve your concerns. Whether that means quicker payouts, clearer reporting, or a more consistent support team, having specific goals gives the conversation direction.

- Follow Up in Writing When Needed: If you reach a verbal agreement or service change, confirm it in writing. This creates a record and helps avoid miscommunication later.

If your factoring company is responsive and willing to improve, you may be able to resolve the issue without switching. If not, you will have clarity and a head start on your transition.

Step 2: Review Your Contract and Find Your Exit Path

Even if you’re confident about your decision to switch, your contract ultimately determines whether you can do so immediately, at the end of a notice period, or with a financial penalty. Understanding your factoring agreement, including what the contract allows and where it might give you room to move, is essential.

Key Clauses That Affect Your Ability to Switch

Contracts are typically written to reduce risk for the factoring company, but that doesn’t mean they’re inflexible. As you review your agreement, pay close attention to the areas outlined below.

- Termination Timing and Process: Contracts typically require written notice well in advance of your intended exit, often measured in weeks or months. You may also need to follow a specific delivery method, such as sending a registered letter or contacting a designated individual by email. If you don’t follow the process exactly, your notice may not be accepted.

- Early Termination Fees: Some agreements allow for early termination but impose a flat fee or penalty based on anticipated factoring volume. Understanding how the fee is calculated helps you evaluate whether it’s worth paying or better to wait out the term.

- Volume or Exclusivity Requirements: If your agreement includes minimum monthly volumes or requires you to factor all receivables, you may face penalties if those terms are not met before departure. You may need to maintain some level of factoring through the end of the contract to remain in good standing.

- End-of-Contract Procedures: Look for language outlining how outstanding reserves will be released and how the PPSA lien will be discharged. While these issues were introduced earlier, your contract may provide insight into the timeline or steps required to finalize the relationship.

Ways to Exit Your Factoring Contract Without a Penalty

If your factoring company has failed to meet its obligations, you may be able to terminate early without financial consequences, even if the contract is tight. While the specific language varies by agreement, look for performance-related clauses that may justify your departure.

- Service Level Agreement (SLA) Violations: If the company promised specific funding timelines, response times, or deliverables and failed to meet them, that may constitute a breach of contract.

- Material Breach of Agreement: If your factor has withheld funds without explanation, refused to release reserves, or changed fee structures without proper notice, it could be considered a material breach, especially if those actions contradict what’s outlined in the agreement.

- Pattern of Misrepresentation: Repeatedly providing incorrect information, hiding key terms, or failing to disclose PPSA filings can be grounds for ending the relationship without penalty.

- Failure to Perform Core Services: If your invoices are not being funded or your clients are not receiving accurate payment instructions, the provider may be failing to deliver core factoring functions.

If you believe your provider is in breach, seek legal advice before terminating. A legal review of the agreement and your documentation can help you exit cleanly while protecting your business from claims.

Step 3: Quietly Benchmark Other Providers

Once you’ve reviewed your contract and confirmed that switching is possible, or at least worth preparing for, the next step is to evaluate other factoring companies. At this stage, it’s best to explore your options quietly. Until you’ve made a firm decision and confirmed your ability to exit your current agreement, it’s often wiser to avoid signaling a potential departure. This helps keep your existing relationship stable while you gather the information needed to move forward with confidence.

Note that, at this stage, you’re not making a commitment. You’re simply gathering the information you’ll need to make a confident, well-informed decision when the time comes.

- Identify Providers That Understand Your Industry: Seek out factoring companies that specialize in your sector. A provider that regularly works with trucking companies, for example, will have different systems and expectations than one that primarily works with staffing firms or construction businesses.

- Request Sample Agreements and Service Details: Look beyond the rate. Ask for a sample contract, a fee breakdown, and details on reserve policies, customer communication practices, and funding timelines. You’ll want to know exactly how their process compares—not just how much they charge.

- Review Online Feedback and Talk to Existing Clients: Look at independent reviews, Better Business Bureau ratings, and industry forums. If possible, ask for a reference from a current or recent client in a similar industry to learn more about what the working relationship looks like day to day.

- Evaluate Operational Fit: Some factoring companies offer robust client portals, direct integrations with accounting software, or same-day funding. Others offer hands-on customer service and custom reporting. Decide what will make the biggest difference to your business and prioritize accordingly.

- Look for Signs of Stability and Transparency: Avoid providers that are vague about fees, slow to answer questions, or unwilling to provide documentation upfront. The way they handle the early stages of the relationship often reflects how they’ll treat you once you’re under contract.

Want help with this step? Connect with us and we’ll match you with a qualified factoring company.

Step 4: Line Up Your New Partner Before Giving Notice

Once you’ve identified a factoring company that aligns with your needs, take the necessary steps to ensure they’re fully prepared to support your business. This preparation should happen before you give notice to your current provider. Having a new partner lined up in advance reduces the risk of funding delays and operational disruptions during the transition.

- Complete the Underwriting and Onboarding Process: Most factoring companies will conduct due diligence before finalizing the agreement. This may include reviewing your customer list, financial history, average invoice volume, and existing factoring terms. Provide everything requested promptly to keep the process moving.

- Review and Sign the New Agreement: Do not assume the new contract will be better simply because the company seems more responsive. Review all clauses with the same level of scrutiny you applied to your original agreement. Confirm funding timelines, reserve policies, termination terms, and any volume or exclusivity requirements.

- Ensure PPSA Coordination is Understood: Your new provider cannot begin funding until the PPSA lien from your current factoring company has been discharged. Confirm that your new partner is aware of this requirement and has a clear process in place for filing their own lien once the release is complete.

- Confirm Customer Notification Procedures: Your new factoring company will likely send a formal Notice of Assignment to your clients. Review their process in advance so you can manage messaging and ensure your customers understand what to expect.

- Discuss a Transition Timeline: Work with your new partner to establish when funding will begin, how overlapping invoices will be handled, and what documentation needs to be in place. This timeline will help you align your termination date with the start of your new agreement.

Establishing the relationship in advance ensures your business remains financially stable throughout the transition. It also gives your new provider a stronger start, allowing them to serve your business more effectively from day one.

Step 5: Send Formal Notice to Terminate

Once your new factoring company is fully prepared to support your business and you’ve reviewed your existing agreement, it’s time to formally end the relationship with your current provider.

While the responsibility to provide notice is yours, your new factoring company may assist during this process. They may supply a draft letter, advise on timing, or confirm specific language that aligns with standard industry practices. However, you must still follow the instructions in your existing agreement exactly to ensure the termination is valid.

- Follow the Required Format and Delivery Method: Contracts often outline not just the notice period but how the notice must be delivered. Whether the agreement calls for a registered letter, couriered document, or email to a designated individual, be sure you meet every requirement.

- Include the Key Details: Your notice should include the name of your business, the intention to terminate the agreement, the planned final day of funding, and a request for written confirmation. If possible, cite the relevant section of the contract to demonstrate that you’re following the agreed terms.

- Confirm PPSA Discharge Timing and Reserve Release: Request written confirmation of when the PPSA lien will be discharged and how the remaining reserve balances will be handled. This ensures both parties are aligned and helps your new factoring company prepare.

- Keep Communications Professional and Clear: Even if the relationship has been challenging, maintaining a respectful and professional tone will support a smoother transition. You may need the cooperation of your current provider in the weeks ahead.

- Retain a Copy of the Notice and Confirmation: Store all documentation related to your termination, including your notice, delivery receipt (if applicable), and the written confirmation from your factoring company.

Providing formal notice may feel like a formality, but it plays a critical role in protecting your business from contractual disputes and ensuring your transition proceeds without delays.

Step 6: Coordinate the PPSA Release and Transition Timeline

Once notice has been given, your next priority is ensuring a smooth legal and operational transition, starting with the release of your current factoring company’s PPSA registration. Your new factor cannot fund invoices until this is complete, so proper coordination is essential.

- Understand the Role of PPSA in Factoring: Your current factoring company likely registered a lien under the Personal Property Security Act (PPSA) when the agreement began. This filing grants them a legal claim over your receivables and must be discharged before your new partner can file their own.

- Request a Formal Discharge Timeline: In your notice of termination or shortly after, request written confirmation of when the PPSA will be discharged. Some factoring companies will release it immediately after the final payment is received, while others may have internal review processes that take additional time.

- Align the Timing with Your New Provider: Share the estimated discharge date with your new factoring company so they can prepare their own PPSA filing and schedule funding accordingly. If there is likely to be a gap between your final funding and your first deposit with the new provider, plan for it now to avoid cash flow disruptions.

- Clarify the Handling of Overlapping Invoices: Determine whether any invoices will be caught in the middle, funded by your previous provider but not yet paid by the customer. If so, confirm who will be responsible for collections and how payments will be routed until all outstanding balances are cleared.

- Keep Lines of Communication Open: Your new factoring company may coordinate directly with your previous provider regarding lien timing, documentation, or specific customer issues. Stay involved and informed throughout this process to ensure nothing is missed.

The PPSA release is one of the most time-sensitive parts of switching. Addressing it early and following through ensures your business can move forward without unnecessary funding delays.

Step 7: Notify Your Customers of the Change

Once your termination has been accepted and the transition timeline is confirmed, the next step is to notify your customers that payments should now be directed to your new factoring company. This is a routine part of the process, but it must be handled with care to avoid payment delays, confusion, or damaged relationships.

- Coordinate the Notice of Assignment (NOA): Your new factoring company will typically prepare a formal Notice of Assignment, which outlines the change in remittance instructions. This document is sent to your customers to inform them of where future payments should be directed and when the change takes effect.

- Confirm Delivery Methods and Timing: Ask your new provider whether they will send the notices directly, provide them for you to send, or handle the process jointly. In most cases, the notice should be delivered shortly before the first new invoice is issued to avoid conflicting instructions.

- Send a Personal Communication Where Appropriate: For key customers, it’s often worth sending a brief email or making a phone call to explain the change directly. A simple message reassuring them that your operations and service remain unchanged can go a long way in maintaining trust.

- Update All Internal and Customer-Facing Documents: Ensure that all future invoices reflect the new remittance information. If your company uses a customer portal, billing system, or automated invoice templates, update these before issuing the first invoice under your new agreement.

- Clarify the Handling of Invoices in Transition: If there are outstanding invoices funded by your previous factoring company, those payments still need to go to the original provider until they are settled. Make sure your customers are aware of which invoices should go where.

- Monitor Customer Compliance During the First Cycle: Your new factoring company may alert you if a customer submits payment to the wrong account. Promptly follow up with those customers to correct the issue and reduce the likelihood of repeated errors.

Notifying your customers is not just an administrative step; it’s a key part of protecting your cash flow and preserving strong business relationships during the transition.

Step 8: Monitor the First Few Funding Cycles

Even if your transition appears seamless on paper, missteps are most likely to occur in the first few weeks with a new factoring company. Monitoring your funding cycles closely during this period helps you identify and resolve any issues before they impact your operations or client relationships.

- Verify That Invoices Are Being Processed Correctly: Double-check that your invoices are being received, verified, and funded according to the timeline and terms you agreed upon. If there are discrepancies or delays, notify your new provider immediately.

- Ensure Reserve Releases Are on Schedule: Review when and how reserve funds are being released. If the provider is holding reserves longer than expected or applying adjustments, request a breakdown to confirm that everything aligns with your contract.

- Confirm Customer Payments Are Flowing to the Right Place: Keep an eye on collections and remittance activity. If a customer sends payment to your old factoring company by mistake, follow up promptly to redirect them and initiate a transfer of funds if needed.

- Track Fee Deductions and Adjustments: Your first few funding reports will give you insight into how the provider applies fees, discounts, and service charges. Compare actual deductions against your contract to make sure everything is accurate.

- Stay Involved Until Patterns Are Established: While many factoring companies provide online dashboards and daily reports, don’t rely on automation alone during the early weeks. Manually review reports or request summaries to ensure you understand how your receivables are being handled.

- Maintain Internal Communication: Make sure your finance team, bookkeeper, or accounting partner is aware of the new processes and is tracking activity as closely as you are. Aligning internally reduces the likelihood of overlooked discrepancies.

Staying hands-on during this phase gives you the opportunity to catch and correct issues early, before they compound or create operational friction. Once patterns are in place and confidence is built, you can shift back to routine oversight.

Step 9: Confirm Your Old Account is Closed

Once the transition is complete, take time to close the loop with your previous factoring company. Unresolved issues, whether legal, financial, or procedural, can linger if they’re not addressed directly. A formal wrap-up helps protect your business and ensures you are fully released from any remaining obligations.

- Request Written Confirmation of Termination: If you haven’t already received it, ask your previous provider to confirm in writing that the agreement has been terminated and all contract requirements have been fulfilled.

- Verify That the PPSA Filing Has Been Discharged: Check your provincial PPSA registry to confirm that the lien has been removed. If it remains active after your final payment and reserve release, follow up until you receive confirmation that it has been discharged.

- Confirm All Reserves Have Been Returned: Factoring companies typically hold a portion of funds in reserve to cover customer non-payment or chargebacks. Once all outstanding invoices have been paid, ensure the remaining balance has been released and transferred back to your business account.

- Request a Final Statement of Account: Ask for a full breakdown of your account activity, including the final reserve payout, any remaining fees or adjustments, and the account’s closing balance.

- Archive Documentation for Future Reference: Save all correspondence, payment records, and closure documents for your internal files. If questions arise later, such as from an auditor, lender, or customer, you’ll have a clear record of how and when the relationship ended.

Once your account is fully closed and documented, you can move forward with confidence, knowing that your business is no longer contractually or financially tied to your previous provider.

Get Help Finding Your Next Factoring Company

If you’ve decided it’s time to move on and are ready to hear what other factoring companies have to offer, we can streamline the search by matching you with vetted factoring partners. Share a few details about your business to take the next step.

FAQs on Switching Factoring Companies

What steps should I take before leaving my current factoring provider?

Start by reviewing your contract to understand notice periods, termination clauses, and financial obligations. Then, benchmark new providers, complete onboarding with your chosen partner, and coordinate the PPSA release. Only give notice once you have a clear exit path and a transition plan in place.

Can I cancel a factoring contract early without paying penalties?

It depends on your agreement. Some contracts allow early termination without penalty if the factor fails to meet service obligations or breaches key terms. Others impose flat fees or volume-based penalties. Review your contract carefully and seek legal advice if you believe your provider hasn’t met its obligations.

What are common contract terms to review before switching factoring companies?

Key terms include notice periods, early termination fees, volume requirements, exclusivity clauses, and PPSA lien language. These determine when and how you can leave. Understanding these details upfront helps you time the transition correctly and avoid penalties or delays in releasing funds or receivables.

How do I get my PPSA lien released when changing factoring providers?

Your current factoring company must discharge the lien after your final invoices are paid and the relationship is closed. Request written confirmation of the release timeline and follow up through your provincial PPSA registry. Your new factor cannot fund until this lien is officially removed.

Should I tell my current factoring company that I’m thinking about switching?

Not initially. It’s better to explore your options quietly until you’re confident in your decision and have reviewed your contract. Premature notice can complicate the transition. However, if you’re open to staying, it’s worth raising concerns to see if the provider can address them.

How do I notify customers when I change factoring companies?

Your new factoring company will typically prepare a Notice of Assignment for your customers. It’s best to follow up personally with key clients to explain the change and confirm the new remittance details. Be sure all invoice templates and systems are updated to reflect the switch.

Can a new factoring company help me terminate my old contract?

Most new providers offer guidance, including suggested language for termination letters, timing recommendations, and support with lien coordination. While they don’t terminate the contract for you, they can help you meet all requirements and avoid common missteps during the transition.

What should I watch for during the first few funding cycles with a new factor?

Verify that funding timelines, reserve releases, and fees align with your contract. Check that customer payments are routed correctly and that reporting is accurate. Stay hands-on until you’re confident in how the new system operates and that there are no early communication gaps.

Why do businesses switch factoring companies in the first place?

Common reasons include slow funding, poor communication, unclear fees, inflexible terms, or lack of industry expertise. In some cases, a business has outgrown its original provider and needs better tools or more responsive service. Trust, speed, and transparency often drive the decision to switch.

How long does it take to switch factoring companies?

The full process typically takes two to four weeks, depending on notice requirements, PPSA discharge timing, and how quickly the new provider completes onboarding. Planning ahead and coordinating both providers early can significantly reduce delays and protect your cash flow throughout the transition.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778