Making that trip to the mailbox can be absolutely draining when you’re just a hair away from making payroll or covering another crucial expense and just need one single client to pay. It’s not worth taking out a loan or getting tangled in a long-term commitment, but if that receivable doesn’t come in soon, you know you’re left with no other choice… or are you? Single invoice finance, sometimes called spot factoring or selective invoice factoring, is perfect for situations like this. We’ll walk you through how it works, some of the benefits, and how to get started on this page.

What is Spot Factoring?

One in four small businesses has a cash reserve buffer of 13 days or less, JP Morgan reports. This doesn’t leave much room for late payments or unexpected issues. Spot factoring fills short-term cash flow gaps by allowing your business to sell individual invoices to a third-party company, known as a factor, for immediate cash.

Single Invoice Factoring vs. Single Invoice Finance

Single invoice factoring and single invoice finance both turn your unpaid invoice into immediate cash. However, factoring does so by allowing you to sell the invoice, whereas financing involves receiving a loan that uses the invoice as collateral. Factoring does not create debt. Financing does. The information contained on this page focuses on factoring rather than financing.

Spot Factoring vs. Traditional Invoice Factoring

Spot factoring and traditional factoring are both tools that can help your business manage cash flow by selling accounts receivable (invoices) to a third party. However, there are distinct differences between the two that make each suitable for different types of business needs.

Invoice Selection

- Spot Factoring: This method allows you to select specific invoices to factor on a case-by-case basis. It offers a high degree of flexibility, as you can choose which invoices to sell based on immediate cash flow requirements.

- Traditional Factoring: In contrast, traditional factoring generally involves the sale of a substantial portion of your company’s receivables or even all of them. It’s a more comprehensive approach where your business agrees to factor multiple invoices regularly.

Commitment and Contract

- Spot Factoring: There is typically no long-term commitment required. Each transaction is treated as a standalone agreement, so your business is not locked into ongoing obligations.

- Traditional Factoring: This usually involves a contract that stipulates the terms under which invoices will be factored, often requiring a business to commit to factoring invoices for a specified period or to a minimum volume of invoices.

Costs and Fees

- Spot Factoring: Because it’s used selectively, the fees may be higher per invoice compared to traditional factoring. The factor assumes more risk by not having a broader insight into the business’s receivables. However, because you’re choosing to factor on a case-by-case basis, your overall costs may be lower.

- Traditional Factoring: The fees might be lower per invoice due to the volume and regularity of the transactions. The factor can better assess the risk associated with the ongoing business and invoice history.

Control and Relationships

- Spot Factoring: Your business maintains more control over customer relationships, as you can decide which invoices to factor and potentially limit customer awareness of the factoring arrangement.

- Traditional Factoring: Factors handle the collections process for all factored invoices, so customers are usually aware that their invoices are being factored.

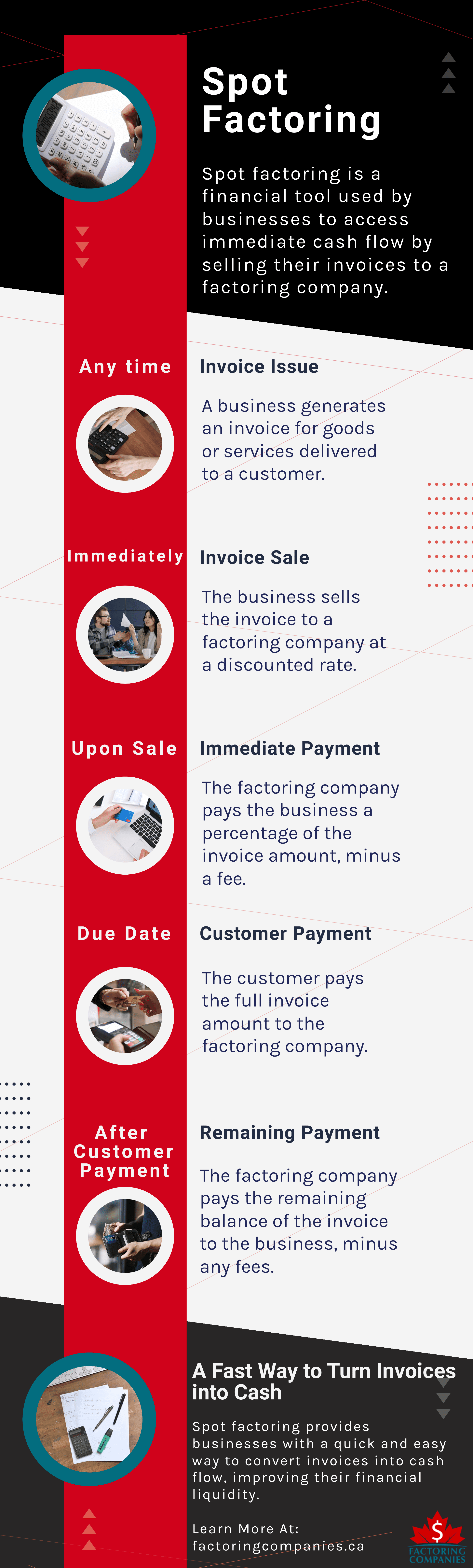

The Spot Factoring Process

Let’s take a quick look at how the spot factoring process typically works.

- Invoice Issuance: Your business completes a service or delivers goods to a customer and issues an invoice for that specific transaction.

- Invoice Sale: Instead of waiting for the customer to pay within their payment terms, which could be 30, 60, or even 90 days, you sell this invoice to a factoring company.

- Immediate Payment: The factoring company pays you up to 95 percent of the invoice’s value upfront, depending on the agreement.

- Customer Payment: The factoring company takes over the management of the receivables. When your customer pays the invoice, they pay directly to the factoring company.

- Remaining Payment: Once the factor receives the payment from the customer, they release the remaining balance of the invoice to you, minus a small fee for their services.

Easy Steps to Apply for Spot Invoice Financing

Applying for spot invoice finance is straightforward, offering businesses a flexible way to improve cash flow. Follow these steps to get started:

Step 1: Identify Invoices You Want to Fund

Choose specific, outstanding invoices that align with your immediate cash flow needs. These should come from creditworthy clients and meet the finance company’s eligibility criteria. Ensure the invoice amount and original payment terms are clear, as these factors determine funding terms like the advance rate and repayment conditions.

Step 2: Research and Choose a Finance Company

Look for a finance company with experience in spot invoice finance or accounts receivable financing. Compare funding options, fees, and advance rates to ensure the best fit for your business. A company that provides tailored solutions for your industry can help you maximize the value of your invoices while meeting your working capital goals.

Step 3: Submit Your Application

Complete a straightforward application process, often online. Provide details such as the invoice value, customer information, and original payment terms. Many companies offer quick access to cash, with approvals and funds disbursed within 24 hours.

Step 4: Review Terms and Finalize the Agreement

Once approved, review the terms and conditions carefully. Confirm the service fee and repayment terms align with your needs. The process is designed to be transparent, ensuring businesse

s that trade on credit can use invoice financing with confidence.

Step 5: Receive Funds and Maintain Cash Flow

After approval, receive up to 90% of the invoice value upfront, depending on the advance rate. The remaining balance, minus fees, is released once your customer pays. This financing solution allows businesses to access funds tied to receivables without taking on debt, supporting stable cash flow.

Avoiding Common Mistakes in Spot Factoring Applications

Spot factoring is a valuable solution to better manage cash flow, but businesses must avoid common errors to maximize its effectiveness. By addressing these potential pitfalls, businesses across industries can use selective invoice finance confidently and without long-term commitments.

1. Choosing the Wrong Invoices to Finance

Instead of factoring every invoice, focus on invoices to finance based on cash flow needs. To secure favorable terms, prioritize high-value invoices tied to creditworthy customers. Factoring low-value or high-risk receivables can reduce the percentage of the invoice value offered and increase fees, leading to less efficient cash flow management.

2. Failing to Review Terms Carefully

Understanding agreement details is critical. Ensure you know if the agreement involves non-recourse factoring, its impact on your sales ledger, and any hidden costs. Clear terms help businesses align financing options with their goals and avoid surprises.

3. Submitting Incomplete Documentation

Missing or inaccurate details, like invoice amounts or payment terms, can delay funding. Ensure the invoice is approved, and documentation is complete to get quick access to cash, often in as little as 24 hours.

4. Overlooking Spot Factoring Company Credentials

Partnering with a reliable spot factoring company familiar with your industry ensures seamless processing. Choose a provider who understands your market and can efficiently process invoices for financing.

By addressing these issues, businesses can avoid cash tied up in unpaid invoices and invest in growth opportunities while optimizing the benefits of spot factoring.

Benefits of Spot Factoring

Spot factoring offers several advantages, particularly attractive to small and medium-sized businesses that need flexibility in managing their cash flow. Let’s review some of the key benefits.

Immediate Cash Flow Improvement

Your business can convert their invoices into immediate cash, often within 24 to 48 hours. This is crucial for covering immediate expenses such as payroll, supplier payments, or emergency repairs without waiting for customers to pay within their standard credit terms.

Flexibility

Your business chooses which invoices to factor based on your current cash needs. This is particularly useful for companies that do not have a constant requirement for cash or those that experience seasonal fluctuations in their business.

No Long-Term Commitments

Unlike traditional factoring, which may require committing to factor a certain volume of invoices, spot factoring is transactional, allowing your business to use it as needed without ongoing obligations.

Improves Credit Management

By factoring invoices from customers who may take longer to pay, your business can effectively manage credit risk and reduce the burden of chasing payments so you can focus more on core business activities.

Avoids Debt

Spot factoring does not create debt on your balance sheet, as it’s simply an advance against sales already made. This can be a significant advantage if you want to maintain a healthy balance sheet or avoid additional financial leverage.

Saves Time and Administrative Costs

The factoring company typically takes over the management of the factored invoices, including collection from customers, which saves a typical business around 14 hours per week, according to Intuit surveys.

Customer Credit Analysis

Factoring companies usually conduct credit checks on clients, providing an additional layer of security and insight regarding the creditworthiness of your customers.

Signs Spot Factoring May Be Ideal for You

While spot factoring can be ideal in many different situations, there are times when it really shines. Below, we’ll cover a few signs that indicate spot factoring might be ideal for you.

You Have Cash Flow Shortages Due to Slow-Paying Customers

If your business experiences cash flow issues because customers are slow to pay, spot factoring can provide immediate liquidity. This is especially common in industries where long payment terms are standard, such as manufacturing, construction, and

You Need Quick Cash Infusions to Seize Opportunities

Businesses often need quick access to funds to take advantage of opportunities, such as bulk-buy discounts from suppliers or the need to fulfill a large order. Spot factoring allows you to capitalize on these opportunities without waiting for customers to pay their invoices.

You Have Limited Access to Traditional Financing

Newer businesses or those with limited credit history may struggle to secure traditional bank loans. Spot factoring can be a viable alternative, as the decision to factor is based more on the creditworthiness of the invoice’s debtor rather than the business itself.

You Experience Seasonal Demand Fluctuations

Businesses that experience seasonal variations in sales may find spot factoring helpful for managing off-peak cash flow needs. It provides flexibility to factor invoices only when necessary, aligning funding needs with actual business cycles.

You’re Reluctant to Take on Debt

Spot factoring is not a loan; it’s an advance on receivables. For businesses that want to keep debt levels low while still managing cash flow, spot factoring is an attractive option as it doesn’t add liabilities to the balance sheet.

You’re Experiencing a Rapid Growth Phase

Companies experiencing rapid growth often find that their expenses and receivables grow faster than their incoming cash. Spot factoring can bridge this gap, providing the cash needed to sustain operations and grow without interruption.

You Want to Avoid Long-Term Commitments

If your business is not interested in long-term factoring contracts due to uncertainty about future cash flow needs, spot factoring offers a no-commitment solution that can be utilized on an as-needed basis.

Get Matched with the Right Factoring Company for Your Needs

Not every factoring company offers spot factoring. It can sometimes be challenging to find one that does and that also understands your industry. That’s where Factoring Companies Canada comes in. Whether you need spot factoring, traditional factoring, or you’re not sure yet, We’re happy to match you with the right factoring company for your needs. To get started, request a complimentary factoring quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778