You have lots of options when choosing a factoring company. Knowing which is the right fit for your business can be challenging, especially when comparing multiple factoring companies that all seem good. This page will help you find clarity fast. We’ll walk you through important considerations for choosing a factoring company and provide you with a printable checklist to streamline your search.

1. How Long Has the Factoring Company Been Operational?

The factoring industry is valued at CAD $3.7 billion now and is expected to hit $8.1 billion by 2032, according to The Brainy Insights. While part of this boom can be attributed to more businesses leveraging factoring, the exponential growth can also be attributed to a surge in new factoring companies.

As a business owner or leader, you don’t need to be reminded of the struggles that new businesses face. If you want a better, more streamlined experience, it’s best to work with a company that’s been operating for a longer period.

2. Do They Have the Ability to Support Your Funding Needs as You Grow?

One of the most overlooked factors to consider for factoring company selection is whether they’re actually able to support your funding needs as you grow. For instance, perhaps you run a construction company, and your typical invoice is only $50,000 or $100,000 now, but as your business grows and you can secure more lucrative contracts, some invoices will be closer to $500,000.

If there’s a chance your needs will grow as your business does, either in terms of invoice volume or value, confirm that any factoring companies you’re considering will be able to support your needs as you grow.

3. What Will Your Factoring Rate Be?

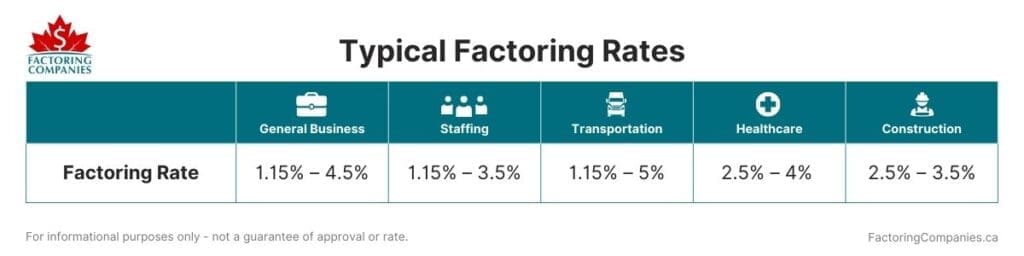

Your total cost of factoring is primarily influenced by your factoring rate. A typical factoring rate is between one and five percent of an invoice’s value, though it varies based on your industry, the service options you select, and other details.

Focus more on finding a competitive factoring rate than the lowest possible rate. This will help you keep more money in your pocket without compromising the level of service you and your customers receive.

4. What Will Your Advance Rate Be?

Factoring companies advance between 60 and 80 percent of an invoice’s value. There are variances across industries. For instance, those in the transportation industry can sometimes be advanced up to 96 percent of an invoice’s value. You may also see differences depending on the value of your invoices and other considerations.

Advance rates can also influence factoring rates. If you’re comparing factoring companies, ensure the terms offered are the same or at least be aware of the differences to make an informed decision.

5. Are You Required to Factor a Minimum Number (or Value) of Invoices?

Factoring is typically a very flexible funding solution. You can sign up, factor and invoice, and then never factor again, or you can factor all your invoices. However, some factoring companies require you to meet volume requirements on a monthly basis.

Because this approach is usually used in conjunction with lower rates or a discount, minimums may only be a deal-breaker for businesses that aren’t sure how often or how much they’ll factor. However, it’s something to watch for as you connect with different companies.

6. How Quickly Will They Pay Your Advance?

One of the most important considerations when choosing a factoring company is how quickly they’ll pay you. Most factoring companies pay by ACH, which means cash should be deposited into your bank account within two business days of your invoice being approved.

Others offer accelerated payment options, such as next-day or same-day payments via wire transfer, though there is often a small fee for the expedited service.

If timing is essential for your business, determine which payment options are available and how quickly they validate invoices. It’s also helpful to establish what happens if the factoring company fails to meet their obligations., particularly if you may ever leverage factoring for something time-sensitive like payroll.

7. Do They Offer the Level of Risk Mitigation You Need?

Your factoring company will help keep the risk of invoice non-payment low by providing customer credit checks. However, there will always be some risk that one of your customers does not pay an invoice.

Most factoring companies offer recourse factoring, which means your company is liable for the balance if this happens. Each factoring company has its policies in these cases. For instance, you may be required to submit another invoice in place of the unpaid invoice or pay back the advance.

Conversely, you can search for a factoring company that offers non-recourse factoring. This means the factoring company absorbs the loss when an invoice goes unpaid. It is the more expensive option of the two, so it may only be worth looking into if your business cannot afford to lose out on payment for a single invoice or you work in a riskier industry.

8. Do They Offer Back-Office Services?

Outsourcing some of your back-office tasks to your factoring provider can often save your business time and money. For example, virtually all factoring companies provide collections services. Some offer invoice preparation services as well.

Confirm which additional back-office services can be provided and whether they provide value to your business. While they may not be key factors in selecting a factoring service provider, they can make deciding between two similar options easier.

9. Do They Have Industry-Specific Expertise?

It’s always best to go with someone who understands your industry when choosing a factoring company. An organization with industry expertise will be more familiar with your business’s challenges and how to overcome them. They’re also more likely to offer additional services specific to your industry that can help your business grow. For example, freight factoring companies sometimes offer fuel discount cards and load boards.

You’ll also want an industry specialist if your needs are likely to change as your business grows. For instance, some offer equipment leasing and financing. You’ll likely get a better deal and more funding if the company understands the value of what you’re buying and how it helps you generate revenue.

10. Do They Have a Strong Reputation?

Check into reputation when choosing a factoring company. The experiences other businesses report can help you gauge what your experience will be like. This includes reviewing any testimonials or case studies the company provides and reviewing sites. It may also be helpful to explore whether the factoring company belongs to professional organizations. Although this doesn’t guarantee a good reputation, those who put forth the effort and create ties are more likely to be committed to serving their clients well or have additional expertise.

11. What is Their Level of Customer Service and Support?

When you have a question or need help, will you call a general service line or have a dedicated account manager? How quickly do they respond, and what’s their approach to resolving issues?

While you may still get decent service by calling a general support line, factoring companies that provide you with a single point of contact or account manager often provide superior support.

12. How Do They Handle Communication?

Communication comes in a variety of forms. Having a dedicated account manager is a good start, but it’s better if you have access to self-service tools, such as a mobile application or online portal. These often allow you to submit invoices online, track payments, and see account information in real-time. That way, you can get information whenever you need it.

Get Help Choosing a Factoring Company

If you prefer to explore your factoring options independently, feel free to leverage our checklist as you reach out to individual companies. If you’d like to streamline the process, we’re happy to match you with a factoring company specializing in your industry and offering competitive rates. Request a free factoring quote to get started.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778