The advantages of invoice factoring for manufacturers cannot be overstated. However, if you’re new to the concept, you probably have many questions about factoring and why it’s such a good fit.

On this page, you’ll learn why managing cash flow is so difficult in the manufacturing industry, even when you’re doing everything right, plus how factoring works to solve those issues and help companies like yours grow.

Why Cash Flow Management is Difficult in Manufacturing

Manufacturing is Canada’s second-largest industry as measured by GDP contributions, Investopedia reports. The industry has grown more than 16 percent over the past year and now sits at around $738 billion, with food manufacturing leading the pack at $129.8 billion, per Statistics Canada. While this speaks to the growth potential for manufacturing businesses throughout the country, far too many manufacturers, especially smaller ones, won’t realize their potential due to cash flow issues.

Cash flow refers to the money flowing in and out of your business, and it’s just as important as profit. After all, it doesn’t matter if your sizeable corporate client is sending a check next month if you can’t cover payroll or perform vital upgrades on your equipment today.

Unfortunately, industry conditions don’t make it easy to manage cash flow. Most manufacturers struggle with cash flow due to one or more of the following issues.

Thin Margins

After distributors and wholesalers take their cut, there’s often little profit left for the manufacturer to carry into the next production cycle.

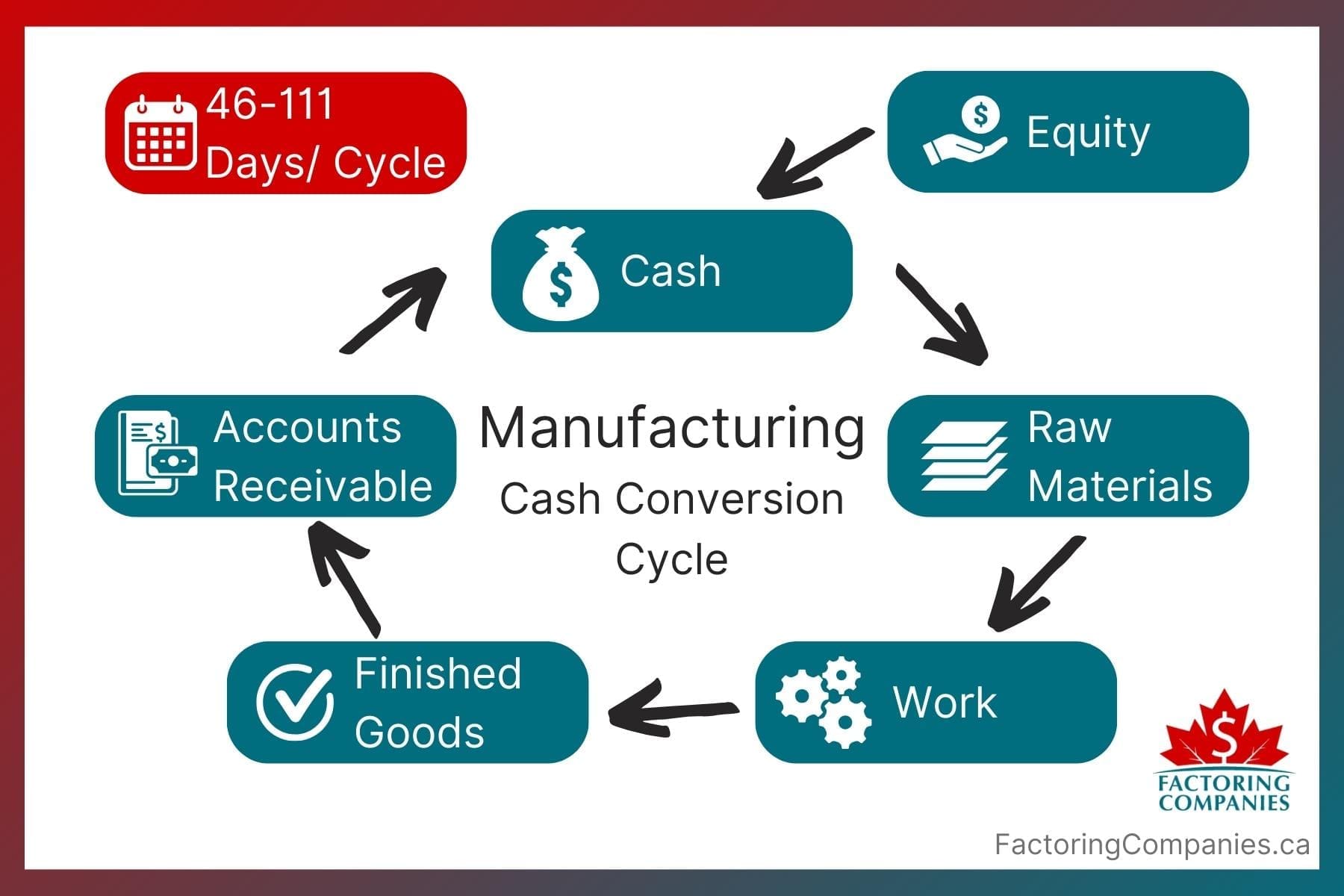

Long Cash Conversion Cycles

Even if you’re handling receivables in manufacturing comparatively well, the time to convert your investment into cash is relatively long. The complete cash conversion cycle takes anywhere from 46 to 111 days on average, experts at North Shore report. That means the little capital you could tuck away from the last cycle may be dwindling or gone by the end of the current one.

Inconsistent Revenue

Seasonal fluctuations in manufacturing and downtime between cycles can make it difficult to predict when revenue will come in and how much will arrive.

Constant Development and Upgrades

Reinvesting in manufacturing technology is essential to maintaining efficient operations and strong relationships with distributors and wholesalers. However, these upgrades can be expensive, and the best time to make improvements is when things are slower.

Options in Alternative Financing for Manufacturers

There are many cash flow solutions for manufacturers. Comparing financing options before you commit will help ensure you make the best choice for your company so you can confidently move forward.

Traditional Loans

Traditional bank loans tend to be the first funding solution businesses explore. They’re also usually the most affordable option. However, bank loans can be challenging to obtain for small businesses and those without solid credit.

Asset-Based Lending

If you don’t have strong enough credit or meet all bank criteria for a traditional loan, you may still qualify for asset-based lending. You’ll use an asset as collateral to secure the loan. This can work if you have valuable equipment and your lender understands its worth, but finding a lender specializing in manufacturing can be difficult. For this reason, many small business owners use their personal assets, such as their homes, as collateral.

Credit Cards

Although limits aren’t generally high enough for significant expenses such as materials or payroll, commercial credit cards can help with incidentals. It’s best to pay them off in full every month because interest rates are high, and it’s easy to get trapped in a cycle of debt.

Lines of Credit

Another option is a secured or unsecured line of credit. It works like a credit card but usually has a lower interest rate and higher limit. However, the qualification process is similar to obtaining a loan.

Invoice Factoring

Although invoice factoring isn’t often discussed, it’s a popular form of business funding. Instead of borrowing money, you sell your unpaid B2B receivables to a factoring company at a discount and receive immediate payment. Most businesses qualify because factoring companies are more concerned with the creditworthiness of the company paying the invoice than the one selling the invoices.

How Factoring for Manufacturers Works

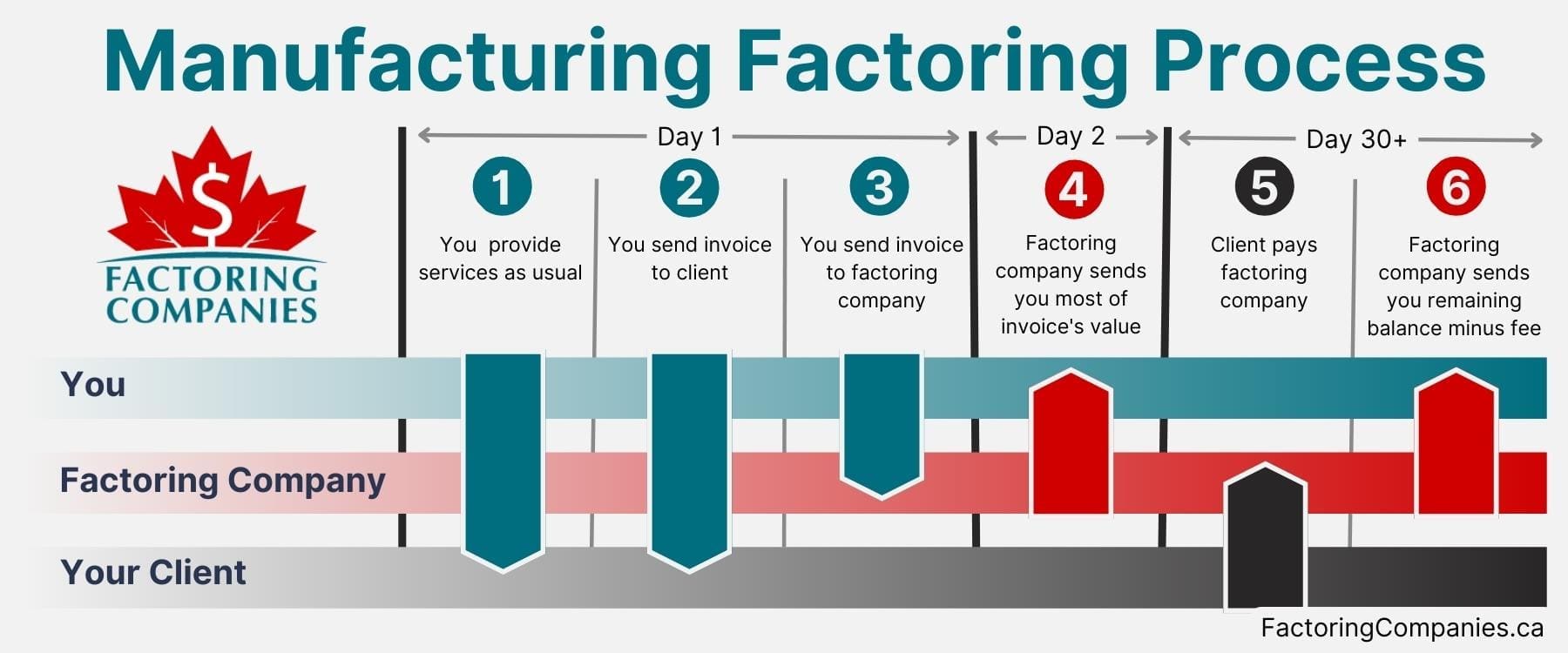

Invoice factoring in manufacturing is a straightforward process. You perform work like you usually would. However, when you invoice your client, you also send a copy of the invoice to the factoring company if you’d like accelerated payment.

Some factoring companies offer same-day payments, though it usually takes around two business days for funds to be deposited. The advance amount can be anywhere from around 60 percent of an invoice’s value to over 90 percent.

You can spend the cash however you wish. The factoring company waits and collects payment from the client. When the client pays, you’ll receive the final sum minus a nominal factoring fee. Fees are usually between one and five percent of an invoice’s value.

For manufacturers operating in Quebec, partnering with a Quebec factoring company can provide localized support and tailored financial solutions to maintain steady cash flow.

12 Advantages of Invoice Factoring for Manufacturers

Now that you know the background, let’s explore the unique advantages of invoice factoring for manufacturers.

1. It’s Easy to Qualify

Whereas most funding solutions make businesses jump through hoops and meet rigid criteria, it’s easy to qualify for factoring. You can qualify even if your business is newer, doesn’t have strong credit, or doesn’t meet other criteria banks set.

2. You Get Immediate Cash Flow

Factoring provides immediate funding for manufacturing businesses. Again, you can spend the money however you wish, so it’s ideal for bridging cash flow gaps and covering urgent expenses like payroll and maintenance or even purchasing new equipment.

3. Your Risk Reduces

As part of the signup process, your factoring company will run a credit check on any client with invoices you’d like to factor. You’ll learn how much credit you can extend to each client without exposing your business to unnecessary risk. You can still take on more work for a client even if it exceeds these guidelines, but those invoices won’t qualify for factoring.

4. Seasonal Shifts Are a Breeze

Factoring can help you ramp up for seasonal shifts or unexpected orders. It helps make cash flow more predictable, too. That way, you can budget with ease and spend confidently.

5. It Shortens Pay Cycles and Cash Conversion Cycles

While factoring doesn’t fix the underlying cause of long cash conversion and payment cycles in manufacturing, it still reduces their impact. This may help ensure your capital lasts throughout the production cycle.

6. You Have Access to Flexible Funding

Whereas most funding solutions force you to take a lump sum, you can tap into factoring as needed. This ensures you have greater control over your funding and any related costs.

7. Your Funding Scales with Your Business

Lenders don’t typically provide you with additional capital if you need it. You must apply for a new loan every time. Conversely, factoring grows with your business. You can factor larger invoices or more invoices to receive additional capital.

8. The Funding is Debt-Free

Rather than creating debt that you need to pay back over a period of months or years and potentially creating a cycle of debt that is difficult to climb out of, your balance is cleared when your client pays their invoice. No debt is created, and you’re free to move forward without constantly paying back what you’ve borrowed.

9. Your Credit May Improve

Your level of debt is a significant factor in your business credit score. Because factoring provides debt-free funding, your score doesn’t take a hit like it would with a loan, credit card, or line of credit.

Additionally, business credit reports don’t just examine whether you’ve made timely payments. Some will only rate you well if you pay early. Factoring can give you cash injections to make timely payments to increase your score.

10. Growth Opportunities Open

Manufacturers turn down work all too often due to a lack of capital. The capital needs are sometimes great, such as when new equipment is needed. Other times, it’s simply due to a lack of raw materials.

With factoring, you can ramp up quickly and accept these orders. That not only gives you cash in the near future but also helps build trust with your corporate clients. They learn they can rely on you and return for future orders.

11. Back-Office Support is Included

Your factoring company collects invoice payments for you. Some will even prepare your invoices, too. This relieves you of back-office burdens and allows you to focus more on running your business.

12. Supplier Relationships May Improve

Maintaining solid supplier relationships is crucial. It helps ensure your business receives priority care and can help insulate it from supply chain issues. Timely payments, made possible through factoring, help support this. Many suppliers offer bulk discounts or early payment discounts. Factoring can help you leverage these, too.

Get a Free Factoring Quote for Your Manufacturing Business

If it sounds like invoice factoring is the ideal cash flow solution for your manufacturing business, take the next step and request a free rate quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778