Simplify your search for the best Québec factoring companies and gain valuable insights to make an informed decision with Factoring Companies Canada. On this page, you’ll explore comprehensive information about business funding options in Québec, expert tips on operating a business in the province, and answers to frequently asked questions. You can also be matched with a factoring company that understands your specific industry needs and enhances your cash flow, enabling your business to thrive. Explore the page in full, or if you’re ready to take the next step toward financial stability and growth, request a complimentary factoring quote now.

How Receivables Financing Works

Receivables financing, often referred to as invoice financing, is a financial arrangement where a business uses its accounts receivable (invoices) as collateral to receive funds. This helps improve cash flow by providing immediate access to money that is otherwise tied up in unpaid invoices. There are several forms of receivables financing, including invoice discounting and factoring.

Factoring is a specific type of receivables financing where you sell your invoices to a factoring company at a discount in exchange for immediate cash. Unlike a loan, factoring does not add debt to your balance sheet, as you are essentially selling an asset (your receivables) rather than borrowing money. This is a key distinction because it can make factoring a more attractive option for businesses looking to maintain a healthy balance sheet.

The Factoring Process Explained

Benefits of Invoice Factoring

Invoice factoring offers several benefits for Québec businesses.

Improved Cash Flow

Invoice factoring provides immediate access to cash that would otherwise be tied up in unpaid invoices. This improved cash flow can help you manage day-to-day operations, pay suppliers, and invest in growth opportunities without waiting for customers to pay their invoices.

No Additional Debt

Since factoring is not a loan, it doesn’t add to your company’s debt load. You’re essentially selling an asset (your receivables), which means your balance sheet remains healthy. This can be especially beneficial if you’re looking to maintain a good credit rating or qualify for other types of financing in the future.

Flexible Financing

Factoring is highly flexible. You can choose which invoices to factor based on your cash flow needs. This allows you to scale the financing according to the fluctuating demands of your business.

Quick Access to Funds

The approval and funding process for invoice factoring is typically faster than traditional bank loans. You can often receive funds within 24 to 48 hours, providing quick relief when cash flow is tight.

Outsourced Collections

Factoring companies handle the collection of payments from your customers. This not only saves you time and effort but also reduces the administrative burden on your team. It allows you to focus on your core business activities.

Credit Protection

Many factoring companies offer non-recourse factoring, which means they assume the risk if your customer fails to pay the invoice. This provides an extra layer of protection for your business against bad debt.

Improved Business Relationships

With immediate cash flow, you can take advantage of early payment discounts from suppliers, strengthening your business relationships and potentially reducing your costs.

Understanding Factoring Rates and Fees in Québec

Factoring is a key financing tool for businesses in Québec, but understanding factoring rates and associated costs is essential. Unlike traditional loans, factoring companies in Canada advance funds based on outstanding invoices to a factoring partner. Fees vary depending on factors like industry risk, invoice volume, and client creditworthiness.

How Factoring Rates Are Calculated

The factoring rate ranges from 1% to 5% of the invoice amount, depending on payment terms and risk assessment. Businesses with clients who pay their invoices quickly typically receive lower factoring fees. Advance rates—the upfront percentage of the invoice a business receives—range between 70% and 95%, with the remaining amount to the factoring company paid once the customer pays their invoice, minus the factoring fee.

Comparing Factoring Costs in Québec

To find the best deal, businesses should compare factoring services in Canada based on fees, contract terms, and flexibility. Some Canadian factoring companies charge extra for credit checks or administration. Options like recourse factoring agreements and spot factoring also impact the cost of factoring. For companies in Montréal, partnering with factoring companies in Canada can provide local support and competitive factoring rates.

How Québec Businesses Use Invoice Factoring

Invoice factoring can be a versatile financial tool for small businesses in Québec, providing immediate cash flow to address various operational needs.

Making Payroll

Ensuring that your employees are paid on time is crucial for maintaining morale and productivity. Factoring can provide the necessary funds to cover payroll expenses, especially during periods of slow customer payments. This can be particularly helpful for businesses with large seasonal workforce requirements or those experiencing rapid growth.

Purchasing Inventory

Maintaining adequate inventory levels is essential for meeting customer demand and preventing stockouts. Factoring can provide the cash needed to purchase inventory, allowing you to take advantage of bulk discounts or prepare for seasonal peaks.

Covering Operating Expenses

Running a business involves numerous ongoing expenses, such as rent, utilities, and supplies. Factoring can help you manage these costs by providing a steady cash flow, ensuring that your business operations run smoothly.

Taking Advantage of Growth Opportunities

When growth opportunities arise, having immediate access to cash can be critical. Factoring can provide the funds needed for marketing campaigns, expansion projects, or entering new markets, helping your business grow without waiting for customer payments.

Managing Seasonal Variations

Many businesses experience seasonal fluctuations in sales and cash flow. Factoring can help bridge the gap during slower periods, ensuring that you have the funds needed to sustain operations and prepare for busy seasons.

Reducing Supplier Payment Times

Timely payments to suppliers can strengthen your business relationships and possibly earn you early payment discounts. Factoring can provide the cash needed to pay suppliers promptly, improving your standing and potentially reducing costs

Businesses and Industries That Use Invoice Factoring Services

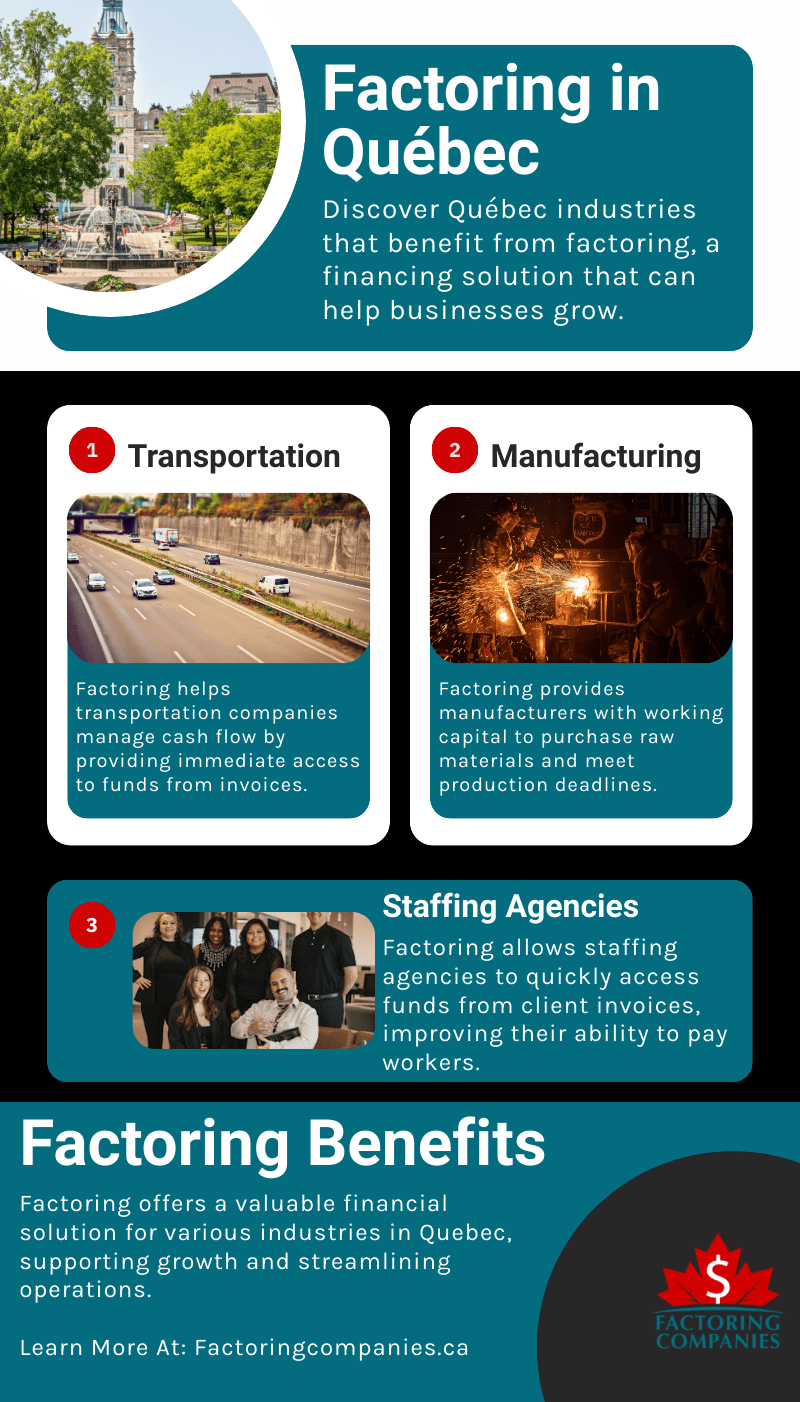

Several key industries in Québec can significantly benefit from invoice factoring, leveraging the immediate access to cash flow to enhance their operations and growth. A few notable examples are outlined below.

Transportation and Logistics

The transportation and logistics sector, including trucking companies and freight brokers, often deals with long payment cycles. Factoring can provide the necessary cash flow to cover fuel, maintenance, payroll, and other operational costs without waiting for customer payments.

Manufacturing

Manufacturers frequently face substantial upfront costs for raw materials and production. Factoring can help manage these expenses by providing immediate funds, allowing manufacturers to maintain production schedules and meet delivery deadlines.

Staffing Agencies

Staffing agencies must pay their employees regularly, even if clients delay payments. Factoring provides the necessary cash flow for temporary staffing companies to meet payroll obligations, ensuring that employees are paid on time and helping the agency maintain a reliable workforce. It works well for permanent staffing companies, too.

Wholesale and Distribution

It’s common for wholesalers and distributors to deal with high inventory costs and extended payment terms. Factoring can provide the liquidity needed to purchase inventory, take advantage of bulk discounts, and maintain steady operations.

Construction

The construction industry typically experiences long payment cycles and significant upfront costs for materials and labor. Factoring can help manage cash flow, allowing construction companies to take on new projects and pay suppliers and subcontractors promptly.

Professional Services

Professional services, such as consulting firms, legal practices, and marketing agencies, often face delays in client payments. Factoring can provide the cash flow service providers need to cover operational expenses, payroll, and other costs.

Other Industries

Virtually any business with B2B receivables can benefit from factoring. A few additional industries and business types that routinely leverage factoring in Québec include:

Additional Services Offered Alongside Accounts Receivable Financing in Québec

Additional Services Offered Alongside Accounts Receivable Financing in Québec

Partnering with a factoring company in Québec provides more than just instant working capital. Businesses can also benefit from a range of additional services designed to optimize operations and strategic planning.

Credit Checks

Factoring companies in Québec conduct detailed credit checks on your clients, reducing the risk of late payments or defaults. This service is particularly valuable for startups and businesses in industries with lengthy payment terms, such as technology and manufacturing. Access to current credit information allows you to make informed decisions and safeguard your cash flow.

Collections Management

A fundamental service included with invoice factoring is the management of collections. By allowing your factoring partner to handle this task, Québec businesses can save significant time, allowing them to focus on growth and development rather than chasing payments.

Invoice Preparation Assistance

Some factoring companies in Québec offer invoice preparation services, which can greatly enhance your billing process’s accuracy and efficiency. This is especially useful for logistics and wholesale trade industries, where precise and timely invoicing is critical.

Industry-Specific Services

Factoring companies often provide industry-specific tools and services tailored to address unique sector challenges. For example, those focusing on logistics may offer fuel advance programs, fuel discount cards, or access to load boards. These specialized services help Québec businesses manage finances more effectively while leveraging opportunities to cut costs and improve efficiency.

Diverse Financing Options

As your business evolves, so do your financial needs. Factoring companies in Québec often provide a variety of alternative funding solutions beyond invoice factoring.

Alternatives to Small Business Loans in Québec

Traditional loans are useful, but the flexibility and targeted benefits of invoice factoring make it an advantageous option for businesses focused on growth and efficiency. In addition to factoring, your factor may be able to provide other alternatives to small business loans.

By considering these alternatives to traditional small business loans in Québec, businesses can find tailored financial solutions that support their cash flow management, operational needs, and growth ambitions.

Operating a Business in Québec

Operating a Business in Québec

Québec offers a vibrant business environment with numerous opportunities for entrepreneurs and established companies alike.

Economic Landscape

Québec boasts a diverse and dynamic economy, with strong sectors including manufacturing, information technology, aerospace, and natural resources. The province’s economy is the second-largest in Canada, contributing around $400 billion to the country’s GDP, Statista reports.

Business Registration and Legal Structure

To operate a business in Québec, you must register with the province. Whether you choose to operate as a sole proprietorship, partnership, or corporation, it’s crucial to understand the legal requirements and implications for your chosen business structure.

Taxation

Québec has its own tax system, separate from the federal system, which includes both corporate income tax and personal income tax. The corporate tax rate in Québec is competitive, with various credits and incentives available to businesses.

Labour Market and Employment Standards

Québec has a skilled and educated workforce, with numerous educational institutions providing a steady stream of talent. The province’s labour laws are governed by the Commission des normes, de l’équité, de la santé et de la sécurité du travail (CNESST), which outlines employment standards, occupational health and safety, and labour relations.

Funding and Support Programs

Québec offers various funding and support programs for businesses, particularly in innovation and export development.

Market Access and Trade

As part of Canada, Québec benefits from free trade agreements with numerous countries, including the United States, the European Union, and Mexico. The province’s strategic location and robust infrastructure facilitate easy access to key markets, making it an attractive base for export-oriented businesses.

Innovation and Technology

Québec is a hub for innovation, particularly in artificial intelligence, biotechnology, and aerospace sectors. The province supports innovation through various initiatives and research institutions. For instance, Montréal is renowned for its AI research and has attracted numerous tech startups and global tech giants.

Help Your Québec Business Grow with Factoring

Help Your Québec Business Grow with Factoring

Invoice factoring provides immediate cash flow by advancing funds on your outstanding invoices, allowing you to manage expenses and grow your business without waiting for customer payments. In Québec, this financial solution is particularly advantageous due to the province’s diverse and dynamic economy. Factoring Companies Canada can connect you with a factoring company that understands the unique needs of Québec businesses, ensuring you maximize the benefits and efficiency of the process. Take the next step towards financial stability and growth by requesting a complimentary rate quote today.

FAQs About Québec Factoring Companies

FAQs About Québec Factoring Companies

What are the benefits of invoice factoring for small businesses in Québec?

Invoice factoring offers immediate cash flow, reduces debt burden, and provides flexible financing. It also includes credit checks and collections management, saving time and resources. These benefits help small businesses in Québec maintain smooth operations and seize growth opportunities.

How can invoice factoring improve cash flow for Québec businesses?

Invoice factoring provides immediate funds based on unpaid invoices, ensuring businesses have the cash needed to cover expenses, payroll, and inventory. This improved cash flow helps businesses manage daily operations and invest in growth without waiting for customer payments.

What types of businesses in Québec can benefit from factoring?

Industries such as transportation, manufacturing, staffing, wholesale, and construction benefit from factoring. Any business with long payment cycles, B2B customers, and significant upfront costs can use factoring to improve cash flow and maintain smooth operations.

What additional services do factoring companies in Québec offer?

Factoring companies in Québec offer services like credit checks, collections management, invoice preparation, and industry-specific perks. They may also provide alternative funding solutions such as asset-based lending and lines of credit, helping businesses manage cash flow and grow efficiently.

How do I choose the best factoring company in Québec?

Consider factors like industry expertise, service fees, contract terms, and additional services offered. Research and compare different factoring companies to find one that understands your business needs and provides the best value and support. To streamline your search, work with a platform like Factoring Companies Canada that can match you with your ideal factoring partner at no cost to you.

What is the difference between invoice factoring and a business loan?

Invoice factoring involves selling unpaid invoices for immediate cash without adding debt to your balance sheet. On the other hand, a business loan involves borrowing money that must be repaid with interest, increasing your debt load.

Are there any risks associated with invoice factoring?

Risks include potentially high fees, loss of control over customer relationships, and dependency on the factoring company. Understanding the contract terms and choosing a reputable factoring company to mitigate these risks is essential.

How quickly can I get funds through invoice factoring in Québec?

Funds are typically available within 24 to 48 hours after submitting your invoices to the factoring company. This quick turnaround helps businesses address immediate cash flow needs and manage expenses efficiently.

What are some alternatives to traditional business loans in Québec?

Alternatives provided by Québec factoring companies include invoice factoring, asset-based lending, equipment leasing and financing, and commercial credit cards. These options provide flexible and accessible financing solutions to help Québec businesses manage cash flow and support growth.

How does spot factoring work for Québec businesses?

Spot factoring lets business owners sell specific invoices to a third-party factoring company for immediate cash without long-term commitments. This is ideal for Québec companies with slow-paying customers who need occasional working capital solutions. Unlike traditional financing, spot factoring provides fast funding, often within 24-48 hours, and flexibility to factor only select invoices.

What’s the difference between invoice factoring and purchase order financing?

Invoice factoring involves selling unpaid invoices to a factoring company for immediate cash, helping businesses manage payroll and daily expenses. Purchase order financing provides funds to pay suppliers upfront, ensuring businesses fulfill large orders. Québec businesses with slow-paying customers benefit from factoring, while growing companies needing supplier payments prefer purchase order financing. Both options are offered by factoring providers in Canada, including local Québec factoring companies. Understanding your needs and working with the right factoring company ensures a flexible business financing solution that supports growth and stabilizes cash flow effectively.

How do Québec businesses get approved for invoice factoring?

To get approved for invoice factoring, Québec business owners typically need to provide basic documents like invoices, proof of delivery, and customer payment terms. Unlike traditional financing, factoring focuses on your customers' creditworthiness, not your credit score, making it accessible for companies with limited credit history. Many financing companies process approvals quickly, ensuring funds are available in 24-48 hours. Whether you're working with capital is a leading provider or another provider of factoring, having reliable customers and clear documentation helps streamline approvals, providing the business financing you need to support business growth.

What People Say About Our Factoring Partners

“Good customer service, a good partner for your business to grow!”

“I am more knowledgeable about my business and have more help now than I could have ever imagined. Great experience !!”

“Very helpful and welcoming from the beginning to present. Outstanding TEAM!!!!”

“The whole staff is very friendly knowledgeable, helpful, and go to extra mile to make sure you accomplish all your goals.”

“I’m very happy with the service I’ve received from beginning to end.”

“Everyone I talk with is very knowledgeable and patient in helping get the information needed to improve my Business! Thank you!”

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778

As Seen In

Our Partners Belong To