Nova Scotia Factoring Companies

Simplify your search for the best Nova Scotia factoring companies and get the details you need to make an informed decision with Factoring Companies Canada. Below, you can explore a wealth of information about Nova Scotia business funding options, insights on running a business here, and answers to the most common questions. Or, if you’re ready to be matched with a factoring company that can accelerate your cash flow and help your business thrive, you can jump straight to a complimentary factoring quote.

How Receivables Financing Works

Receivables financing, often referred to as invoice financing, is a financial arrangement where you use your outstanding invoices as collateral to obtain funds. This helps your business maintain a steady cash flow by bridging the gap between when you issue an invoice and when you receive payment from your clients.

Factoring is a specific type of receivables financing that differs from traditional loans. Unlike a loan, where you borrow money and repay it with interest, factoring involves selling your invoices to a factoring company at a discount. This means you receive a significant portion of the invoice value upfront, and the factoring company takes on the responsibility of collecting payment from your customers.

The Factoring Process

Factoring is quick and easy. Although each company follows a unique process, it typically involves the steps outlined below.

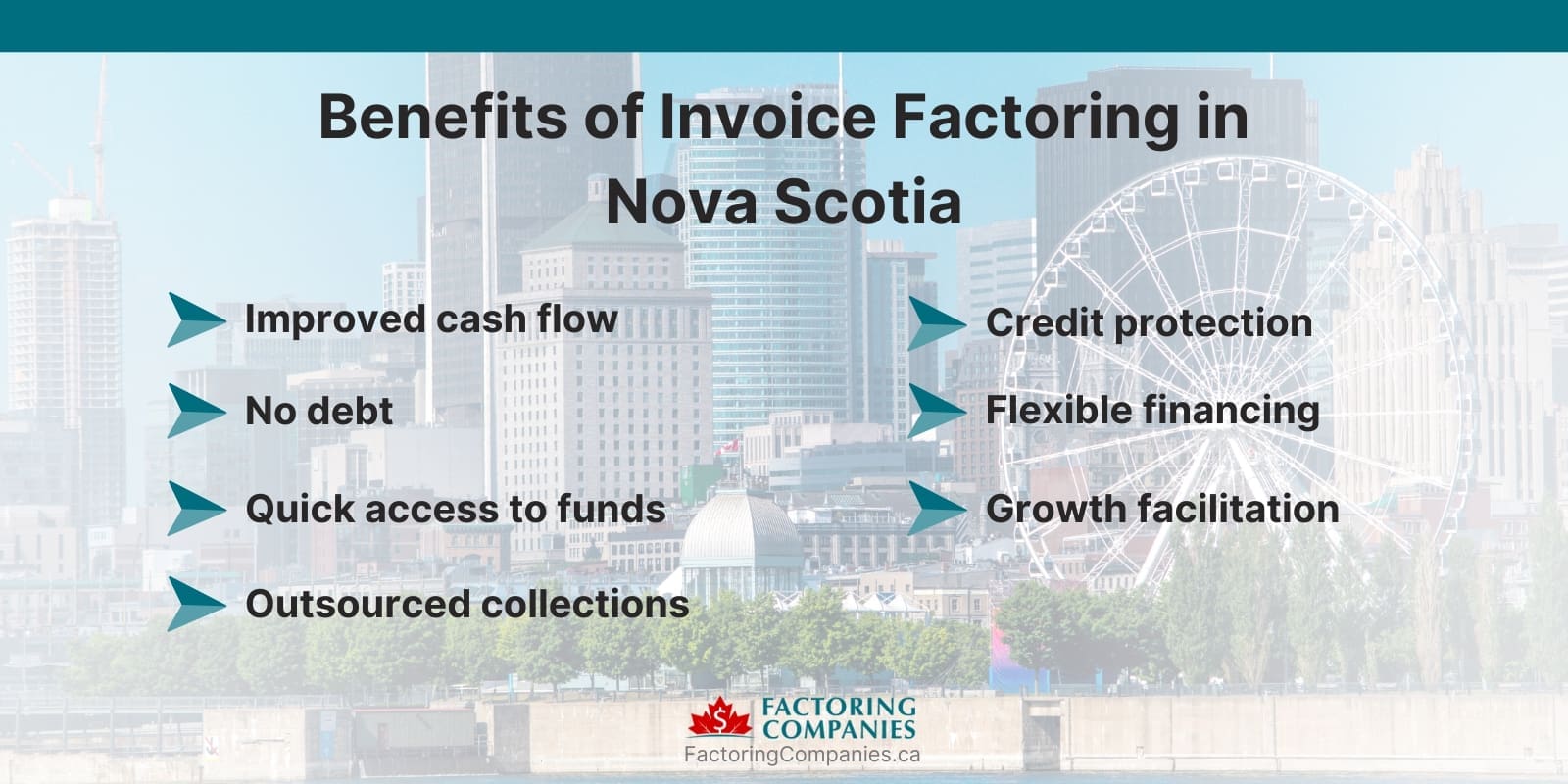

Benefits of Invoice Factoring

Invoice factoring offers many benefits for Nova Scotia businesses, such as:

How Nova Scotia Businesses Use Invoice Factoring

Invoice factoring is a versatile financial tool that can be used for various purposes, such as:

Businesses and Industries That Use Invoice Factoring Services

Several key industries in Nova Scotia can significantly benefit from invoice factoring. Here’s a look at some of these industries and how factoring supports them.

Construction

The construction industry often deals with long payment cycles and significant upfront costs for materials and labor. Factoring helps construction companies manage cash flow, ensuring they can pay subcontractors, purchase materials, and keep projects on schedule without financial delays.

Manufacturing

Manufacturers frequently face large orders and extended payment terms from buyers. Factoring provides immediate funds to purchase raw materials, maintain production schedules, and fulfill orders promptly. This is crucial for maintaining a competitive edge and meeting customer demand in the manufacturing industry.

Transportation and Logistics

Often, trucking and logistics companies experience cash flow challenges due to the time lag between delivering goods and receiving payment. Factoring allows these companies to get paid quickly for completed deliveries, ensuring they can cover fuel costs, vehicle maintenance, and driver wages.

Fisheries and Seafood Processing

Nova Scotia’s seafood industry, including fishing and processing, can benefit from factoring to manage seasonal cash flow fluctuations. Immediate funds from factoring help businesses purchase fresh catch, pay workers, and handle processing costs during peak seasons.

Tourism and Hospitality

Tourism businesses, such as hotels, tour operators, and restaurants, often experience seasonal peaks and troughs. Factoring helps these businesses maintain steady cash flow during off-peak seasons, allowing them to invest in marketing, staff, and facility improvements.

IT and Tech Services

It’s common for IT companies and tech startups to work with clients on net 30 or net 60 payment terms. Factoring allows these businesses to access immediate funds to cover operational expenses, invest in new technology, and hire skilled professionals, driving growth and innovation.

Professional Services

Accounting firms, consultants, marketing agencies, and other professional service providers can use factoring to manage cash flow when dealing with delayed client payments. This ensures they can cover salaries, invest in business development, and maintain high service standards.

Other Industries

Because factoring can work for just about any business that issues B2B invoices, a few additional industries and business types that benefit from factoring in Nova Scotia include:

Additional Services Offered Alongside Accounts Receivable Financing in Nova Scotia

Additional services that enhance the benefits of accounts receivable financing and allow your Nova Scotia business operate more efficiently and effectively will likely be available through your factoring company, too.

Alternatives to Small Business Loans in Nova Scotia

Navigating the world of small business loans can be challenging due to lengthy approval processes, slow disbursements, and stringent criteria. Fortunately, there are diverse funding options available to meet the unique needs of Nova Scotia businesses. In addition to factoring, your factoring company may also provide:

Operating a Business in Nova Scotia

Operating a business in Nova Scotia offers unique opportunities and advantages, thanks to the region’s supportive business environment, strategic location, and skilled workforce.

Strategic Location

Nova Scotia’s location on the east coast of Canada provides excellent access to North American and European markets. The Port of Halifax is one of North America’s deepest and largest natural harbours, making it a vital hub for international trade.

Skilled Workforce

Nova Scotia is home to a highly educated and skilled workforce, thanks to its numerous universities and colleges. Institutions such as Dalhousie University and Saint Mary’s University contribute to a vibrant talent pool, particularly in sectors like technology, healthcare, and marine industries.

Supportive Business Environment

The provincial government offers various programs and incentives to support business growth and innovation.

Growing Economy

Nova Scotia’s economy is diverse and growing, with key industries including technology, ocean industries, renewable energy, and tourism. The province has seen steady economic growth, per IBISWorld. This makes it an attractive location for new and expanding businesses.

Quality of Life

Nova Scotia boasts a high quality of life, with stunning natural landscapes, a rich cultural heritage, and a strong sense of community. This makes it an appealing place to live and work, attracting talent from across Canada and beyond.

Business Resources

There are numerous resources available to help you start and grow your business in Nova Scotia. The Nova Scotia Government’s Services for Businesses page provides comprehensive information on licensing, permits, and regulations. Additionally, the Atlantic Canada Opportunities Agency (ACOA) offers support for business development in the region.

Access to Funding

Businesses in Nova Scotia have access to various funding options, including government grants, loans, and private investment opportunities. Platforms such as Factoring Companies Canada can also connect you with factors that work in the area and provide easy access to funding.

Help Your Nova Scotia Business Grow with Factoring

Getting started with factoring in Nova Scotia is easy. We’ll match you with a factoring company that understands your business, offers competitive rates, and is eager to help your business thrive. To take the first step, request a complimentary rate quote.

FAQs About Nova Scotia Factoring Companies

How can invoice factoring help my small business in Nova Scotia?

Invoice factoring provides immediate access to cash by converting outstanding invoices into working capital. This helps businesses manage cash flow, cover expenses like payroll and inventory, and invest in growth opportunities without taking on debt. It’s especially useful for businesses facing slow client payments.

What industries in Nova Scotia benefit the most from factoring?

Industries that benefit the most from factoring in Nova Scotia include construction, manufacturing, transportation and logistics, fisheries and seafood processing, tourism and hospitality, IT and tech services, and professional services. Factoring helps these sectors manage cash flow, reduce financial stress, and support growth.

What alternative funding options are available for businesses in Nova Scotia?

A Nova Scotia factoring company can provide alternative funding options, such as factoring lines of credit, equipment leasing and financing, commercial credit cards, and asset-based lending. These options provide flexible and timely financial support, helping businesses manage cash flow, cover operational expenses, and invest in growth opportunities.

How does the invoice factoring process work in Nova Scotia?

Invoice factoring involves selling your invoices to a factoring company at a discount. The process includes issuing an invoice, selling it to the factor, receiving an advance (typically 60 to 95 percent of the invoice value), and the factor collecting payment from your client. The remaining balance is paid to you, minus a fee, once the client pays.

How can I find a reliable factoring company in Nova Scotia?

Connect with Factoring Companies Canada to be matched with a reliable factoring company that understands your business and offers competitive rates.

What is the quality of life like for business owners in Nova Scotia?

Nova Scotia boasts a high quality of life with stunning natural landscapes, a rich cultural heritage, and a strong sense of community. The province offers a balanced lifestyle with excellent healthcare, education, and recreational opportunities, making it an appealing place for business owners and their families.

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

What People Say About Our Factoring Partners

“The whole staff is very friendly knowledgeable, helpful, and go to extra mile to make sure you accomplish all your goals.”

“Good customer service, a good partner for your business to grow!”

“Everyone I talk with is very knowledgeable and patient in helping get the information needed to improve my Business! Thank you!”

“I am more knowledgeable about my business and have more help now than I could have ever imagined. Great experience !!”

“I’m very happy with the service I’ve received from beginning to end.”

“Very helpful and welcoming from the beginning to present. Outstanding TEAM!!!!”

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778

As Seen In

Our Partners Belong To