Factoring is built on trust, speed, and precision, but even the smallest errors in invoice verification can disrupt your cash flow, strain customer relationships, and jeopardize your credibility. Below, we’ll explore how factoring companies evaluate your invoices and share invoice verification management strategies to keep your funding on track.

How Invoice Verification Fits into the Factoring Process

Invoice factoring is a financing tool that helps your business access immediate cash by selling your unpaid invoices to a factoring company. Instead of waiting a month or more for clients to pay, factoring allows you to bridge cash flow gaps and keep operations running smoothly.

How the Factoring Process Typically Works

To better understand where verification fits into the overall picture, let’s take a quick look at the factoring process.

Submit Invoices

You send your unpaid invoices to a factoring company. These should be for goods or services already delivered.

Invoice Verification

This is a key step. The factoring company will verify that the invoices are valid, accurate, and undisputed. They often contact your customers to confirm details like:

- The invoice amount

- Delivery or service completion

- Any payment terms

Advance Payment

Once the invoices are verified, the factoring company advances a percentage of the invoice value. This can be anywhere from around 60 percent to 95 percent of the invoice value but is usually somewhere around 80 or 90 percent.

Customer Payment

Your customers pay the factoring company directly based on the terms agreed upon.

Remaining Funds

After deducting their fees, the factoring company pays you the balance.

Why Invoice Verification Matters

Invoice verification is a crucial step in the factoring process, ensuring that all parties involved can operate with confidence and efficiency. Here’s how it safeguards your business and facilitates smooth funding.

It Ensures Invoice Legitimacy

Invoice verification protects both your business and the factoring company by confirming that all invoices are legitimate. This step reduces the risk of fraud or errors, providing a strong foundation for a successful factoring process.

It Helps You Avoid Disputes

Discrepancies in invoices can lead to complications, including delays, additional fees, or rejected invoices. Verification ensures there are no unresolved issues, allowing the factoring process to move forward without interruptions.

It Allows You to Maintain Credibility

Verified invoices reflect positively on your business. They demonstrate professionalism and reliability, reinforcing trust with both your factoring partner and your customers. Maintaining this credibility strengthens relationships and supports smoother operations.

The Basics of Invoice Verification

Now that we’ve explored how invoice verification fits into the factoring process, let’s take a deeper look at what invoice verification actually entails.

What Happens in the Verification Process

The verification process can happen so quickly that you may not even realize it’s happening in the background. However, three critical things occur during verification.

1. Cross-Checking of Invoice Details

The factoring company reviews the submitted invoices to confirm the following:

- The amounts match agreed-upon terms

- Payment terms (due dates, discounts) align with prior agreements

- Supporting documents, like proof of delivery or signed contracts, are in place

2. Customer Confirmation

The factoring company contacts your customers directly to confirm the following:

- The goods or services were received

- The invoice details (amount, date, terms) match their records

- No disputes, chargebacks, or outstanding issues exist

3. Flagging of Potential Issues

If anything seems off, such as missing documents, mismatched amounts, or customer confusion, the factoring company may pause to clarify these issues before proceeding.

How Verification is Done

Historically, all invoice verification was done manually. The factoring company would pick up the phone and call your customer or send them a fax of the invoice to review. While some factoring companies still leverage manual processes, many have moved to digital or automated verification processes.

Manual Verification

- Typically involves emails or phone calls to your customers

- Often preferred for high-value or unique invoices

- Time-intensive but allows for personalized follow-ups

Digital or Automated Verification

- Uses software integrations with platforms like QuickBooks, Xero, or SAP

- Automatically cross-checks invoices against customer records

- Fast, scalable, and ideal for businesses with high invoice volumes

How Long Does it Take?

Invoice verification can be completed instantly when the latest technology is leveraged. However, you should allow a few hours for it in most cases, or one to two business days in complex situations. If customers are slow to respond, the process can be delayed further—sometimes by several days.

Common Causes of Invoice Discrepancies

Invoice discrepancies are one of the main hurdles during the verification process. They can lead to delays, additional costs, or even rejected invoices. Understanding the most frequent issues can help you prevent them and streamline the factoring process.

Inconsistent Invoice Details

This happens when the information on the invoice doesn’t match the details agreed upon with the customer. Common examples include:

- Incorrect amounts due (taxes, discounts not applied properly, etc.)

- Mismatched invoice numbers or purchase order references

- Payment terms that differ from the agreement

Missing Documentation

Factoring companies often require supporting documents to verify invoices. Missing or incomplete paperwork can halt the process, including:

- Proof of delivery (for example, signed bills of lading for trucking companies)

- Contracts or service agreements

- Time logs for service-based businesses

Customer Disputes

When customers raise issues during the verification process, it can delay or derail the funding. Common disputes include:

- Goods or services not received as described

- Claims of incomplete or defective work

- Questions about the invoice’s accuracy

Duplicate or Previously Paid Invoices

Submitting an invoice that has already been paid, partially paid, or submitted previously can create confusion and harm your credibility.

Errors in Data Entry

Simple mistakes like typos or arithmetic errors can cause big headaches, such as:

- Incorrect invoice dates or due dates

- Transposed digits in invoice amounts

- Mislabelled customer information

Customer-Specific Requirements

Some customers have unique invoicing rules or preferences that, if not followed, can result in rejections. For example:

- Requiring invoices to include a specific reference or job code

- Sending invoices to the wrong department or email address

- Failing to account for unique payment terms, such as early payment discounts

Unresponsive Customers

When customers don’t respond promptly to verification requests, it slows down the process. This can happen if:

- The customer contact is unavailable or unaware of the factoring arrangement

- Verification emails or calls are sent to the wrong person

Disputed Payment Terms

Occasionally, discrepancies arise because the agreed-upon payment terms weren’t clear or properly documented, leading to confusion about:

- Early payment discounts

- Late payment penalties

- Partial payment arrangements

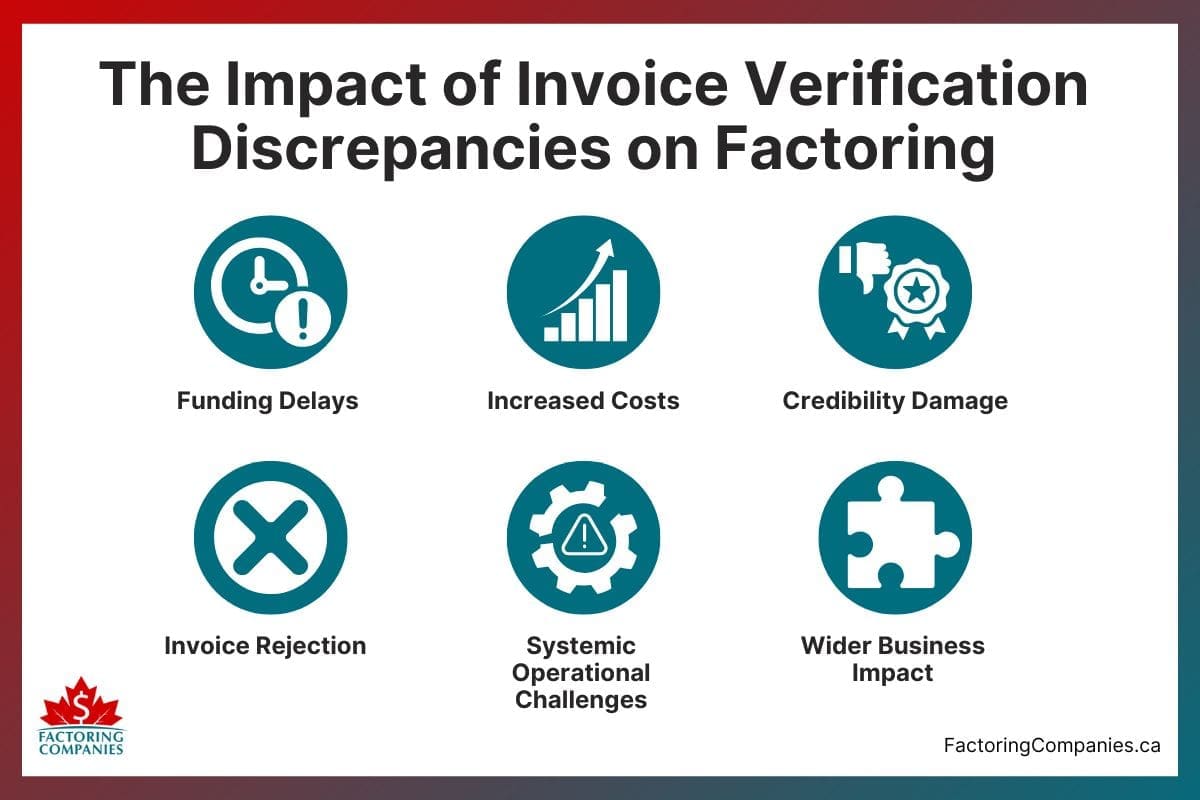

The Impact of Invoice Verification Discrepancies on Factoring

Invoice verification discrepancies might seem like minor hiccups, but they can have significant consequences for your business. These issues affect more than just the speed of funding. They also touch on your credibility, cash flow, and customer relationships. Let’s break it down.

Funding Delays

Factoring is built around quick access to cash, but discrepancies disrupt this process. Factoring companies will pause funding until the issues are resolved, leaving your business without the immediate liquidity it needs. If you’re relying on factoring to cover payroll, purchase inventory, or meet other obligations, even a short delay can create financial strain.

Increased Costs

Discrepancies can also lead to higher costs. Many factoring companies charge fees for the extra time and effort required to investigate and resolve these issues. Over time, frequent discrepancies may result in stricter terms, such as reduced advance rates or higher factoring fees, cutting into the financial benefits of the arrangement.

Credibility Damage

Frequent errors in your invoices can harm your credibility with both the factoring company and your customers. Factoring companies may begin to see your business as high-risk, potentially limiting the terms they offer. Meanwhile, involving customers to resolve disputes or clarify discrepancies can frustrate them, leading to strained relationships or even lost business opportunities.

Invoice Rejection

In some cases, discrepancies lead to invoices being rejected outright. If a customer disputes the validity of an invoice or refuses to confirm its details during verification, the factoring company will not fund it. This leaves you to handle the issue directly with the customer, adding stress and delaying payment even further.

Systemic Operational Challenges

Recurring discrepancies often point to deeper operational inefficiencies. Disorganized invoicing processes, unclear agreements with customers, or inconsistent internal communication can all contribute to the problem. Addressing these root causes may require investment in better systems, staff training, or more streamlined processes. While these steps take time and resources, they are crucial for preventing future disruptions.

Wider Business Impact

The ripple effects of discrepancies can be significant. Cash flow instability makes it harder to seize growth opportunities or respond to emergencies. Over time, repeated issues can harm your reputation, making it more difficult to retain customers, secure new contracts, or negotiate favourable terms with factoring companies.

Strategies to Mitigate Invoice Verification Challenges

Invoice verification challenges can disrupt cash flow, strain customer relationships, and slow down your factoring process. However, with the right strategies in place, you can reduce the risk of discrepancies and ensure a smoother verification experience. Here’s how to tackle these challenges effectively.

1. Use Technology to Streamline Processes

Investing in invoicing and accounting software can help eliminate many common errors. These tools ensure consistency, automate calculations, and integrate with factoring platforms, making it easier for factoring companies to verify your invoices. Popular options like QuickBooks, Xero, or Sage can even help with reconciliation and reporting, adding another layer of accuracy to your operations.

2. Standardize Invoicing Practices

Consistency is key to avoiding verification issues. Use a standard template for all invoices, ensuring every detail—such as customer information, payment terms, and invoice numbers—is accurate and properly formatted. Double-check that any customer-specific requirements, like referencing a purchase order or including specific terms, are addressed.

3. Communicate Clearly with Customers

Open and consistent communication with your customers can prevent disputes during the verification process. Confirm terms like payment schedules and invoice amounts before issuing invoices. Let your customers know that a factoring company may contact them to verify details and encourage them to respond promptly to avoid delays.

4. Maintain Comprehensive Documentation

Incomplete or missing documentation is a common cause of discrepancies. Keep thorough records, such as signed delivery receipts, contracts, and proof of service completion. These documents should be easily accessible in case the factoring company needs to review them during the verification process.

5. Conduct Internal Audits Regularly

Regularly review your invoicing process to catch errors before they become issues. Look for common mistakes like typos, incorrect calculations, or missing fields. Auditing your processes can also reveal inefficiencies or recurring problems that need to be addressed.

6. Train Your Team on Best Practices

Invest in training for your employees to ensure they understand how critical accurate invoicing is to your business. Provide guidance on customer communication, invoice creation, and documentation requirements. A knowledgeable team can prevent many of the errors that lead to verification challenges.

7. Choose a Factoring Company with Industry Expertise

Working with a factoring company familiar with your industry can make a big difference. They’ll better understand the nuances of your business and may offer tailored solutions or leniency when addressing common verification issues. For instance, a factoring company experienced with trucking businesses will know the importance of signed bills of lading and may offer digital tools to simplify submission.

8. Build Strong Customer Relationships

Your customers play a vital role in the verification process. Maintaining good relationships with them can ensure they’re cooperative when contacted by your factoring company. Be proactive in resolving disputes and maintaining clear communication about expectations and terms.

9. Monitor and Resolve Discrepancies Quickly

When a discrepancy arises, address it promptly. Delays in resolving issues can lead to extended funding delays or even damaged relationships with your factoring partner and customers. Act quickly to provide missing documentation, clarify terms, or resolve disputes to keep the process moving.

10. Set Realistic Expectations

Finally, understand that no process is perfect. Occasional challenges are inevitable, but setting realistic expectations with your team and customers can help minimize stress when issues do arise. Focus on creating a system that allows for quick identification and resolution of problems.

Work with a Factoring Company That Understands Your Business and Customers

Working with a factoring company that specializes in your industry is key to breezing through the invoice verification process and receiving your factoring advances quickly. To be matched with a suitable factoring company, request a complimentary rate quote.

FAQs on Invoice Verification Management in Factoring

What are the best methods for resolving invoice discrepancies in factoring without disrupting cash flow?

Quickly resolving discrepancies involves reviewing invoices for accuracy, providing missing documentation, and maintaining open communication with customers and factoring companies. Using automated invoicing systems can minimize errors upfront. Clear agreements with customers about payment terms and thorough record-keeping also help avoid prolonged disputes.

How do businesses overcome common invoice verification challenges in factoring to ensure faster funding?

Businesses can overcome verification challenges by using standardized invoicing, adopting software for accuracy, and ensuring clear customer communication. Providing supporting documentation, like proof of delivery, and training staff on invoicing best practices are also essential. Choosing a factoring company with industry expertise can expedite resolution.

What are the most effective ways of minimizing factoring disruptions from discrepancies during the verification process?

Disruptions can be minimized by ensuring invoices are accurate and complete, notifying customers about the factoring process, and responding quickly to discrepancies. Automation tools and regular audits can catch issues early. Strong relationships with customers and a proactive approach to addressing errors are key.

How can enhancing invoice accuracy for factoring improve cash flow and reduce funding delays?

Accurate invoices eliminate verification issues, allowing factoring companies to process funding faster. This improves cash flow, prevents costly delays, and builds trust with factoring partners. Using software to automate calculations and maintaining clear records ensures invoices meet customer and factoring requirements.

What are the most common factoring process and verification issues businesses face, and how can they be addressed?

Common issues include missing documentation, customer disputes, or incorrect invoice details. These can be addressed by standardizing invoicing processes, communicating payment terms with customers, and keeping thorough records. Training staff and leveraging digital tools can also streamline the process and reduce errors.

What are the top strategies for invoice discrepancy resolution that businesses should implement?

Key strategies include reviewing invoices for accuracy, maintaining comprehensive documentation, and communicating openly with customers to clarify issues. Automated invoicing systems help prevent common errors, and proactive follow-ups with factoring companies ensure quicker resolution of disputes, keeping cash flow intact.

What are the key invoice verification best practices for factoring to prevent delays and disputes?

Best practices include using standardized templates, providing complete documentation, and training employees on accuracy. Informing customers about factoring verification and responding promptly to any inquiries are essential. Partnering with an experienced factoring company can also prevent delays and streamline verification.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778