Invoice factoring and invoice financing can both turn your unpaid B2B invoices into instant cash, but they work very differently. On this page, we’ll provide some background information on each, then quickly compare invoice factoring vs. invoice financing so it’s easier to make the right choice for your needs.

What is Invoice Factoring?

Before we break down invoice factoring vs. invoice financing, it’s crucial to understand how each works independently.

Invoice factoring involves selling your unpaid B2B invoices to a factoring company at a discount.

How Invoice Factoring Works

- You complete work as usual and invoice your client.

- You send the invoice to your factoring company.

- The factoring company sends you most of the invoice’s value right away.

- The factoring company waits for payment from your client and follows up as needed.

- You receive the remaining sum minus a small factoring fee when the client pays.

Recourse vs. Non-Recourse Factoring

Up to ten percent of invoices are written off as bad debt, either because they’re never paid or are paid very late, CPA Practice Advisor reports. This has the potential to become a significant issue for businesses that receive third-party funding with their invoices, but factoring companies address it in two ways: customer credit checks and non-recourse factoring.

Before a factoring company agrees to purchase an invoice, it runs a credit check on your client. In this step, you learn how much credit you can extend to each client without exposing your business to unnecessary risk. For instance, if you accept government contracts, your factoring company may agree to factor an invoice worth $500,000. Yet, the “mom and pop shop” you also serve may only be good for up to $10,000. You can still do $25,000 of work for that mom-and-pop shop, but you’ll likely only be able to factor the $10,000 value or may not be able to factor invoices for that company. This step helps shield your company from late and unpaid invoices.

Non-recourse vs. recourse factoring is the other way you can protect your business. Under ordinary circumstances, if a client doesn’t pay their invoice, your business is responsible for ensuring the factoring company still receives the funds its owed. You may need to submit another invoice of equal value, pay the money back, or have money pulled from your reserve to cover it. This is referred to as recourse factoring. The alternative is non-recourse factoring. In these cases, the factoring company absorbs the loss. It’s more expensive and often unnecessary because of the credit checks, so it’s the less popular of the two methods. However, it can be leveraged by businesses with more significant concerns over non-payment.

Invoice Factoring Benefits

- Most businesses qualify – approval is quick and easy, even for those without good credit and startups.

- Payment is fast. You’ll usually get paid within a couple of business days, though some factoring companies can expedite it even more.

- There’s no debt to pay back. Your client clears the balance when they pay their invoice.

- You’re relieved of back-office burdens. Your factoring company handles collections; some will even create invoices for you.

- It’s flexible. You choose which invoices to factor and how to spend your cash.

- It boosts cash flow and helps protect your business from bad debt.

Invoice Factoring Advance Rates

The advance rate is the portion of the invoice you can receive as upfront cash. It varies by industry and other factors but is usually somewhere between 60 and 95 percent of your invoice’s value.

Invoice Factoring Costs

Rather than paying interest, your factoring cost is primarily determined by your factoring rate, which is usually between one and five percent of the invoice’s value. For instance, if your factoring rate is one, and your invoice is valued at $10,000, you’ll pay $100.

While this structure is the most common, you may also see other fee structures that account for the length of time an invoice remains outstanding. Some charge additional fees for things like expedited payments, too.

What is Invoice Financing?

Invoice financing involves borrowing against your unpaid B2B invoices. Your invoices are used as collateral in a loan or line of credit that you must pay back with fees and interest. The process is sometimes referred to as invoice discounting.

How Invoice Financing Works

- You complete work as usual and invoice your client.

- You send the invoice to your financing company.

- The financing company advances you most of the invoice’s value right away.

- You wait for payment from your client and follow up as needed. Interest charges accrue.

- You pay the financing company the principal, interest, and fees when the client pays.

Invoice Financing Benefits

- Most businesses qualify.

- Payment is fast.

- It’s flexible. You choose which invoices to finance and how to spend your cash.

- Your invoice financing company does not have contact with your customers.

Invoice Financing Advance Rates

Although advance rates vary, most businesses can receive 75 to 90 percent of an invoice’s value.

Invoice Financing Costs

Invoice financing companies typically charge an origination fee and interest, though interest may not kick in until the invoice’s due date. Interest rates tend to be close to those for credit cards or lines of credit.

Let’s say you’re financing a $10,000 invoice with a 3 percent origination fee and 18 percent APR. You’ll pay $300 for the origination fee. That may be the only fee you pay, but more than likely, it will take your customer some time to pay. If it takes one month, you’ll pay an extra $150 in interest. If it takes three months, you’ll pay $457 in interest. So, your final total cost would likely be between $450 and $757.

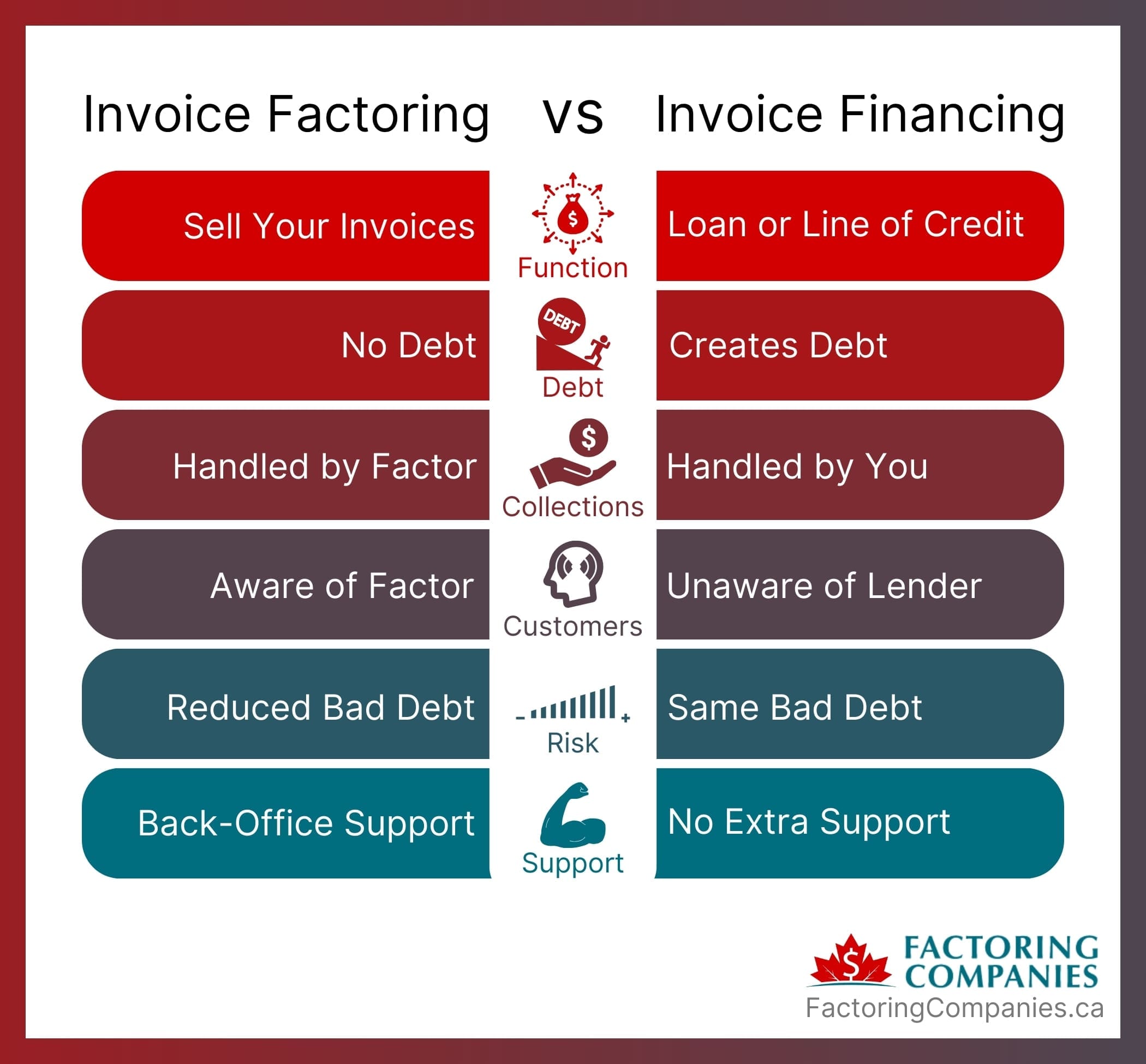

Differences Between Invoice Factoring and Invoice Financing

Factoring and financing both offer easy approvals and quick funding. Because you control when you access them and how the cash is spent, they can bridge cash flow gaps, help your business grow, and more. However, many things set these two business funding types apart.

- Sale vs. Loan: With factoring, you’re selling your invoices. With financing, you’re obtaining a loan or line of credit.

- Debt: Factoring doesn’t create debt. Financing does.

- Collections: Factoring companies collect the balances for you. Financing companies do not.

- Customer Awareness: Although some factoring companies offer non-notification factoring, most of the time, your customers will learn your payments are being processed by a third party. This is a common arrangement in the business world, so most are comfortable with it. Financing differs because you’re collecting, so your customers never engage with a third party and never need to know you’re financing.

- Risk: Factoring can help reduce or eliminate bad debt. Financing doesn’t impact it.

- Support: Factoring companies provide back-office support as part of their services. Financing companies usually don’t.

Invoice Factoring vs. Invoice Financing: What’s Best for Your Business?

Financing is a strong option if your customers are excellent payers and your only concern is accelerating cash flow. However, factoring may be better if you:

- Are Debt-Averse: Factoring allows you to avoid debt and can make it easier to pay off your debts.

- Want More Security: Credit checks performed by factoring companies can help you reduce bad debt. You can also opt for non-recourse factoring to eliminate risk for your business entirely.

- Want Support: Factoring companies collect for you and often offer adjacent services.

Get a Complimentary Invoice Factoring Quote

The best way to learn about invoice factoring and explore the fit for your business is to connect with a factoring company that specializes in your industry. To be connected with one that offers competitive rates, request a complimentary invoice factoring quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778