Your business plays a critical role in keeping Canada healthy, but does your cash flow truly reflect this? Healthcare companies must be ready for action at any point, able to deliver top-notch care, provide equipment, and scale to meet the needs of our communities. Yet, despite the expectation to respond to needs immediately, payment for providing those goods or services can easily take weeks or months to arrive. That’s where understanding healthcare factoring advantages becomes essential. In this guide, we’ll explain how healthcare factoring works, compare it to other financing options, and explore what to look for in a factoring partner.

Why Cash Flow Matters in Healthcare

Cash flow is a critical issue for businesses in the healthcare industry. Whether you’re running a small family medical clinic, managing a long-term care facility, or operating a medical supply company, delayed payments and high costs can create financial bottlenecks. Let’s take a closer look at the common challenges across the sector.

Delayed Payments Are the Norm

For healthcare providers, payments often come from government programs like OHIP or MSP, insurance companies, or patients themselves. These can take weeks or even months to process.

For suppliers and vendors, if you’re selling medical equipment or providing essential services like home care staffing, you might also be stuck waiting for payments from your clients, who are facing their own financial pressures.

High Overhead Costs

Providing quality services or products isn’t cheap. You’re likely coping with high staff wages, especially for highly skilled professionals like nurses or technicians. You probably have expensive equipment that needs regular maintenance or upgrades. There are also compliance costs to meet health and safety standards. These things add up and can drain bank accounts quickly.

Unpredictable Revenue Streams

Many healthcare businesses don’t have steady, predictable revenue. For instance, providers often see patient numbers fluctuate seasonally or during crises. It’s also common for medical supply companies to see orders spike one month and drop off the next depending on hospital needs. This can make it difficult to predict cash flow and set budgets.

Increased Demand for Services

Growing populations, aging demographics, and unexpected health crises create spikes in demand. Meeting this demand often requires upfront investment in staff, supplies, or new facilities, long before payments come in.

Balancing Growth with Cash Flow

Expanding a healthcare business, whether through opening a new clinic, adding services, or scaling distribution, requires capital. However, cash flow gaps can stall growth, leaving businesses stuck in survival mode.

What is Invoice Factoring?

Invoice factoring is a financial tool that helps businesses manage cash flow by unlocking the value of unpaid invoices.

How it Works

- You Provide a Service or Product: For example, you run a medical clinic and submit claims to insurance companies or government programs, or you sell medical equipment to a hospital.

- Invoices Are Issued: Once the service or product is delivered, you issue an invoice to the client. This might be an insurer, a health authority, or even a corporate client.

- You Sell the Invoice to a Factoring Company: With factoring, you sell your unpaid invoices to a factoring company at a discount. They advance you most of the invoice value right away.

- The Client Pays the Factoring Company: When the invoice is due, the client pays the factoring company directly. You receive the remaining balance minus a small factoring fee.

What Makes Factoring Different from Traditional Financing Solutions

- It’s Not a Loan: You’re not borrowing money, so there’s no debt to repay. Instead, you’re simply getting paid sooner for work you’ve already done.

- Cash Flow on Demand: You don’t have to wait on delayed payments, which means you can keep up with operating costs, invest in growth, or respond to emergencies.

Benefits of Invoice Factoring for Healthcare Businesses

Invoice factoring offers more than just quick cash. It’s a powerful tool for overcoming common financial hurdles in the healthcare industry. Let’s take a quick look at some of the benefits.

Steady Cash Flow to Cover Day-to-Day Expenses

One of the biggest challenges in healthcare is the gap between when you deliver services or products and when you actually get paid. Factoring bridges this gap, giving you immediate access to the cash tied up in unpaid invoices. It can help you pay staff on time, including high-demand professionals like nurses and specialists, keep up with operational costs, like utilities, rent, and supplies, and more.

Focus on Patient Care, Not Paperwork

Financial stress can pull your focus away from what matters most: serving your patients or clients. Factoring allows you to streamline your cash flow without adding new financial stressors.

No Additional Debt

Unlike a loan, factoring doesn’t add to your debt. You’re simply getting paid early for work you’ve already completed. This allows you to keep your balance sheet clean, which is especially important if you plan to apply for other financing or expand your business.

Scale Your Business Faster

When cash isn’t tied up in receivables, you can reinvest in your business. That might mean hiring more staff, upgrading your equipment, or expanding into new locations. Medical supply companies can also use factoring to purchase more inventory and meet growing demand without waiting for customer payments.

Protect Your Relationships

Factoring companies often handle collections professionally, which can help preserve your relationships with clients. They understand the nuances of dealing with insurance companies, government programs, and corporate clients, so you don’t have to.

Flexible and Customised Solutions

Factoring isn’t a one-size-fits-all approach. You can choose which invoices to factor and adjust based on your needs. For instance, if you’re a home health provider, you can factor invoices only during high-demand months to smooth out cash flow spikes.

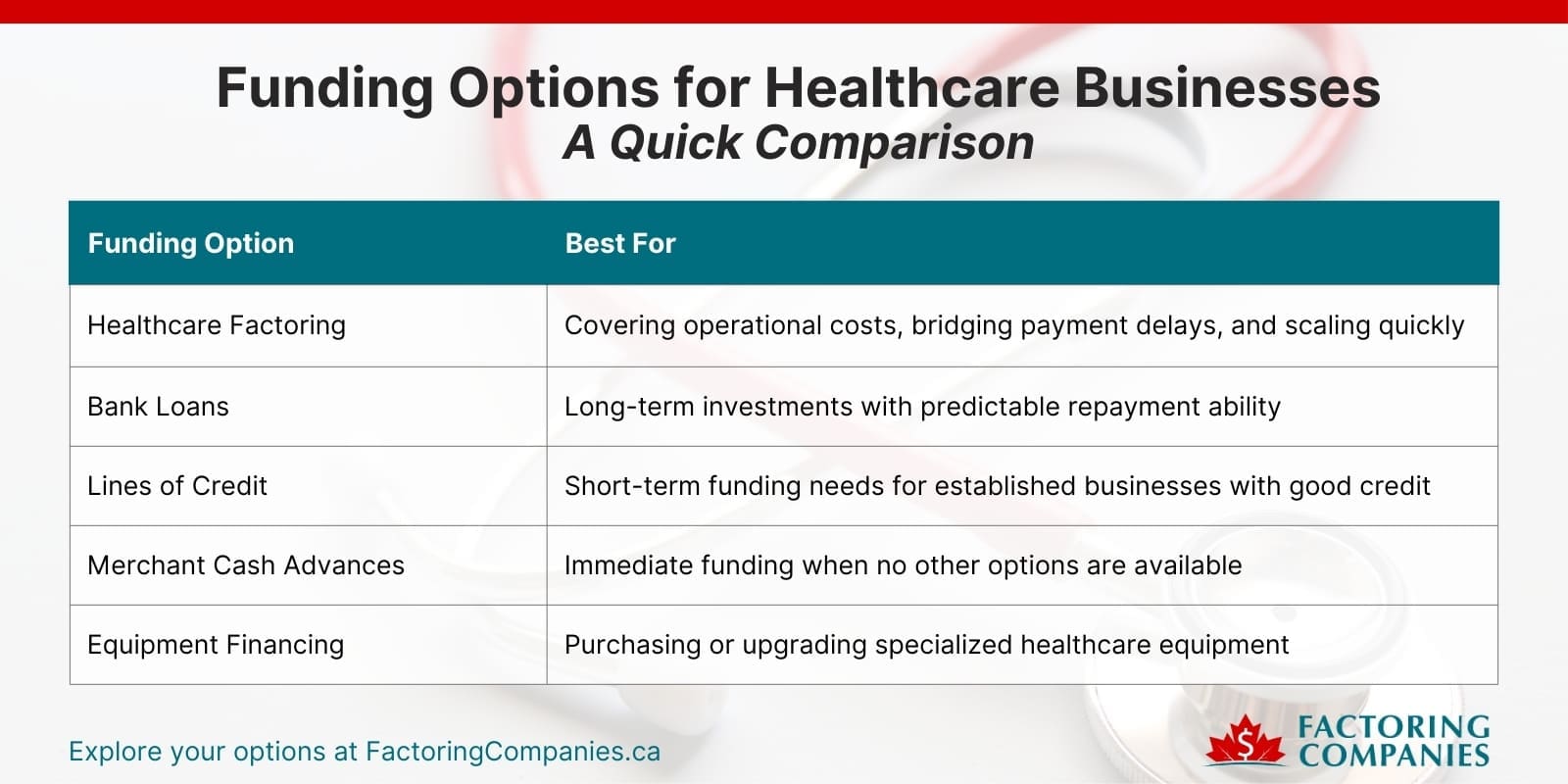

Comparing Healthcare Factoring to Other Funding Options

When your healthcare business needs cash, you have several financing options but each works differently. Let’s explore how invoice factoring stacks up against other common methods, so you can choose what works best for your needs.

Factoring vs. Traditional Bank Loans

- Bank Loans: Loans provide a lump sum upfront, but they come with strict repayment schedules, interest rates, and often collateral requirements. Approval can take weeks or even months, and healthcare businesses with fluctuating cash flow or newer operations may struggle to qualify.

- Healthcare Factoring: Factoring provides quick cash based on your unpaid invoices. There’s no waiting, no collateral, and no new debt. Since it’s based on receivables rather than credit history, it’s a more accessible option for businesses facing delayed payments.

In short, if your invoices are tied up with slow-paying clients like government health plans, factoring offers a faster and simpler solution than bank loans.

Factoring vs. Lines of Credit

- Lines of Credit: These offer flexibility, allowing you to borrow as needed up to a set limit. However, they often come with credit score requirements, annual fees, and variable interest rates.

- Healthcare Factoring: Instead of borrowing, factoring lets you access the funds you’ve already earned. There’s no interest, and you’re not limited by a predetermined credit limit. Your funding grows with your business as your receivables increase.

If your revenue fluctuates seasonally or spikes during health crises, factoring provides more scalability than a line of credit.

Factoring vs. Merchant Cash Advances (MCAs)

- Merchant Cash Advances: MCAs give you a lump sum in exchange for a percentage of future sales. They’re quick but come with high fees and can create a cycle of dependency as payments eat into your cash flow.

- Healthcare Factoring: Factoring fees are typically lower and more predictable. Plus, it doesn’t reduce your future cash flow, as you’re not pre-committing revenue to pay off debt.

For healthcare businesses with consistent receivables, factoring is more cost-effective and sustainable than an MCA.

Factoring vs. Equipment Financing

- Equipment Financing: This is a great option if you need to purchase or upgrade expensive healthcare equipment, as it provides funds specifically for that purpose. However, it doesn’t address broader cash flow needs.

- Healthcare Factoring: While it doesn’t fund specific purchases, factoring gives you the flexibility to cover day-to-day expenses or reinvest where you need it most.

Use equipment financing for major capital investments and factoring for operational cash flow.

What to Look for in a Medical Factoring Company

When it comes to healthcare, choosing the right partner can make a big difference. Here’s a guide to help you evaluate your options and find the best fit for your business.

Expertise in Healthcare

The healthcare industry has unique challenges, and a factoring company with experience in this field can help you navigate them effectively. Look for understanding in areas like:

- Payment Cycles: Familiarity with how systems like OHIP or MSP affect when you get paid.

- Insurance Receivables: Knowledge of the complexities involved in dealing with insurers.

- Regulatory Compliance: Awareness of industry regulations that influence cash flow.

Transparent Fees

A reputable factoring company will clearly outline its costs, so there are no surprises. This includes:

- Fee Clarity: A detailed breakdown of all fees, including charges for collections or account management.

- No Hidden Costs: Assurance that additional charges won’t appear unexpectedly.

Flexible Factoring Plans

Healthcare businesses often have changing needs, and the right factoring company will adapt to them. Look for:

- Selective Invoicing: The ability to choose which invoices you want to factor.

- Adjustable Volumes: Flexibility to factor more or fewer invoices as your business needs shift.

Quick Turnaround Times

Cash flow gaps don’t wait, so fast funding is essential. The best factoring companies will provide:

- Fast Funding: Same-day or next-day payments for approved invoices.

- Streamlined Onboarding: A quick and efficient process to get you started without delays.

Strong Client Support

Responsive support can make all the difference when challenges arise. Prioritise companies that offer:

- Dedicated Account Managers: Personalised assistance from someone who understands your business.

- Prompt Issue Resolution: Clear processes for handling disputes or collection issues.

Proven Track Record

A factoring company’s reputation speaks volumes. Evaluate their experience by looking for:

- Industry Longevity: A history of serving healthcare businesses in Canada.

- Customer Testimonials: Positive reviews or case studies from similar clients.

Professional Client Interactions

Your clients, whether they’re insurers or government programs, are vital to your business. A factoring company should:

- Preserve Relationships: Handle collections professionally and courteously.

- Understand Healthcare Clients: Demonstrate experience working with similar clients, like insurers or hospitals.

Compliance with Canadian Regulations

Ensure your factoring partner meets all relevant laws and standards, including:

- Data Privacy: Properly managing personal health information (PHI), if applicable.

- Legal Adherence: Compliance with provincial and federal financial regulations.

Experience the Healthcare Factoring Advantages for Yourself

Factoring is a powerful funding solution that helps healthcare businesses bridge cash flow gaps and grow. However, not every factoring company works with medical companies or can offer the level of service you deserve. We’re happy to match you with an experienced healthcare company and streamline your search. To get started, request a complimentary rate quote.

FAQs on Healthcare Factoring Advantages

Why do healthcare businesses face cash flow challenges?

Healthcare businesses often experience delays in payments from insurers, government programs like OHIP or MSP, and patients. Meanwhile, operational costs like staff salaries, equipment, and rent need consistent funding. These delays, combined with fluctuating revenue and high overheads, create cash flow gaps that can strain daily operations and growth plans.

What are the benefits of invoice factoring for medical providers?

Invoice factoring improves cash flow, allowing medical providers to cover operating costs and invest in growth. It doesn’t create debt, making it an ideal alternative to loans. Providers can focus on patient care instead of financial stress, and factoring companies often handle collections professionally, preserving client relationships. Additionally, funding is quick—often within 24-48 hours.

Can healthcare businesses use factoring for insurance and government receivables?

Yes, invoice factoring is particularly suited for healthcare businesses dealing with slow-paying clients like insurers and government programs (e.g., OHIP or MSP). Factoring companies are experienced in handling these types of receivables, ensuring your business receives cash upfront while they manage collections from these entities.

How is invoice factoring different from a loan or line of credit?

Factoring isn’t a loan—it involves selling your receivables, so there’s no debt to repay. Unlike a line of credit, it doesn’t depend on credit scores or require collateral. Factoring provides immediate cash based on invoices, while loans and lines of credit may take weeks to approve and have strict repayment terms.

What should healthcare businesses look for in a factoring company?

Choose a factoring company with healthcare expertise, transparent fees, and flexible plans. Look for quick funding, strong client support, and a proven track record in handling insurance and government receivables. Ensure they comply with Canadian regulations and handle personal health information responsibly if applicable.

Is invoice factoring a good option for small healthcare businesses?

Yes, small healthcare businesses benefit greatly from factoring. It provides immediate cash flow without adding debt, helping to cover expenses like payroll, equipment, or supplies. Factoring is also easier to access than loans, as it’s based on receivables, not credit history or collateral.

How quickly can healthcare businesses access funds through factoring?

Factoring companies typically provide funds within 24 to 48 hours of invoice approval. The exact timeline depends on the company and the setup process, but reputable firms prioritise fast funding to ensure healthcare businesses can address cash flow needs immediately.

What fees are typically involved in medical invoice factoring?

Factoring fees generally range from one to five percent of the invoice value, depending on factors like invoice size, client creditworthiness, and the industry. Some companies may charge additional fees for account management or collections, so always ask for a full breakdown to ensure transparency.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778