Many founders view venture capital (VC) as the ultimate startup funding. After all, it can provide large sums of money and is designed explicitly for fast-growing companies. But, as the saying goes, “All that glitters is not gold.” There are drawbacks to venture capital financing, and they’re a big part of the reason startups are leaning more toward factoring. On this page, we’ll explore how VC and factoring work and their pros and cons, as well as provide a quick comparison so it’s easier to see which will work best for your startup.

Why Obtaining Startup Funding is So Challenging

Startup funding refers to the various ways new businesses can obtain the capital they need to launch and grow. This funding is crucial as it helps startups cover initial costs like product development, marketing, hiring staff, and other operational expenses. However, many startups face extreme challenges when trying to obtain funding for various reasons.

High Risk

Startups are inherently risky. Around 20 percent fail within the first year, 30 percent within two years, and around half within five years, Entrepreneur reports. This risk makes traditional lenders, such as banks, hesitant to offer loans without significant collateral or a proven track record.

Lack of Credit History

New businesses often lack the credit history and financial statements lenders require to assess their creditworthiness. This makes it difficult for startups to secure traditional loans.

Unpredictable Cash Flow

Startups typically experience irregular cash flow, especially in the early stages. This unpredictability can deter lenders and investors who prefer stable, predictable returns.

Market Conditions

Economic downturns or market uncertainties can tighten lending criteria and make it more difficult for startups to secure funding.

How Venture Capital Works

Venture capital is a form of private equity financing provided by venture capital firms or individual investors to startups and early-stage companies with high growth potential. These investors, known as venture capitalists, invest in exchange for equity (ownership) in the company.

Stages of Venture Capital Financing

- Seed Stage: The initial phase where a small amount of capital is provided to help an entrepreneur develop an idea into a viable business.

- Early Stage: Funding provided to startups that have a product and need to scale operations, typically involving Series A and Series B rounds.

- Expansion Stage: Later-stage financing for companies with established revenue streams aiming to expand their market reach, improve infrastructure, or make strategic acquisitions.

The Venture Capital Process

- Pitch and Due Diligence: Entrepreneurs pitch their business idea to VCs. If interested, VCs conduct thorough due diligence, assessing the business model, market potential, team, and financial projections.

- Term Sheet Negotiation: If the VC decides to invest, they present a term sheet outlining the investment terms, including the amount of capital, equity stake, and control rights.

- Investment and Support: Once the terms are agreed upon, the VC provides the capital. In addition to funding, VCs often offer strategic guidance, mentorship, and industry connections.

- Exit Strategy: VCs seek significant returns on their investment and aim to exit their investment within five to ten years through an IPO, acquisition, or sale of their equity stake.

Venture Capital Deal Example

To give an example of how VC might work in the real world, let’s imagine a Toronto-based technology startup developing innovative AI-driven software seeking significant capital to accelerate product development and market expansion. The startup pitches to several venture capital firms and secures a five-million-dollar Series A investment in exchange for 25 percent equity. The VC firm provides funding, strategic guidance, industry connections, and mentorship. This enables the startup to hire top talent, enhance its product, and scale rapidly. In return, the VC firm aims for substantial returns through an eventual IPO or acquisition.

Pros and Cons of Venture Capital

Now that we’ve covered the background, let’s examine some of the pros and cons of VC.

Pros of Venture Capital

- Large Amounts of Capital: VC firms can provide substantial funding, enabling startups to scale quickly and compete effectively in their market.

- Expertise and Mentorship: VCs often bring valuable industry experience, strategic guidance, and a network of contacts, helping startups navigate challenges and accelerate growth.

- No Repayment Obligation: Unlike loans, venture capital does not require repayment. The investment is equity-based, so the startup doesn’t incur debt.

- Increased Credibility: Securing VC funding can enhance a startup’s credibility and attract additional investors, customers, and top talent.

Cons of Venture Capital

- Equity Dilution: Founders must give up a portion of their ownership in the company, which can lead to a loss of control and influence over business decisions.

- High Expectations and Pressure: VCs seek high investment returns, often expecting rapid growth and significant profitability. This can create pressure on the startup to meet ambitious targets.

- Rigorous Selection Process: VCs are highly selective, investing in only a tiny percentage of the startups they evaluate. Less than one percent of startups qualify for VC, Harvard Business Review reports. This means most startups won’t secure VC funding.

- Potential for Misaligned Interests: The goals of VCs and founders may not always align, particularly concerning the timing and method of the exit strategy, which can lead to conflicts.

How Invoice Factoring Works

Invoice factoring, also known simply as factoring, is a financial transaction where a business sells its accounts receivable, or invoices, to a third party, called a factor or factoring company, at a discount. This allows the business to receive immediate cash flow rather than waiting for customers to pay their invoices.

The Factoring Process

- Invoice Generation: The business delivers goods or services to its customers and generates invoices with payment terms, typically 30 to 90 days.

- Selling Invoices: The business sells these invoices to a factoring company at a discounted rate, typically receiving 60 to 95 percent of the invoice value upfront.

- Collection: The factoring company then collects the invoice payments directly from the business’s customers.

- Final Payment: Once the factoring company collects the full invoice amount from the customers, it pays the remaining balance to the business minus a factoring fee.

Invoice Factoring Example

An Edmonton trucking company frequently waits 60 to 90 days for clients to pay their invoices. To maintain smooth operations and cover immediate expenses like fuel, maintenance, and driver salaries, the company uses factoring. By selling their outstanding invoices to a factoring company, they receive immediate cash, typically 90 to 95 percent of the invoice value upfront. This improves cash flow without incurring debt or giving up equity. The factoring company then collects payments directly from the trucking company’s clients, allowing the business to focus on growth and service quality.

Pros and Cons of Invoice Factoring

Now that we’ve covered how factoring works, let’s examine its pros and cons.

Pros of Invoice Factoring

- Immediate Cash Flow: Factoring provides quick access to cash, helping businesses manage their working capital and cover immediate expenses like payroll, rent, and inventory.

- No Debt Incurred: Unlike loans, factoring does not add debt to the business’s balance sheet. It’s a sale of an asset (invoices) rather than a loan.

- Flexible Financing: Factoring is often easier to obtain than traditional financing, especially for startups and small businesses with limited credit history or collateral.

- Improved Credit Management: Factoring companies often handle collections and credit checks, allowing businesses to focus on their core operations and potentially improve their customer payment terms.

Cons of Invoice Factoring

- Cost: Factoring fees can be higher than traditional financing options. The discount rate and additional fees can add up, reducing the overall revenue from the invoices.

- Customer Perception: Involving a third party in collections might affect customer relationships, as customers will interact with the factoring company rather than the business.

- Dependency on Customer Creditworthiness: The factoring company’s willingness to purchase invoices depends on the creditworthiness of the business’s customers, not the business itself.

- Partial Advances: Factoring companies typically provide only a portion of the invoice value upfront, so businesses must manage their cash flow accordingly until the remaining balance is paid.

Factoring vs Venture Capital Financing

Startups must consider their unique needs, financial goals, and business models when deciding between factoring and venture capital financing. Below, we’ll make a detailed comparison of the two funding options so it’s easier to see which is best for your startup.

Nature of Financing

Factoring

- Type: Debt-free funding (sale of receivables).

- Cash Flow: Provides immediate cash by selling invoices.

- Repayment: No repayment is required as it’s not a loan.

Venture Capital

- Type: Equity startup financing (sale of ownership stakes).

- Cash Flow: Provides large amounts of capital in exchange for equity.

- Repayment: No repayment is required, but investors expect returns through equity growth and eventual exit.

Ownership and Control

Factoring

- Ownership: Does not affect ownership.

- Control: No loss of control; the business retains full decision-making power.

Venture Capital

- Ownership: Dilutes ownership; investors acquire equity stakes.

- Control: Potential loss of control; VCs may want a say in key business decisions and may demand board seats.

Cost and Fees

Factoring

- Cost: Factoring fees and discount rates can be high (typically one to five percent of the invoice value).

- Fees: Charged based on the value of invoices sold; no long-term obligations.

Venture Capital

- Cost: No direct fees, but the high cost of equity dilution is a common concern.

- Fees: None, but investors expect significant returns on investment through equity appreciation.

Eligibility and Criteria

Factoring

- Eligibility: Based on the creditworthiness of customers, not the business.

- Criteria: Suitable for businesses with receivables from creditworthy customers.

Venture Capital

- Eligibility: Based on the business’s growth potential, market opportunity, and team.

- Criteria: Suitable for high-growth startups in scalable industries.

Application and Approval Process

Factoring

- Speed: Quick approval process; funds can be accessed within days.

- Complexity: Less complex; focuses on receivables and customer creditworthiness.

Venture Capital

- Speed: Lengthy process; can take months from pitching to funding.

- Complexity: More complex; involves detailed due diligence, negotiations, and legal processes.

Risk and Stability

Factoring

- Risk: Low risk; improves cash flow without incurring debt.

- Stability: Provides stable, predictable cash flow based on existing receivables.

Venture Capital

- Risk: High risk; requires the business to meet aggressive growth targets.

- Stability: Less stable; depends on market conditions and investor expectations.

Support and Resources

Factoring

- Support: Typically limited to financial transactions; factors may offer credit management services.

- Resources: Factors specializing in specific industries may offer strategic guidance and industry connections.

Venture Capital

- Support: Extensive support; VCs provide mentorship, strategic guidance, and industry connections.

- Resources: Access to a network of experts, potential customers, and partners.

Understanding Typical Factoring Rates and Fees

When evaluating invoice financing for startups, it’s important to understand how factoring rates are structured. Unlike a business loan or a line of credit, invoice factoring is a type of financing that involves selling unpaid invoices to a factoring company in exchange for immediate cash. The cost of this service depends on several operational variables, not a fixed interest rate.

Typical factoring fees fall between one and five percent of the total invoice amount, but the exact percentage depends on customer payment terms, invoice volume, and industry risk. Many factoring companies offer both flat and tiered fee structures. For example, one model charges a base rate for the first thirty business days, then adds a small fee if the invoice is due beyond that timeframe.

The choice between recourse factoring and non-recourse factoring also affects the rate. In recourse agreements, the startup business retains responsibility if the customer fails to pay, while non-recourse shifts that risk to the factor, often at a premium.

For a startup company with limited business credit, factoring provides more predictable and accessible terms than traditional bank financing. Funds are typically deposited into your business bank account within one or two business days, helping to stabilize cash flow and grow your business.

If you’re starting a business or managing unpredictable income cycles, invoice factoring for startup companies can be a practical, scalable financing solution. Just be sure to review your factoring agreement carefully to understand how fees apply based on when your customer pays.

Why Startups Choose Factoring Over Venture Capital Financing

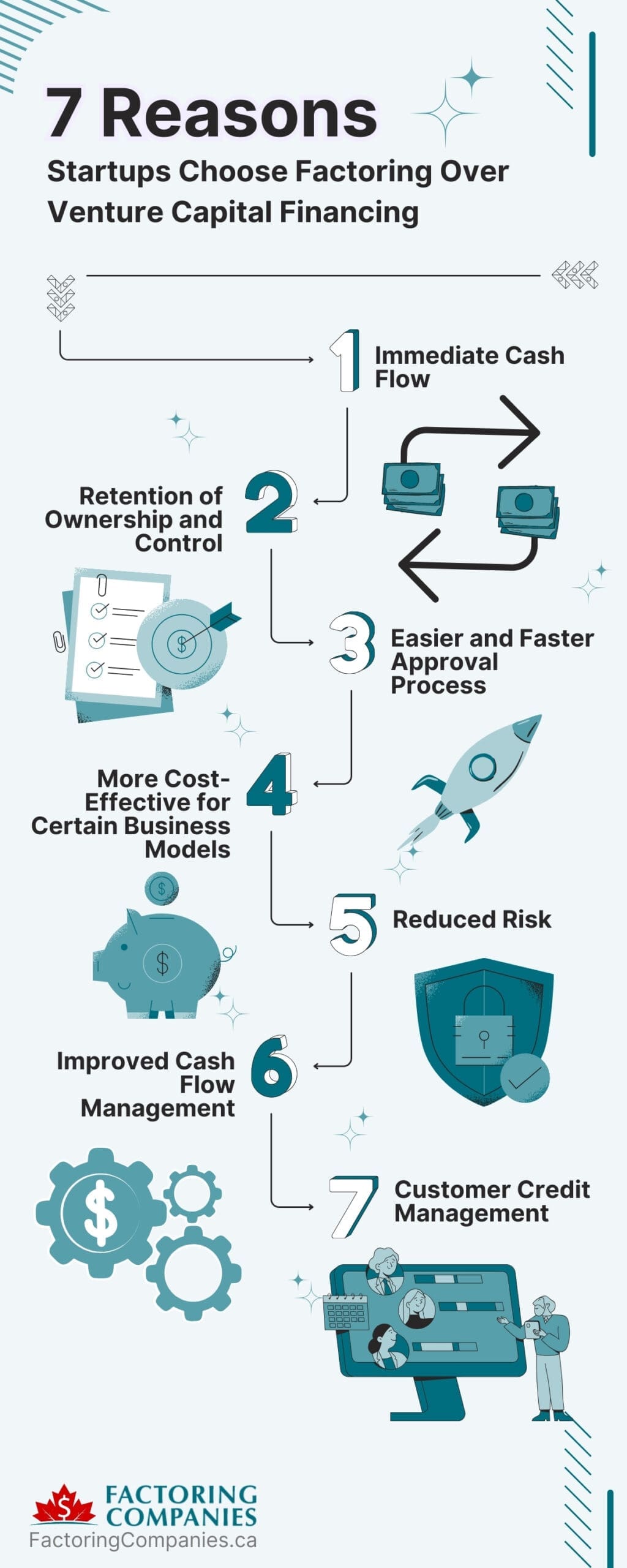

There are many reasons startups are choosing factoring over venture capital financing today. We’ll review a few of the most common below.

Immediate Cash Flow Benefits

Factoring provides immediate cash flow by selling outstanding invoices, which is crucial for startups needing to cover operational expenses, manage working capital, and seize growth opportunities without waiting for customer payments.

Retention of Ownership and Control

Factoring does not involve giving up any ownership stakes, allowing founders to retain complete control and decision-making power over their business. This is particularly important for entrepreneurs who wish to maintain autonomy.

Easier and Faster Approval Process

Factoring companies focus on the creditworthiness of the startup’s customers, not the startup itself. This makes it easier and faster for businesses with limited credit history or collateral to obtain funding, compared to the rigorous and lengthy due diligence process required by venture capital firms.

More Cost-Effective for Certain Business Models

While factoring involves fees, these costs can be more predictable and manageable compared to the high expectations for returns and growth imposed by venture capital investors. This predictability can be advantageous for businesses with steady receivables.

Reduced Risk

Factoring is not a loan, so it does not add debt to the startup’s balance sheet. This reduces financial risk and avoids the pressure of repayment schedules, making it a less burdensome option for businesses focusing on stability and steady growth.

Improved Cash Flow Management

For startups in industries with long payment cycles, such as manufacturing or logistics, factoring helps bridge the gap between invoice issuance and payment receipt. This enhances liquidity and ensures smoother business operations.

Customer Credit Management

Factoring companies generally handle collections and credit checks, which can improve cash flow management and allow the startup to focus on core business activities without worrying about chasing payments.

Explore Invoice Factoring for Your Startup Funding Needs

Startups across the country are experiencing factoring success. If you’d like to explore the fit for your growing business, request a complimentary rate quote.

FAQs Factoring vs. Venture Capital Financing

What is the main difference between factoring and venture capital financing?

Factoring involves selling a startup’s invoices to a factoring company for immediate cash without giving up equity or incurring debt. Venture capital financing provides large sums of money in exchange for equity, requiring a rigorous selection process and often leading to dilution of ownership.

Why might a startup prefer factoring over venture capital funding?

Startups may prefer factoring for quick access to cash, retention of ownership and control, easier approval processes, and reduced financial risk. Factoring provides immediate liquidity without the long approval times and equity dilution associated with venture capital.

How does invoice factoring work for startups?

Startups sell their accounts receivable (invoices) to a factoring company at a discount. The factoring company advances a percentage of the invoice value upfront, collects payment from customers, and then pays the remaining balance minus a fee.

What are the benefits of factoring for new businesses?

Factoring provides immediate cash flow, improves liquidity, involves no debt or equity dilution, has a quick and easy approval process, and helps with credit management by outsourcing collections.

Does factoring affect ownership and control of a startup?

No, factoring does not affect ownership or control. It is a transaction based on selling receivables, allowing founders to retain full decision-making power and equity in their company.

How quickly can a startup get funding through factoring?

The approval process for factoring is generally quick, often within a few days. Startups can receive funds almost immediately after selling their invoices, providing swift access to needed cash.

Are there any risks associated with factoring for startups?

While factoring provides quick cash, it can be costly due to fees and discount rates. Additionally, reliance on customer creditworthiness and potential impacts on customer relationships are considerations startups must manage.

What are the costs involved in factoring compared to venture capital?

Factoring involves fees and discount rates typically ranging from one to five percent of invoice value. In contrast, venture capital has no direct fees but involves significant equity dilution and high expectations for returns.

Can a startup with limited credit history qualify for factoring?

Yes, factoring companies focus on the creditworthiness of the startup’s customers, not the startup itself. This makes factoring accessible to startups with limited credit history or collateral.

How does factoring help improve cash flow for startups?

Factoring provides immediate cash by selling invoices, helping startups cover operational costs, and manage working capital without waiting for customer payments. This improves liquidity and ensures smoother business operations.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778