Many businesses across the country are reporting the same problem: cash flow bottlenecks that threaten their survival. Fortunately, solving cash flow problems with factoring is a proven way to keep the money flowing. On this page, we’ll walk you through what’s behind this common challenge and how to leverage factoring for cash flow acceleration to eliminate bottlenecks for good.

The Basics of Cash Flow Explained

Cash flow refers to the movement of money in and out of a business. Think of it as the lifeblood of your business, ensuring that you can cover day-to-day expenses, pay employees, invest in growth opportunities, and meet your financial obligations on time. Positive cash flow means you have more money coming in than going out, which is crucial for keeping your business healthy and running smoothly.

The Problem of Cash Flow Bottlenecks

A cash flow bottleneck occurs when the inflow of money slows down or stops altogether while outflows remain constant or even increase. This can happen for several reasons, such as delayed payments from customers, unexpected expenses, or seasonal fluctuations in revenue. When a business faces a cash flow bottleneck, it might struggle to pay bills, fulfill orders, or take advantage of new opportunities, ultimately putting its survival at risk.

For example, imagine a small manufacturing company in Ontario that supplies custom furniture to retail stores. The company has steady sales, but its customers typically take 60 to 90 days to pay their invoices. Meanwhile, the business needs to pay for materials, employee wages, and overhead costs much sooner. This delay creates a cash flow bottleneck, where the business has bills piling up but insufficient cash on hand to cover them.

Many businesses face this exact issue, with nearly three-quarters of Canadian small businesses reporting cash flow issues within the last year, per Xero surveys. Business owners say these issues have left them unable to pay themselves, forced them to negotiate payment terms with suppliers, left them unable to pay their bills, and more. Overcoming liquidity challenges with factoring is a simple solution.

The Basics of Invoice Factoring Explained

Factoring as a financial tool for small businesses is a service where a business sells its accounts receivable (invoices) to a third party, known as a factoring company, at a discount. In essence, instead of waiting 30, 60, or 90 days for customers to pay their invoices, the business can receive most of the money upfront from the factoring company, often within 24 to 48 hours.

The factoring company then takes over the responsibility of collecting the payment from the customer. Once the customer pays the invoice, the factoring company gives the business the remaining balance, minus a small fee for their services.

It’s a way for businesses to unlock the cash tied up in unpaid invoices, allowing them to maintain smooth operations without waiting for customers to pay. Factoring is commonly used by businesses that operate on credit terms and need steady cash flow to cover their expenses.

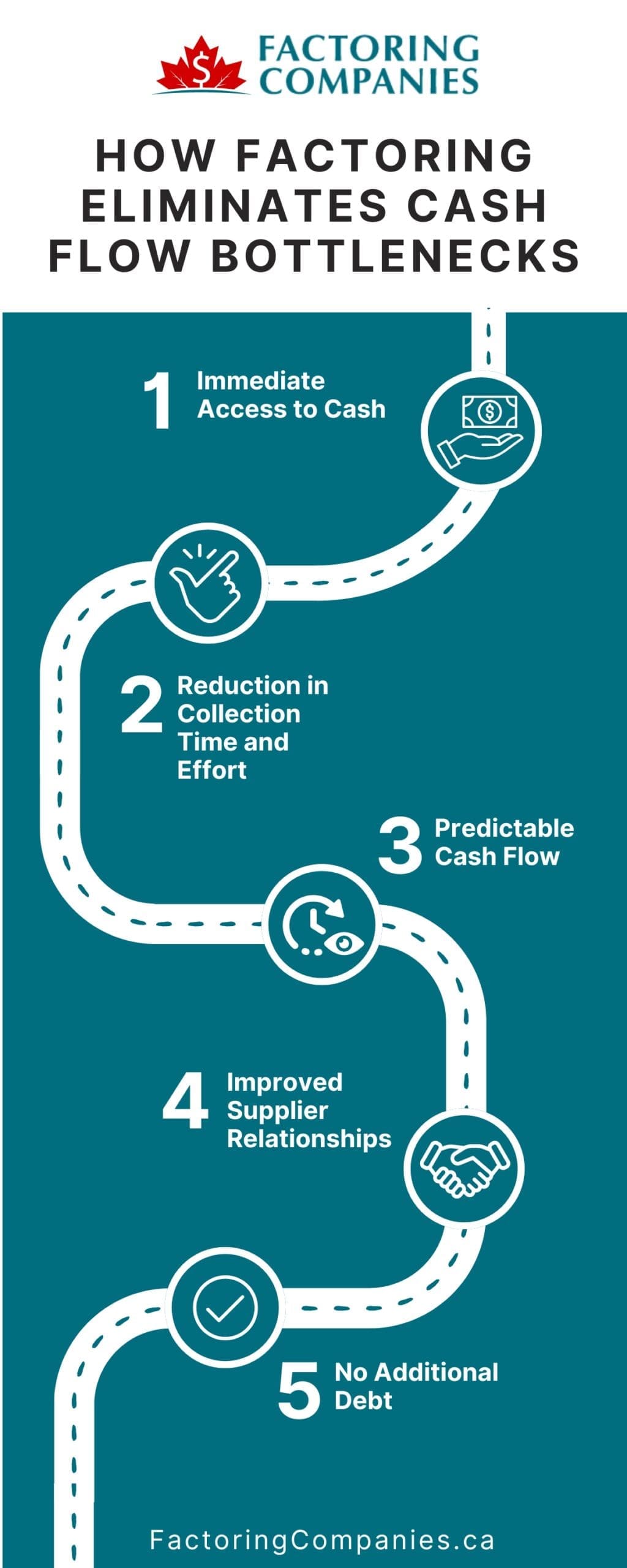

How Factoring Eliminates Cash Flow Bottlenecks

Factoring is particularly effective as a strategy for improving cash flow because it directly addresses the issue of delayed payments, a common cause of bottlenecks for many businesses. While trucking invoice factoring ensures fast access to cash for transportation and logistics companies, single invoice finance provides a more flexible alternative for businesses that need to factor individual invoices on an as-needed basis, offering targeted cash flow relief without requiring long-term commitments. For businesses struggling with payroll expenses, payroll factoring offers an efficient solution, ensuring employees are paid on time without disrupting cash flow. Let’s take a closer look at how these solutions work in practice.

For industries like oil and gas, where payment cycles can stretch beyond 90 days due to complex contracts and supply chain delays, factoring provides a crucial source of working capital. Oilfield factoring services help contractors and service providers access immediate cash to cover equipment costs, payroll, and operational expenses, ensuring business continuity without waiting on long invoice settlement periods.

Immediate Access to Cash

When a business sells its invoices to a factoring company, it receives a significant portion of the invoice value—usually around 60 to 95 percent—almost immediately. This is especially beneficial in industries with long payment cycles, such as construction. For businesses in the construction industry, invoice factoring for construction companies provides immediate cash flow to cover upfront costs for materials and labor without waiting for clients to pay. Similarly, temporary staffing factoring solutions offer staffing agencies the working capital needed to manage payroll and operational expenses despite delayed client payments. This rapid influx of cash allows the business to pay its bills, purchase inventory, cover payroll, and meet other financial obligations without waiting for customers to settle their invoices. This is especially useful for small businesses that might otherwise struggle to bridge the gap between issuing an invoice and receiving payment.

Reduction in Collection Time and Effort

Factoring companies take over the responsibility of collecting payments from customers. This not only speeds up the payment process but also reduces the time and effort the business spends on chasing down payments. As a result, the business can focus on growth and operations rather than on managing receivables.

Predictable Cash Flow

With factoring, businesses can better predict their cash flow because they know they will receive a certain amount of money shortly after issuing an invoice. This predictability is crucial for planning, budgeting, and seizing new opportunities. It removes much of the uncertainty that comes with relying on customer payment schedules.

Improved Supplier Relationships

By maintaining consistent cash flow through factoring, businesses are better able to meet their payment terms with suppliers. This can lead to stronger relationships with suppliers, who may offer better terms or discounts for timely payments. It also reduces the need to negotiate for extended payment terms, which can strain relationships.

No Additional Debt

Unlike taking out a loan, factoring doesn’t add debt to a business’s balance sheet. The business is simply accessing funds it has already earned but hasn’t yet collected. This can be a significant advantage for businesses that want to avoid increasing their liabilities.

Eliminate Your Cash Flow Bottlenecks By Factoring

If you’d like to leverage factoring for small business liquidity, we can match you with a factoring company that understands your needs and offers fast payments for your unpaid invoices. To take the first step toward cash flow acceleration, request a complimentary rate quote.

FAQs on Factoring for Cash Flow

What causes cash flow bottlenecks in small businesses?

Cash flow bottlenecks occur when incoming funds slow down or stop while expenses continue. Common causes include delayed customer payments, seasonal sales fluctuations, unexpected costs, and poor financial planning. These bottlenecks can lead to an inability to pay bills, missed opportunities, and financial stress, making it critical for businesses to manage their cash flow effectively.

How does factoring as a financial tool for small businesses work?

Factoring involves selling unpaid invoices to a third-party company at a discount in exchange for immediate cash. The factoring company advances a percentage of the invoice’s value (usually 60 to 95 percent) and takes responsibility for collecting the payment from the customer. Once the customer pays, the business receives the remaining balance minus a fee, providing a quick and reliable way to improve cash flow.

How can factoring help resolve cash flow issues?

Factoring provides immediate cash from unpaid invoices, eliminating the wait for customer payments. This helps businesses cover expenses, pay employees, and invest in growth without the strain of cash flow delays. By converting receivables into working capital, factoring smooths out cash flow, reduces financial stress, and allows businesses to operate more efficiently.

What are the benefits of factoring for small enterprises over traditional loans?

Factoring offers immediate access to cash without adding debt to a business’s balance sheet. Unlike loans, it doesn’t require collateral or lengthy approval processes. Factoring is based on the creditworthiness of a business’s customers, making it accessible even to those with limited credit history. It’s a flexible solution that grows with the business, providing ongoing cash flow support.

Is factoring suitable for all types of small businesses?

Factoring is suitable for businesses that sell products or services on credit terms and have outstanding invoices. It’s especially beneficial for industries like manufacturing, trucking, and staffing, where cash flow gaps are common. However, businesses with a steady cash flow or those not extending credit to customers might not benefit as much from factoring.

How quickly can a small business receive funds through factoring?

Most businesses can receive funds within 24 to 48 hours after submitting their invoices to a factoring company. The speed of funding is one of the main advantages of factoring, providing quick access to cash when it’s most needed. Once the factoring relationship is established, this process becomes even more streamlined, ensuring ongoing cash flow support.

What are the costs associated with factoring?

Factoring fees typically range from one to five percent of the invoice value, depending on factors like the industry, customer creditworthiness, and the volume of invoices factored. Some factoring companies may also charge additional fees for services like credit checks or wire transfers. It’s essential to understand the fee structure before entering a factoring agreement to ensure it aligns with your business’s financial goals.

How can you enhance small business cash flow via factoring?

Factoring provides immediate access to cash by selling your unpaid invoices to a third-party company. This cash can be used to cover daily expenses, invest in growth opportunities, and maintain smooth operations, effectively enhancing your small business cash flow without waiting for customers to pay.

What are quick cash solutions for small businesses with factoring?

Factoring is one of the quickest cash solutions available for small businesses. By converting unpaid invoices into immediate cash, factoring allows businesses to address financial needs quickly, covering payroll, inventory purchases, and other urgent expenses without taking on additional debt.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778