Are you trying to find a complete cost breakdown of factoring services in Canada? We’ve got you covered. Although it’s better to get a personalized quote because the cost of factoring will vary slightly for each business, you can get a good idea of your costs if you understand how factoring works and what types of fees may apply. Below, we’ll walk you through typical factoring rates, options that impact your costs, and additional charges you may see when you factor, so it’s easier to estimate your total costs on your own.

Understanding Factoring Fees in Canada: Costs and Fee Structures

Invoice factoring is not a loan. You’re selling your unpaid B2B invoices at a discount to a third party known as a factor or factoring company. The invoice factoring company immediately provides you with most of the invoice’s value and then collects payment from your client. When that payment comes in, the factoring company sends you the remaining balance minus a small factoring fee.

Advance Rates

The amount of upfront cash your business receives is called an “advance rate.” Your industry is one of the largest considerations in how much a factor will advance. Most advance rates are between 60 and 80 percent, though a few industries, such as staffing and transportation, top 90 percent. For example, if you run a trucking company, want to factor a $100,000 invoice, and your advance rate is 96 percent, you will receive $96,000 immediately.

Common Factoring Fee Structures

As mentioned, your factoring company will retain a small portion of the invoice payment to cover your factoring fee. There are two main types of fee structures here: flat and variable fees.

Flat Fee

It’s quite common for factors to charge a flat fee between one and five percent of an invoice’s value.

Tiered Factoring Fee

Sometimes, factors will use a tiered factoring rate, which means the rate changes on each invoice depending on how quickly the client pays. The faster your client pays, the lower the factoring rate will be.

How is Your Factoring Rate Determined?

While factoring companies will each have their own methods for determining factoring rates, the variables they consider are relatively consistent. The information below can help you ballpark your rate.

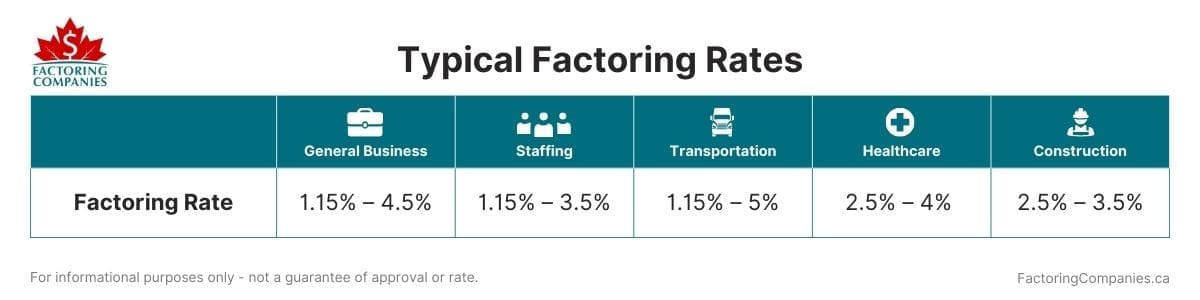

Your Industry

Your industry is one of the biggest factors influencing your rate, especially when considering the cost of factoring for service providers, who depend on predictable cash flow and steady client payments. While rates may be between one and five percent on average, you can get a clearer picture of what you’re likely to pay by looking at industry-specific figures.

For example, the range is 1.15 to five percent in the transportation industry. Using our earlier example of a $100,000 invoice and a two percent flat factoring rate, the business pays a $2,000 factoring fee.

If this is the only fee the business pays, that means the business receives $96,000 upfront and another $2,000 when their client pays.

How Creditworthy Your Customers Are

You can qualify for factoring even if you don’t have strong credit or other forms of lending. This is because the factor is more concerned with the financial behaviours of your client, as they’re responsible for paying the invoice.

Your factor will check the credit of your client before factoring any invoices. If your client has a history of paying their balances on time, it will be reflected in a good or excellent credit rating. Your factor will also examine debt levels and the client’s ability to pay balances owed. There’s less risk in extending credit through invoicing when your client’s score is high, and they have the financial ability to pay, so factoring rates are lower in these cases. The risk of non-payment increases as credit scores and ability to repay drop. Therefore, the factoring rate paid on invoices for those clients will be higher.

Invoice Size and Volume

Many things happen on the back end when you factor an invoice. Your factoring company takes over the collection process. This involves everything from client interactions to processing and logging payments. Sometimes, they’ll handle invoice preparation too. Because each client and invoice consumes resources, costs will often increase with the number of clients and invoices, even if the value of the invoices doesn’t change. For instance, the factoring rate for a single $50,000 invoice will typically be lower than the rate for five $10,000 invoices.

Equally, businesses that factor more often usually have a lower overall factoring rate. For instance, a business that consistently factors $100,000 in invoices each month will typically have a lower factoring rate than one that only factors periodically or only factors $25,000 in invoices each month.

Your Payment Terms

Although 30 and 60-day payment terms are relatively standard in most industries, some also provide windows that are 90 days or longer. Factoring rates increase with the payment window. Your factoring company will also consider how long your clients usually take to pay. For instance, if you allow 30 days but clients pay in 40, you may see a slight uptick in costs.

The Length of Your Factoring Agreement

Factoring companies don’t always tie you into a long-term agreement. However, it’s somewhat common for a factoring company to offer reduced rates if you agree to stay with them for a period of time. Factoring companies don’t always tie you into a long-term agreement. However, it’s somewhat common for a factoring company to offer reduced rates if you agree to stay with them for a period of time. Factoring companies don’t always tie you into a long-term agreement. However, it’s somewhat common for a factoring company to offer reduced rates if you agree to stay with them for a period of time.

The Type of Factoring You Choose

The credit checks performed at the onset of factoring considerably reduce the likelihood of non-payment. However, there is always some risk. You may be able to choose whether you or the factoring company assumes that risk, depending on whether the factoring company you partner with offers recourse or non-recourse factoring.

- Recourse Factoring: You assume the risk of non-payment with recourse factoring. Your factoring agreement will stipulate what happens in the event of non-payment. Sometimes, businesses can substitute other invoices of the same value, while the business must repay the factor other times. This is the more common and more affordable type of factoring.

- Non-Recourse Factoring: The factoring company assumes the risk of non-payment with non-recourse factoring. If your client doesn’t pay, the factoring company absorbs the loss. Not all factoring companies offer this option, and it tends to be more expensive, so it’s utilized less often.

Invoice Factoring vs. Alternative Financing Options

Choosing the right financing solution is critical for managing cash flow effectively. Here’s how invoice factoring compares to other common options.

Invoice Factoring: Flexible and Immediate Access to Cash

Invoice factoring can provide immediate access to funds by selling unpaid invoices to a factoring company. Businesses receive an advance, often up to 95% of the invoice value, while the factoring company handles collections. Factoring does not create debt, making it ideal for businesses with irregular cash flow. The factoring cost, determined as a percentage of the invoice value, varies by industry. While factoring is fast and flexible, businesses must consider the total factoring cost, including any additional fees, to evaluate the actual cost of factoring.

Traditional Loans: Structured Financing with Long Approval Times

Loans provide a lump sum repaid over time with interest, often requiring collateral or strong credit. While loans may offer competitive rates, the cost of financing can rise significantly with origination fees and penalties for missed payments. Loans are less suitable for addressing short-term gaps caused by unpaid invoices.

Lines of Credit: Flexible but Dependent on Credit History

Lines of credit allow businesses to borrow as needed, but limits are tied to creditworthiness and may not scale with business growth. Interest accrues on borrowed amounts and additional fees may apply. In contrast, invoice factoring relies on the creditworthiness of customers, making it more accessible for businesses with inconsistent cash flow.

“Hidden” Factoring Fees to Watch For

Your factoring rate largely determines the cost of factoring. However, sometimes factoring companies apply additional charges for all clients, or expenses may increase based on the services you sign up for.

Application Fee

Some factoring companies charge a fee when you submit your application. This covers the administrative costs of reviewing your documentation and processing the application.

Setup Fee

Once approved, some factoring companies charge a fee to set up your account with them.

Credit Check Charges

As covered earlier, factoring companies run credit checks on your clients to determine how much credit you can safely extend through your invoicing process. While many will absorb the cost, others will pass the cost onto you.

Processing Fee

Each time you submit an invoice to your factoring company, they will confirm it is valid, approve it, and send you your advance. Some factoring companies charge a fee to cover the administrative cost of this.

Payment Charges

How you receive your payments from the factoring company can impact your overall costs, too. For instance, some companies don’t charge any fee if you choose to be paid by check, but they will charge a small fee if you want to be paid by ACH. Choosing this method means your cash is automatically deposited into your bank account and usually arrives within two business days. Sometimes, factoring companies will offer same-day payments too. It tends to be slightly more expensive than ACH due to the increased cost of wiring funds.

Monthly or Volume Charges

Factoring companies sometimes have a standard monthly charge for all accounts regardless of usage, while others will waive the fee if you factor or factor a certain amount. Others may have monthly minimums, and a fee is assessed if you don’t meet them.

Termination Fees

While many factoring companies don’t tie you into a contract, those that do will often have a termination fee if you leave the company before your agreement ends. Others charge fees to close your account and wrap up all associated activities.

Other Fees

Although the examples above cover most types of additional charges you may see while factoring, each company is different. Always confirm all fees are represented when reviewing a factoring quote, and thoroughly review your factoring agreement to ensure you’re aware of all potential costs.

Find Out Your Cost of Factoring with a Free Rate Quote

Because the cost of factoring varies with each provider and for each business served, a custom quote is the best way to get total clarity on your anticipated costs. We’re happy to match you with a factoring company that specializes in your industry and offers competitive rates to help ensure you have a great experience while keeping your costs as low as possible. Request a complimentary rate quote to get started.

About Factoring Companies Canada

Related Insights

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778