The construction industry is booming and now contributes more than $151 billion to the economy annually, the Canadian Construction Association reports. Moreover, a typical construction firm clears close to $500 thousand annually, and the vast majority is profitable, government data shows. But, if you’re in the industry, you know all too well that profit and cash flow are totally different things. Businesses must be meticulous when it comes to cash flow management to keep the supplies coming and drills turning. On this page, we’ll walk you through strategies to help alleviate the burden and explore how factoring helps address some of the biggest construction cash flow challenges.

Common Construction Business Cash Flow Challenges

The construction industry faces unique cash flow challenges that can significantly impact the stability and growth of companies.

Delayed Payments

- Client Payment Delays: Clients often delay payments due to extended approval processes, project inspections, or financial constraints. This can create significant cash flow gaps for construction companies.

- Retention Payments: Clients may withhold a percentage of the payment, usually five to ten percent, until the project is fully completed and all punch list items are resolved. This retention can tie up funds for months.

High Upfront Costs

- Material and Equipment Purchases: Construction projects require substantial upfront investments in materials and equipment, which must be paid for before any revenue is received from the client.

- Labour Costs: Paying workers and subcontractors on time is essential for maintaining project schedules, yet these payments often must be made before the company receives payment from clients.

Project Delays and Overruns

- Unexpected Delays: Weather conditions, permit issues, or unforeseen site conditions can cause project delays, leading to extended timelines and increased costs.

- Cost Overruns: Projects can exceed budgeted costs due to changes in scope, rising material prices, or misestimations. These overruns can strain cash flow further.

Complex Payment Structures

- Progress Payments: Construction projects often involve progress payments based on completed milestones. This phased payment structure can lead to cash flow fluctuations, especially if milestone approvals are delayed.

- Multiple Stakeholders: Payments must be coordinated among various stakeholders, including subcontractors, suppliers, and service providers. Delays or disputes at any level can disrupt the entire payment chain.

Effective Strategies to Overcome Cash Flow Challenges

There are many ways to address cash flow management in construction. We’ll quickly review a few below.

Improving Invoicing Practices

To accelerate payment timelines, issue invoices promptly upon completion of milestones or deliverables. Include clearly defined payment terms and conditions in contracts to reduce misunderstandings and disputes and ensure more timely payments are received.

Effective Project Management

Use precise cost estimation techniques and regularly update budgets to help manage project costs and avoid overruns. Setting aside contingency funds for unexpected expenses can provide a financial buffer during project delays or overruns.

Negotiating Better Terms with Clients and Suppliers

Negotiate more favourable payment schedules with clients, such as more frequent progress payments or upfront deposits, to improve cash flow. Establish credit lines with suppliers to delay outflows and provide more time to collect payments from clients before paying for materials.

Maintaining a Cash Reserve

Keep a cash reserve or emergency fund to help manage unexpected cash flow shortfalls and ensure the company can meet its obligations.

Implementing Factoring

Sell invoices to a factoring company for immediate cash flow to bridge the gap between issuing invoices and receiving client payments.

Factoring in the Construction Industry

As mentioned, factoring is a financial service where a business sells its invoices to a third party at a discount in exchange for immediate cash. This practice is especially beneficial in industries with cash flow challenges, such as invoice factoring for construction companies, where delayed payments and substantial upfront costs are common.

For example, contractors operating in Edmonton can take advantage of Edmonton factoring companies that understand the region’s construction payment cycles and regulatory requirements, helping them bridge cash flow gaps and keep projects on track.

Understanding Factoring for Construction Projects

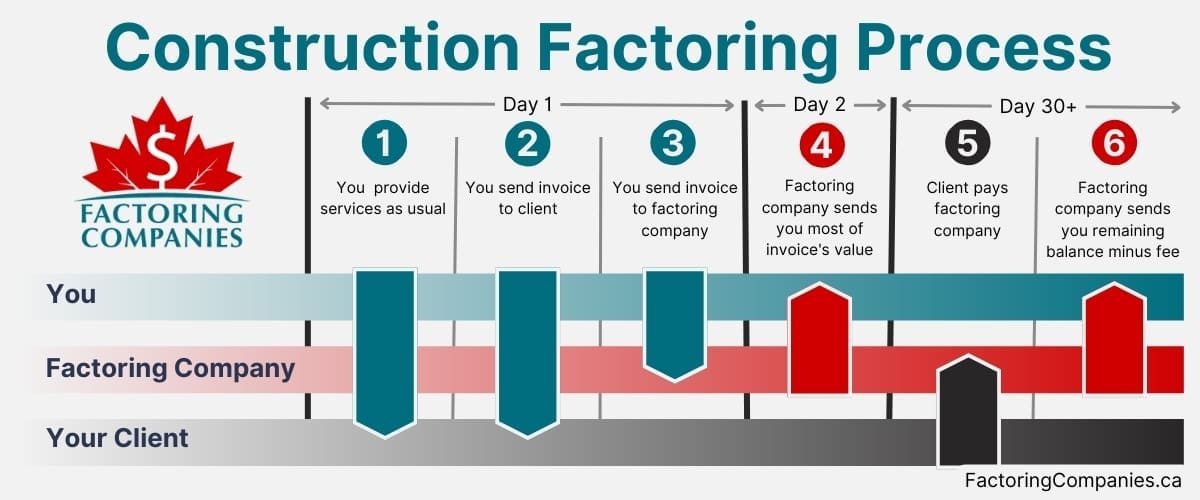

Here’s a simplified breakdown of how construction factoring works.

- Invoice Issuance: A construction company completes a project or a milestone and issues an invoice to the client.

- Invoice Sale: Instead of waiting for the client to pay, the company sells the invoice to a factoring company.

- Immediate Cash: The factoring company advances a significant percentage of the invoice value. In general, this can be anywhere from 60 to 95 percent of the invoice’s value, though the construction industry typically receives factoring advances of 70 to 80 percent.

- Collection: The factoring company collects the payment from the client.

- Remainder Payment: Once the client pays the invoice, the factoring company pays the remaining balance to the construction company, minus a small fee for the service.

Example of How Construction Factoring Works

Let’s take a quick look at how this might work in practice. Picture a general contractor in Quebec. He’s working on a commercial project and will generate an invoice of $100,000 upon completing a phase of the work. Instead of waiting the typical 60-90 days for the client to pay, the contractor sells this invoice to a factoring company. The factor might advance $80,000 immediately. When the client eventually pays the invoice, the factor deducts their fee, let’s say $2,000, and pays the remaining $18,000 to the contractor. This process ensures the contractor has the necessary funds to continue business operations without interruption.

Alternative Subcontractor Payment Method

The scenario described above works well if a general contractor (GC) or construction firm owner needs working capital for their own reasons. However, it’s often the subcontractors rather than the GCs who are unable to wait for payment. In these cases, specialized construction factoring programs allow the general contractor to arrange for advances for their subcontractors. We’ll detail how this process might work below.

- Setup: The initial setup is the same in terms of the GC submitting an invoice to the factoring company and getting approved.

- Decide Who Qualifies: The GC decides which subcontractors qualify for the program, which projects they qualify on, when they’ll qualify, and how large of an advance they can receive.

- Subcontractor Accepts: The subcontractor decides whether they want the advance.

- GC Approves: If the subcontractor requests the advance, the GC has the final say. This helps ensure the subcontractor meets all your requirements for early payment.

- Subcontractor is Paid: The subcontractor provides a few documents and receives payment immediately in accordance with the GC’s wishes. Typically, a small portion is held back from the subcontractor’s payment as a fee to the factoring company, meaning the GC does not incur or pay any fees.

- Balance Clears: When the invoice is paid, the GC receives the remaining balance.

Example of How the Alternate Subcontractor Payment Method Works

Let’s say that a GC in Newfoundland and Labrador is building a doctor’s office and will receive a $100,000 milestone payment. His electrician is completing the wiring. His payment will be $47,000, and he’d normally receive it when the milestone pays out, but that could be a month or two from now. Moreover, the electrician’s next task is to install the lighting fixtures, and he needs working capital to purchase them now. That way, they’re ready to go, and the project isn’t delayed.

The GC gets set up with the factoring company, provides them with a copy of the $100,000 invoice, and lets them know that he wants the electrician to receive an advance of up to $15,000 to purchase the fixtures once the wiring is finished in one week. The factoring company then notifies the electrician he’s approved for the advance. Once the electrician finishes the wiring, he requests the advance. The GC approves it. The electrician then sends the factoring company a few documents, and his advance hits his account the next day. When the client pays, the factoring company sends the GC $85,000, which is the total milestone payment minus the electrician’s advance.

In this example, the GC chose not to advance the electrician’s full payment, so he uses his $85,000 to cover the remaining $32,000 due to the electrician, pay other subcontractors who were not part of the program, and cover his overhead costs.

It’s important to note that this example presents a tailored approach that works for this particular GC in this situation. He could have just as easily advanced more cash to the electrician or selected more contractors to receive advances.

Benefits of Factoring for Construction Businesses

Factoring offers many benefits for construction businesses, making it an attractive option for managing cash flow and supporting growth.

Boosting Business Growth Through Factoring

- Immediate Cash Flow: By converting invoices into immediate cash, factoring ensures construction companies have the funds needed to cover ongoing expenses, invest in new projects, and take advantage of growth opportunities without waiting for clients to pay.

- Improved Financial Health: Consistent cash flow helps maintain the overall financial health of the business. It allows companies to avoid taking on debt or using high-interest credit lines, thereby improving their balance sheets.

Managing Supplier Payments

- Timely Payments: Factoring enables construction businesses to pay suppliers and subcontractors promptly. This timely payment can lead to better relationships and potential discounts from suppliers for early payments.

- Maintaining Project Schedules: With immediate funds available, construction companies can ensure that all necessary materials and services are paid for and delivered on time, preventing project delays and maintaining smooth operations.

Reducing Financial Risks with Factoring Solutions

- Reduced Bad Debt Risk: Factoring companies typically perform credit checks on clients before purchasing invoices. This credit assessment helps construction businesses avoid working with clients who might have payment issues, thus reducing the risk of bad debt.

- Mitigating the Impact of Slow Payments: Slow payments from clients are a common issue in the construction industry. Factoring mitigates this impact by providing immediate cash flow, ensuring that the company can continue to operate effectively without being hampered by late payments.

Enhancing Competitive Edge

- Bidding on Larger Projects: With improved cash flow, construction businesses can confidently bid on larger projects, knowing they have the financial backing to support the upfront costs and sustained cash flow required.

- Strengthened Negotiation Position: Reliable and timely payments to suppliers and subcontractors can strengthen a company’s negotiation position, potentially leading to better terms and pricing for materials and services.

Traditional Loans vs. Factoring for Construction Funding

Understanding the differences between different financing methods is crucial for construction businesses when deciding how to best manage their cash flow. Below, we’ll explore a few key areas that make factoring distinct.

Funding Source

- Factoring: Funding comes from selling your accounts receivable (invoices) to a factoring company. The factor provides immediate cash based on the value of these invoices.

- Loans: Funding is provided as a lump sum by a bank or financial institution, which you repay over time with interest.

Approval Process

- Factoring: Approval is typically faster and easier, focusing on the creditworthiness of your clients rather than your own credit history.

- Loans: Approval is often slower and more complex, requiring a strong credit history, financial statements, and collateral.

Debt and Balance Sheet Impact

- Factoring: Does not create debt. The cash received is not a loan but an advance on your receivables, so it doesn’t add to your liabilities.

- Loans: Adds debt to your balance sheet, which can impact your credit rating and borrowing capacity.

Flexibility and Use

- Factoring: Provides ongoing cash flow as invoices are generated, making it ideal for covering day-to-day operational expenses, payroll, and supplier payments.

- Loans: Typically used for larger, long-term investments or capital expenditures and less flexible for addressing immediate cash flow hurdles.

Repayment

- Factoring: No repayment is required since the factor collects directly from your clients. Your responsibility is to ensure your clients pay their invoices.

- Loans: Requires regular repayments (monthly or quarterly) with interest, regardless of your cash flow situation.

Risk Assessment

- Factoring: The factoring company assesses the risk based on the creditworthiness of your clients. This reduces the risk for your business if clients delay payments.

- Loans: The bank assesses the risk based on your company’s credit history, financial health, and ability to repay the loan.

Cost Structure

- Factoring: Costs are typically higher due to factoring fees, which are a percentage of the invoice value. These fees are paid for convenience and speed in getting immediate cash.

- Loans: Generally have lower interest rates, making them cheaper over the long term but with higher upfront qualification requirements.

Explore Your Construction Factoring Options

Finding a reliable factoring company can be challenging, especially with the unique needs of the construction industry. Factoring Companies Canada simplifies this process by connecting you with reputable factoring providers who specialize in construction. These experts offer tailored solutions, ensuring your cash flow remains steady despite project delays and payment cycles. To explore your construction factoring options, request a complimentary rate quote.

Construction Cash Flow Management FAQs

How does factoring work for construction companies?

Factoring works by converting invoices into immediate cash. A construction company issues an invoice, sells it to a factoring company, and receives an advance. The factor collects the payment from the client and pays the remaining balance, minus a fee, to the construction company once the client pays.

What are the benefits of factoring for construction businesses?

Benefits include immediate cash flow, no added debt, improved supplier relationships through timely payments, reduced financial risk by relying on client creditworthiness, and the ability to take on more projects without waiting for client payments.

How does factoring improve cash flow in construction projects?

Factoring provides immediate cash by advancing funds based on issued invoices. This ensures construction companies have the necessary liquidity to cover operational expenses, pay suppliers and subcontractors, and manage project timelines without financial disruptions.

What are the key differences between factoring and traditional loans for construction companies?

Factoring provides immediate cash based on invoices, does not add debt, and is easier to qualify for. Traditional loans provide a lump sum, require strong credit, add debt to the balance sheet, and have a lengthy approval process.

Why is factoring a better fit for construction projects compared to traditional financing?

Factoring is better suited for construction due to the industry's extended payment cycles and high upfront costs. It provides immediate cash flow, aligns with project-based payments, and does not add debt, making it ideal for managing operational expenses and maintaining project timelines.

What are the common cash flow challenges faced by construction companies?

Common challenges include delayed client payments, high upfront costs for materials and labour, project delays, cost overruns, and complex payment structures involving multiple stakeholders. These issues can disrupt cash flow and hinder project progress.

How can construction companies overcome cash flow issues?

Strategies include implementing invoice factoring, improving invoicing practices, accurate cost estimation, contingency planning, negotiating better payment terms with clients and suppliers, and maintaining a cash reserve to handle unexpected expenses.

What should construction companies consider when choosing a factoring service?

Consider the factoring company's reputation, fees, advance rates, terms and conditions, industry experience, and client credit assessment processes. It's also important to understand the factor's collection practices and customer service quality.

How does factoring help manage financial risks in the construction industry?

Factoring is part of a comprehensive risk management strategy because it provides immediate cash flow so it’s easy to make timely payments to suppliers and subcontractors. It also mitigates the impact of delayed client payments and avoids adding debt to the balance sheet, maintaining financial stability.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778