Do you ever feel like you’re drowning in unpaid invoices? Whether your business consistently produces a high volume of invoices or experiences a deluge at certain times of the year, staying on top of them and managing cash flow can create serious challenges, especially if you operate a small or mid-sized company with limited access to external funds. Thankfully, there’s a single solution that frees you from chasing invoices and provides immediate payment: bulk factoring. In this guide, you’ll learn the basics of invoice factoring and common variants, and how bulk factoring differs, so it’s easy to find the right factoring fit for your needs.

Traditional Factoring Explained

Traditional factoring is a financial arrangement in which a business sells its accounts receivable (invoices) to a third party, known as a factor, at a discount. This allows the business to receive immediate cash instead of waiting for the payment terms to be fulfilled by its customers.

How Traditional Factoring Works

- Invoice Submission: The business provides goods or services to its customers and generates invoices.

- Invoice Sale: The business sells these invoices to a factor.

- Immediate Payment: The factor advances a percentage of the invoice value (typically 60 to 95 percent) to the business.

- Collection: The factor collects the full invoice amount from the customer.

- Final Payment: Once the invoice is paid, the factor remits the remaining balance to the business, minus a factoring fee.

Traditional Factoring Variants

While the above example is typical of traditional factoring, each factoring company and contract is unique. Prime examples of variants that some factoring companies offer include recourse vs. non-recourse factoring and notification vs. non-notification factoring.

Recourse vs. Non-Recourse Factoring

In recourse factoring, the business selling the invoices retains the risk of non-payment. This means that if the factor is unable to collect the invoice amount from the customer, the business must repay the advance received from the factor. Here are the key points:

- Risk Retention: The business remains liable for any uncollected invoices.

- Lower Fees: Because the factor’s risk is lower, the factoring fees are generally lower compared to non-recourse factoring.

- Suitability: Best suited for businesses confident in their customers’ ability to pay and wanting to minimize factoring costs.

In non-recourse factoring, the factor assumes the risk of non-payment. If a customer fails to pay, the factor cannot seek reimbursement from the business. This variant typically comes with higher fees due to the increased risk the factor bears.

- Risk Transfer: The factor bears the risk of non-payment, protecting the business from bad debts.

- Higher Fees: The factoring fees are higher to compensate for the increased risk.

- Credit Evaluation: Factors typically perform rigorous credit checks on the business’s customers to mitigate risk.

Recourse factoring holds the largest market share, according to Grand View Research. However, non-recourse factoring is growing faster.

Notification vs. Non-Notification Factoring

In notification factoring, the customers are informed that their invoices have been sold to a factor. They are instructed to make payments directly to the factor.

- Transparency: Customers are aware of the factoring arrangement, which can sometimes affect customer relationships.

- Direct Payment: Customers pay the factor directly, streamlining the collection process.

- Administrative Ease: The business benefits from reduced administrative tasks related to collections.

Non-notification factoring, also known as confidential factoring, keeps the factoring arrangement undisclosed to customers. The business may continue to collect payments as usual and then forward them to the factor, or the factor may collect them using the business’s contact details.

- Confidentiality: Customers are unaware of the factoring arrangement, preserving existing customer relationships.

- Payment Handling: The business collects payments from customers and remits them to the factor.

- Higher Complexity: This method requires more internal administrative effort to manage payments and reporting to the factor.

Non-notification factoring is newer, so not all factoring companies offer it, and it’s leveraged less often.

Who Uses Traditional Factoring?

Traditional factoring is commonly used by small to medium-sized businesses that need to manage cash flow effectively. It is particularly beneficial for companies with long payment cycles or those experiencing rapid growth. Industries that often use factoring include manufacturing, trucking, staffing, and wholesale distribution, among others.

Benefits of Traditional Factoring

- Improved Cash Flow: Provides immediate cash, helping businesses manage daily operations, pay employees, and cover expenses.

- Credit Management: Factors often provide credit management services, helping businesses assess the creditworthiness of their customers.

- No Debt Incurred: Unlike loans, factoring does not create debt on the company’s balance sheet.

- Flexibility: Can be used as needed, offering flexibility compared to traditional bank loans.

- Focus on Core Business: Businesses can focus on their core activities rather than spending time on collections.

Example of Traditional Factoring

A Manitoba manufacturing company with a steady flow of orders might face a 60-day payment term from its clients. By using traditional factoring, the company can sell these invoices to a factor and receive immediate cash to purchase raw materials and pay workers, thus maintaining smooth operations without waiting for the customers to pay.

Bulk Factoring Explained

Bulk factoring involves a business selling a large volume of invoices to a factor but with a few key specifications: the customers are usually aware of the factoring arrangement and make payments directly to the factor.

How Bulk Factoring Works

- Invoice Submission: The business generates a large volume of invoices.

- Invoice Sale: The business sells these invoices in bulk to a factor.

- Advance Payment: The factor advances a significant portion of the total invoice value, typically 75 to 85 percent.

- Direct Payment: Customers are informed to pay the factor directly.

- Final Payment: Once the invoices are paid, the factor remits the remaining balance to the business, minus a factoring fee.

Bulk Factoring Variant

When bulk factoring is provided with a non-recourse clause, it may also be referred to as “agency factoring.”

Who Uses Bulk Factoring?

Bulk factoring is often used by businesses that issue a high volume of invoices regularly. This includes sectors such as wholesale distribution, manufacturing, logistics, and large-scale services. It’s particularly beneficial for companies with many small transactions or businesses with numerous customers.

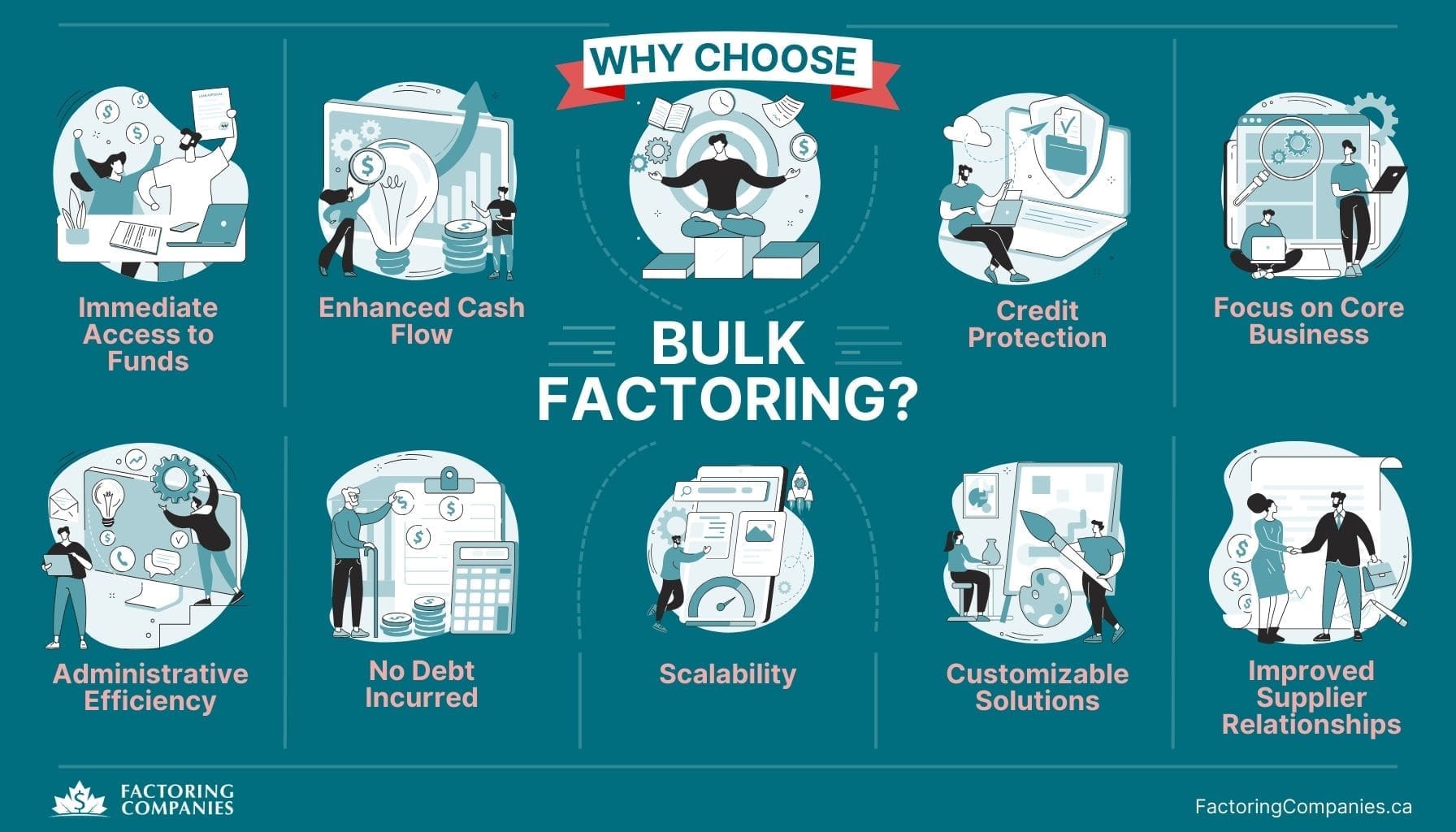

Benefits of Bulk Factoring

- Scalability: Ideal for businesses with high-volume invoicing, allowing them to manage and finance a large number of transactions efficiently.

- Administrative Efficiency: Reduces the workload of managing multiple invoices and collections, freeing up internal resources for core business activities.

- Enhanced Cash Flow: Provides a steady and immediate influx of cash, crucial for businesses with large-scale operations needing consistent liquidity.

- Credit Protection: Often includes credit risk management services, reducing the risk of bad debts, especially in non-recourse agreements.

- Improved Supplier Relationships: Ensures timely payments to suppliers, potentially leading to better terms and discounts.

- Customer Credibility: Direct payment to the factor can improve the business’s credibility with customers, demonstrating professional credit management.

- Customizable Solutions: Bulk factoring agreements can be tailored to meet the specific needs and scale of the business, offering more flexibility than traditional factoring.

Example of Bulk Factoring

Consider a Mississauga logistics company that handles hundreds of shipments monthly, invoicing a large number of clients. By using bulk factoring, the company can sell its invoices to a factor and receive immediate cash. This allows the company to fuel its operations, maintain vehicles, and pay drivers without delay. Since the factor handles collections, the logistics company can focus on expanding its services and acquiring new clients.

Find Your Factoring Fit

Factoring companies offer a wide variety of solutions to meet the needs of modern businesses. For instance, if you find that traditional or bulk factoring isn’t a fit for your needs due to low-volume invoicing or intermittent cash flow concerns, a solution such as spot factoring may work better for you. To explore your options and find your factoring fit, request a complimentary rate quote.

Bulk Factoring FAQs

What is bulk factoring and how does it work?

Bulk factoring involves selling a large volume of invoices to a factor, who then advances a significant portion of the total value and collects payments directly from customers. This provides immediate cash flow and reduces the administrative burden of managing numerous invoices.

Why is bulk factoring beneficial for businesses with high-volume invoicing?

Bulk factoring offers immediate cash flow, allowing businesses to manage operational expenses and invest in growth. It reduces the administrative burden of handling numerous invoices and collections, freeing up resources for core activities.

What types of businesses typically use bulk factoring?

Businesses with high-volume invoicing, such as wholesalers, manufacturers, logistics companies, and large-scale service providers, commonly use bulk factoring to manage their cash flow and operational efficiency.

How does bulk factoring improve cash flow for high-volume businesses?

Bulk factoring provides immediate funds by advancing a significant portion of the invoice value, allowing businesses to cover operational costs, pay suppliers, and invest in growth without waiting for customer payments.

What are the key differences between bulk factoring and traditional factoring?

Bulk factoring involves selling a large volume of invoices with direct customer payment to the factor, which is ideal for high-volume transactions. Traditional factoring typically handles smaller volumes, with varying degrees of notification and recourse options.

Are there any risks associated with bulk factoring?

Risks include potential damage to customer relationships if customers are uncomfortable with the factoring arrangement. Additionally, businesses may face higher fees if customers default on payments, depending on the type of factoring agreement.

How does bulk factoring affect customer relationships?

In notification bulk factoring, customers are informed and pay the factor directly, which may affect relationships. However, it can also enhance credibility by ensuring timely payments and professional credit management.

What should I look for in a bulk factoring provider?

Look for a provider with a strong reputation, transparent fee structure, excellent customer service, and industry experience. Ensure they offer flexible terms and have a solid track record in handling high-volume transactions.

Can small businesses in Canada benefit from bulk factoring?

Yes, small businesses with high-volume invoicing can benefit from improved cash flow, reduced administrative burdens, and enhanced credit management, helping them grow and stabilize their operations.

How does the advance payment process work in bulk factoring?

The factor advances a percentage (typically 75-85 percent) of the total invoice value to the business upon purchase. The remaining balance, minus factoring fees, is remitted once the factor collects payment from customers.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778