When businesses need access to cash, factoring and credit cards are two common options. While both can help bridge financial gaps, they work in fundamentally different ways and are suited for different needs.

Understanding Factoring and Credit Card Financing

Before we compare factoring vs. credit cards, let’s start with the basics of how each one works.

How Factoring Works

Factoring is a straightforward process designed to give businesses faster access to funds without waiting for customer payments. Here’s how it works and why it’s a powerful cash flow solution.

Selling Invoices for Immediate Cash

When you issue an invoice to a customer, it often includes a payment term of 30 to 90 days. Instead of waiting for that payment, you sell the invoice to a factoring company. They advance a significant portion of the invoice’s value—often 80 to 90 percent—within 24–48 hours. Once your customer pays the invoice, the factoring company releases the remaining balance, minus their fee.

Managing Cash Flow with Factoring

Factoring bridges the cash flow gap created by long payment terms. For example, if you need funds to cover payroll, buy inventory, or seize a growth opportunity, factoring gives you the liquidity to act immediately. This makes it especially useful for industries with extended payment cycles, like trucking, manufacturing, or construction.

Receiving Additional Services with Factoring

It’s common for factoring companies to provide collections services for factored invoices, saving businesses time and effort. Some also offer invoice preparation and industry-specific perks, such as fuel discount cards for transportation companies. These benefits can help businesses operate more efficiently, save money, and grow faster.

Why Factoring Is a Controlled Finance Option

Factoring stands out as a controlled financing solution because it ties directly to your accounts receivable. The amount you can access grows naturally with your business as your invoice volume increases. Unlike credit cards, which require regular repayments and can lead to debt, factoring offers a predictable and manageable way to fund your operations.

How Credit Cards Work

Credit cards are another way businesses can access funds, but they function very differently from factoring.

Using Revolving Credit for Short-Term Financing

Credit cards provide businesses with a borrowing limit they can use to cover expenses like supplies, travel, or utilities. As you make payments, the credit becomes available again, offering ongoing access to funds.

Risks of Credit Card Debt

While credit cards are convenient, they come with high interest rates and fees, especially if you carry a balance over time. This can make them an expensive and potentially unstable option for managing cash flow, particularly for businesses with fluctuating revenue or high expenses.

Comparing Factoring and Credit Card Financing

Now that we’ve covered the basics, let’s explore what sets factoring and credit card financing apart.

Key Credit Card and Factoring Financing Differences

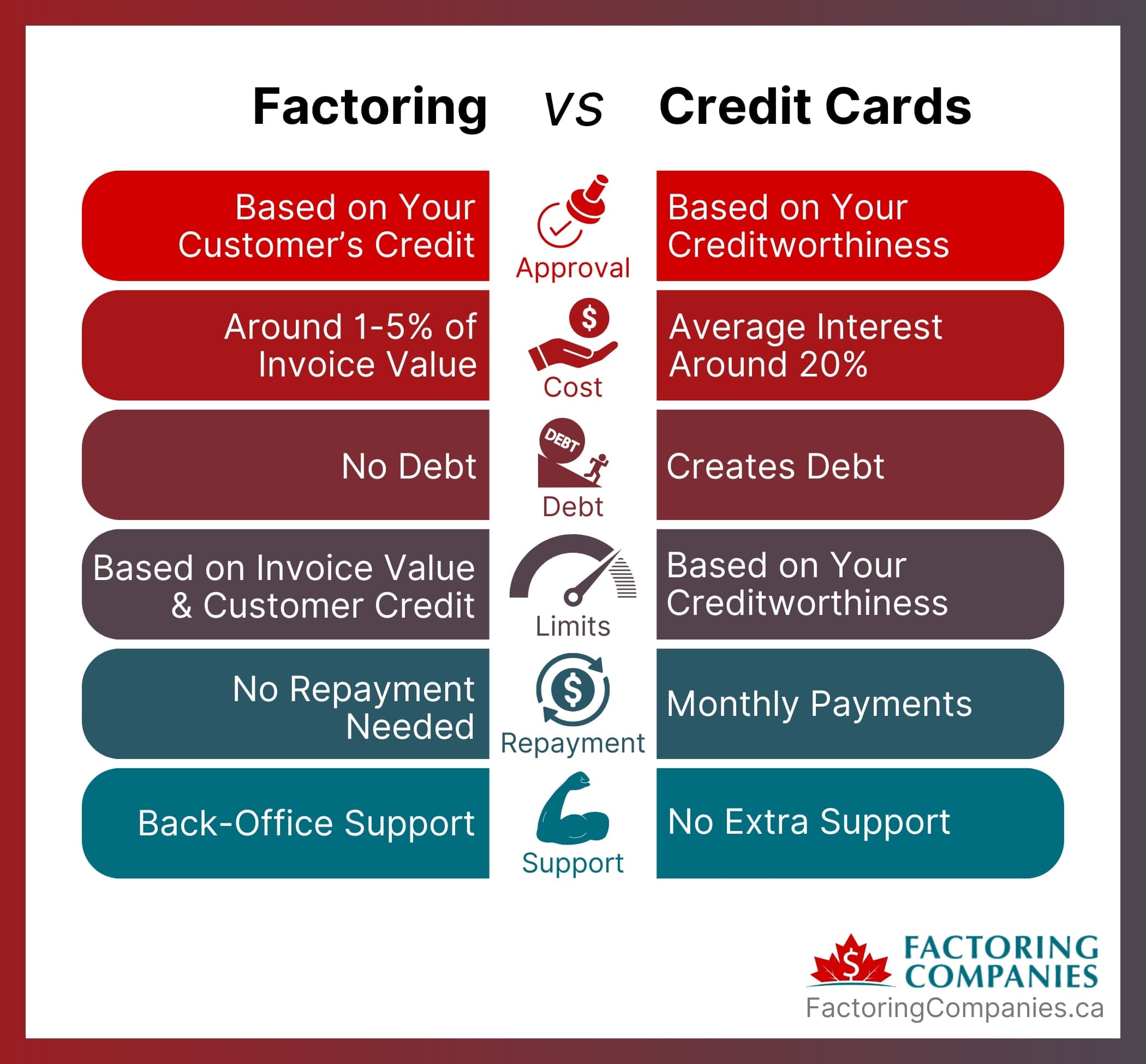

When comparing factoring and credit cards, the differences are clear, but not always obvious at first glance. To help you decide which suits your business, it’s worth looking closely at three main areas: cost, debt, and access to funds. Each of these plays a major role in how effectively you can manage your business finances.

Costs: Fees vs. Interest Rates

With factoring, you’ll typically pay a transparent fee tied to the value of the invoices you sell. For instance, if you’re selling an invoice worth $10,000, the factoring fee might be two to five percent, depending on the provider and terms. It’s a straightforward cost that’s easy to calculate.

The interest rates associated with credit cards, on the other hand, can vary widely but often exceed 20 percent annually for many Canadian businesses. If you carry a balance, that interest adds up fast. On top of that, credit cards may come with other fees, like annual charges or penalties for late payments.

Debt-Free vs. Debt-Based Financing

Factoring is a debt-free solution. You’re not borrowing money. You’re simply selling invoices you’ve already earned but haven’t yet collected. That keeps your liabilities low and your financial health intact.

Conversely, using credit cards means taking on debt. While this might be fine for short-term needs, over-reliance on credit cards can strain your finances and even hurt your credit rating if repayments aren’t managed carefully.

Access to Funds

How quickly and easily you can get cash matters, especially when you’re juggling day-to-day operations. With factoring, funds are tied to your accounts receivable, meaning you get paid for invoices you’ve already issued. With many factoring companies, you can have cash in hand within 24 to 48 hours after your invoices are verified.

Credit cards offer revolving credit, which is convenient, but they have their limits. If you’re a new business or your credit score isn’t great, you might not qualify for a high enough limit to cover your needs.

Managing Cash Flow: Factoring Versus Credit Cards

Cash flow is the lifeblood of any business. Whether you’re covering payroll, buying inventory, or seizing new opportunities, the timing and predictability of your cash flow can make or break your plans. Factoring and credit cards take very different approaches to managing cash flow, and these differences can have a major impact on your operations.

Stability with Factoring

Factoring helps stabilize your cash flow by turning unpaid invoices into immediate cash. This consistency means you can focus on running your business without worrying about when customers will pay. For example, if a client’s payment terms are 60 days, factoring lets you access that cash now rather than waiting two months.

Unpredictability with Credit Cards

Credit cards, in contrast, can create uncertainty. Repayments depend on your spending habits and cash flow, which can vary from month to month. If sales slow down, credit card debt can quickly pile up, along with interest charges. This unpredictability can make it harder to plan your expenses and investments.

Flexibility vs. Cost

While credit cards offer flexibility, like the ability to make minimum payments, this comes at a cost. High interest rates and penalties for missed payments can eat into your profits. Factoring, on the other hand, provides immediate funds without tying you to ongoing repayments, making it a simpler, more predictable way to manage your cash flow.

Benefits of Factoring Over Credit Cards

When it comes to financing your business, factoring offers distinct advantages that go beyond just getting cash in hand. It’s not about choosing any financing option. It’s about choosing the right one for your specific needs. Compared to credit cards, factoring provides a solution that’s more in sync with the way businesses operate, particularly when managing cash flow and avoiding unnecessary debt.

Advantages of Factoring for Business Financing

Factoring stands out as a financing option because it’s designed to align with your business operations and revenue cycle. Here are some of the key reasons factoring can be transformative for your business.

No Debt, No Problem

Factoring allows you to access funds without borrowing money. Instead, you’re simply converting unpaid invoices into cash, keeping your balance sheet clean and free of liabilities. This can make a big difference if you’re looking to maintain a strong financial position or qualify for other forms of financing down the road.

Faster Access to Funds

In business, timing is everything. With factoring, you don’t have to wait for customers to pay their invoices, which can take 30, 60, or even 90 days. Most factoring companies will advance funds within 24–48 hours, giving you the liquidity you need to cover expenses or seize opportunities.

Aligned with Revenue Cycles

Factoring works with the natural ebb and flow of your business’s revenue. For example, if your clients pay on extended terms, factoring bridges the gap so you can keep operations running smoothly. This is especially valuable for industries with long payment cycles, like trucking or manufacturing.

Improved Cash Flow Management

When you know exactly when you’ll receive funds, it’s easier to budget and plan. Factoring provides a predictable cash flow stream, which can help you pay employees, stock inventory, or invest in growth without relying on high-interest credit options.

Why Choose Factoring Over Credit Cards?

While credit cards might seem like a convenient choice, factoring offers a level of financial control and stability that credit cards can’t match. Here’s why factoring often comes out on top.

Avoiding High-Interest Debt

Credit cards can lead to a spiral of debt, especially if you’re unable to pay off the balance each month. Interest rates in Canada often exceed 20 percent, which can quickly erode your profits. Factoring, on the other hand, is a debt-free solution. You’re simply accessing money that’s already yours.

Tailored to Business Needs

Factoring is built for businesses that work with extended payment terms. For example, a construction company waiting 60 days for a client to pay can use factoring to unlock that cash today, avoiding disruptions in cash flow. Credit cards, by contrast, are designed more for consumer use and short-term financing, which may not fit the needs of many businesses.

Greater Financial Control

With factoring, you’re in control of your financing. You choose which invoices to factor, how often to factor them, and when to access funds. Credit cards, while flexible, tie you to minimum payments and interest schedules that can limit your ability to manage cash flow effectively.

Evaluating Financing Solutions: Factoring vs. Credit

When deciding between factoring and credit cards, the choice boils down to understanding your business’s unique needs. There’s no one-size-fits-all solution, but by looking at a few key criteria, you can determine which financing option aligns best with your goals and challenges. Let’s break down the main factors to consider.

Business Size and Cash Flow Needs

Factoring is ideal for businesses of all sizes, but it is particularly helpful for small to medium-sized enterprises (SMEs) and growing companies with significant accounts receivable. If your business deals with customers who pay on extended payment terms, factoring ensures you have the cash flow to cover daily operations, payroll, or unexpected costs.

Credit cards are better suited for very small businesses or startups with limited financing needs. Credit cards can handle smaller, short-term expenses but may struggle to meet the cash flow demands of larger operations or those with cyclical revenue patterns.

If your cash flow is tied up in unpaid invoices, factoring is likely the better choice. Credit cards are useful for short-term needs, but their limits and costs can be restrictive for businesses with ongoing cash flow challenges.

Tolerance for Debt vs. Preference for Debt-Free Solutions

If you prefer to avoid debt and maintain a clean balance sheet, factoring is a clear winner. Since you’re not borrowing money but instead selling your invoices, there’s no impact on your liabilities or credit rating.

Credit cards involve debt, plain and simple. While they offer convenience, they also come with high interest rates and the potential for mounting liabilities. For context, a typical small business in Canada carries around $170,000 in debt, according to the Canadian Federation of Independent Business (CFIB). Businesses with a low tolerance for debt may find credit cards less appealing.

A debt-free approach like factoring can be especially valuable if your business plans to secure other financing in the future, such as a loan or line of credit, where low liabilities improve your eligibility.

Predictability vs. Flexibility

Factoring offers predictable cash flow by providing immediate payment on invoices. This predictability makes it easier to plan budgets, cover fixed costs, and invest in growth without worrying about when customers will pay.

Credit cards provide flexibility, such as the ability to make minimum payments during slower months. However, this flexibility comes at a cost—high interest rates and unpredictable monthly expenses, depending on how much credit you’ve used.

For businesses that need consistent, reliable cash flow, factoring is the more controlled solution. If you value flexibility and can manage repayments effectively, credit cards might work for short-term needs.

Final Thoughts: Choosing the Right Solution

When weighing factoring against credit cards, ask yourself:

- How large is my business, and what are my cash flow needs? If you’re handling large invoices with extended payment terms, factoring can bridge the gap.

- How comfortable am I with debt? If debt feels risky or limiting, factoring offers a safer, debt-free alternative.

- Do I prioritize predictability or flexibility? Factoring provides stability, while credit cards offer short-term flexibility at a higher cost.

Take Control with Factoring

Factoring empowers your business with predictable cash flow, debt-free financing, and the flexibility to grow without the strain of high-interest debt. It’s a smart, controlled solution designed to keep your operations running smoothly. To take the first step toward financial stability and growth, request a complimentary rate quote.

FAQs on Factoring vs. Credit Cards

What makes factoring stand out in controlled finance options: factoring vs. credit?

When it comes to controlled finance options, factoring vs. credit, factoring provides greater stability and predictability. It aligns with your revenue cycles, offering immediate cash flow from unpaid invoices without adding debt. Credit, such as credit cards, often involves fluctuating balances and high-interest payments, making it a less predictable choice.

How does factoring help businesses improve cash flow compared to credit cards?

Factoring provides immediate cash flow by converting unpaid invoices into cash, whereas credit cards rely on borrowing. This means businesses using factoring avoid debt and benefit from a stable and predictable cash flow, tailored to their revenue cycle.

What types of businesses benefit most from factoring instead of credit cards?

Businesses with significant accounts receivable, like those in trucking, construction, or manufacturing, benefit most from factoring. These industries often face long payment cycles, making factoring a better solution than credit cards, which are designed for short-term borrowing.

Why is factoring better for businesses with extended payment terms?

Factoring aligns with extended payment terms by providing cash upfront for invoices due in 30, 60, or 90 days. Credit cards, by contrast, require regular repayments and add interest, which can be challenging for businesses waiting on customer payments.

Can factoring and credit cards be used together?

Yes, some businesses use factoring for large, predictable cash flow needs while reserving credit cards for smaller, short-term expenses. This combination can balance stability from factoring with the flexibility of credit cards.

What are the risks of using credit cards for business financing instead of factoring?

Credit cards can lead to high-interest debt and unpredictable monthly costs if balances aren’t paid in full. Factoring eliminates these risks by offering a debt-free, structured solution for accessing funds tied to your invoices.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778