Did you know that nearly two-thirds of small businesses regularly struggle with cash flow issues, per Intuit research? Understanding the right financial solutions, like merchant cash advances (MCAs) and invoice factoring, could be the key to your business’s survival and overall growth. On this page, we’ll walk you through the basics of business cash flow and how MCAs and factoring work so it’s easy to select the best choice for your business.

Understanding Business Cash Flow

Cash flow refers to the movement of money in and out of a business over a specific period. It’s essentially the net amount of cash being transferred into and out of the company, including all the inflows (revenue, loans, investments) and outflows (expenses, loan repayments, purchases).

Types of Cash Flow

- Operating Cash Flow: This is the cash generated from normal business operations, such as sales of goods and services.

- Investing Cash Flow: Cash flow from the purchase and sale of assets, like equipment or real estate.

- Financing Cash Flow: Cash flow from borrowing and repaying debts, issuing stock, or paying dividends.

Why Cash Flow Matters

Cash flow impacts your business in lots of ways.

Maintains Business Operations

Positive cash flow ensures a business has enough liquidity to cover its daily expenses, such as paying suppliers, employees, and rent. Without adequate cash flow, even profitable companies can struggle to stay afloat.

Supports Growth and Expansion

Healthy cash flow allows a business to reinvest in itself, whether that’s purchasing new equipment, expanding into new markets, or launching new products. It’s essential for fueling growth and taking advantage of opportunities.

Creditworthiness

Consistent positive cash flow improves a business’s creditworthiness, making it easier to secure loans or attract investors. Lenders and investors often examine cash flow statements to assess a business’s financial health and sustainability.

Managing Unexpected Expenses

Cash flow provides a buffer against unexpected expenses or economic downturns. It gives businesses the flexibility to navigate challenges without compromising operations.

Causes of Cash Flow Issues

Cash flow issues can affect even profitable businesses. Understanding the causes can help you manage and prevent these problems.

Delayed Payments from Customers

Businesses often offer customers credit terms, such as 30 or 60-day payment windows, meaning payments are received long after the sale is made. This delay can create a gap between outgoing expenses and incoming revenue. Customers not paying on time exacerbates cash flow problems. Even if the sales are recorded as revenue, the cash isn’t available for use.

High Overhead Costs

High fixed costs such as rent, salaries, and utilities must be paid regardless of revenue fluctuations. These expenses can drain cash reserves quickly, especially during slow sales periods.

Rapid Expansion

Expanding a business often requires significant upfront investment in inventory, equipment, or marketing. While these investments may lead to future profits, they can strain current cash flow.

Poor Inventory Management

Holding too much inventory ties up cash that could be used elsewhere. Additionally, if the inventory doesn’t sell quickly, it may result in losses. Conversely, insufficient inventory can lead to missed sales opportunities and damage customer relationships.

Inefficient Operations

Poor operational practices, such as waste, inefficiencies, or high defect rates, increase costs and reduce available cash.

Seasonal Fluctuations

Businesses with seasonal demand may experience periods of high sales followed by low sales. During off-peak times, maintaining operations can be challenging without sufficient cash reserves.

Understanding Merchant Cash Advances

An MCA is a financing option where a business receives a lump sum of cash upfront in exchange for a percentage of its future credit card sales or daily bank deposits. The advance is repaid through a portion of daily sales or fixed daily/weekly withdrawals until the total amount, plus fees, is repaid.

Advantages of MCAs

MCAs may appeal to businesses for a variety of reasons.

Quick Access to Cash

MCAs typically have a swift application and approval process, often within a few days. This makes them an attractive option for businesses needing urgent cash.

Flexible Repayment

Repayment is tied to daily sales, so during slower periods, payments are lower. This can help businesses manage cash flow more effectively than fixed monthly loan repayments.

No Collateral Required

MCAs do not require collateral, making them an option for businesses without significant assets to pledge.

Easier Qualification

Lenders often place less emphasis on credit scores and more on daily credit card sales or bank deposits, making MCAs accessible to businesses with poor credit.

Disadvantages of MCAs

Despite the advantages, MCAs often have significant drawbacks that make them a poor choice for many businesses.

Confusing Fees

Whereas traditional loans leverage interest rates to calculate your fees, MCAs use a factor rate. The factor rate is multiplied by the advance to determine your fees. Most factor rates are between 1.1 and 1.5. For instance, if a business receives a $100,000 advance and has a 1.4 factor rate, the total cost is $140,000. In addition to this, the business may also pay other costs, such as an origination fee, underwriting fee, or administrative fee.

High Costs

The high costs of MCAs aren’t always obvious until the fees are converted into an annualized interest rate (APR), such as loans and lines of credit use.

Using the earlier example, we know that the business is paying $40,000 to borrow the money based on the factor rate. But let’s also say that the company is charging $500 in additional fees. This means the total payback amount is $140,500, and the cost of the advance is $40,500.

To convert that into a percentage cost, we’ll divide the cost of the advance ($40,500) by the advance amount ($100,000). This works out to 0.405 or 40.5 percent.

Next, we’ll convert that into an APR using the following formula:

Annualized Interest Rate = (Percentage Cost x Days in a Year) / Days to Repay

Assuming the business has three months (90 days) to pay the advance, our calculation then becomes:

1.6425 = (0.405 x 365) / 90

In other words, the APR on this MCA is 164.25 percent. For comparison, the average APR on credit cards typically hovers around 22 percent, Time reports. Traditional loans come in at a fraction of this. However, it’s easy for businesses to overlook the high costs because they aren’t broken down this way.

Impact on Cash Flow

The daily or weekly deductions can strain cash flow, particularly during periods of low sales. This can make it difficult to manage other operating expenses.

Unpredictable Payments

A percentage of sales is held back as payment for the MCA. That means businesses pay more when sales are higher and pay less when sales are lower. This can make it difficult to budget and plan. Moreover, there’s typically no benefit to paying the balance off early, as the fees are added to the balance at the onset. However, fees are often assessed if the business does not pay off the balance in time.

Short Repayment Terms

MCAs are designed to be repaid quickly, often within three to 18 months. This short repayment term can lead to substantial daily or weekly payments.

Lack of Regulation

MCAs are not as heavily regulated as traditional loans, potentially leading to predatory lending practices. It’s essential for businesses to understand the terms and conditions.

Example of How MCAs Work

Picture a small café in Saskatchewan that needs urgent cash to replace a broken espresso machine. Traditional bank loans might take too long, but an MCA can provide the needed funds within a few days. The café agrees to repay the advance through ten percent of its daily credit card sales. During busy periods, the café repays more, and during slow days, the repayment amount adjusts accordingly. However, the café needs to be aware that the overall cost of the MCA is higher than a traditional loan, and daily repayments could impact its cash flow.

Understanding Invoice Factoring

Invoice factoring involves selling a business’s unpaid invoices to a factoring company at a discount. The business receives immediate cash, typically around 60 to 95 percent of the invoice value. The factoring company then collects the full payment from the business’s customers. Once the invoices are paid, the factoring company remits the remaining balance to the business minus a factoring fee.

Advantages of Invoice Factoring

Factoring is a unique business funding solution with lots of benefits.

Improves Cash Flow

Factoring provides immediate access to cash tied up in receivables, improving liquidity and allowing businesses to meet their operational needs without waiting for customer payments.

No New Debt

Factoring is not a loan, so it doesn’t add debt to the business’s balance sheet. It converts accounts receivable into cash without incurring additional liabilities.

Flexible Funding

The amount of funding grows with the business. As sales and receivables increase, the available funding through factoring also increases, supporting business growth.

Focus on Core Operations

The factoring company takes over the collection process, allowing the business to focus on core activities rather than chasing payments from customers.

Disadvantages of Invoice Factoring

Despite these benefits, there are some drawbacks to factoring that businesses should be aware of in order to mitigate them.

Cost

Factoring can be more expensive than traditional financing options. Fees can vary based on factors such as the creditworthiness of customers, invoice amounts, and the factoring company’s terms. However, costs can be minimized by partnering with the right factoring company and only leveraging the service as needed.

Customer Perception

In some cases, customers may perceive factoring negatively, especially if they prefer to deal directly with the business rather than a third party for payments. Businesses can help minimize these concerns by explaining to customers how factoring benefits them or choosing non-notification factoring.

Reliance on Customer Creditworthiness

The factoring company’s willingness to advance funds is based on the creditworthiness of the business’s customers. If customers have poor credit, it may affect the terms or availability of factoring.

Potential Contractual Obligations

Some factoring agreements may require long-term commitments or include volume requirements, which can limit flexibility for the business. However, not all factoring companies operate this way. Choosing the right partner and selecting the best terms for the business can eliminate these concerns.

Example of How Invoice Factoring Works

Picture a small manufacturing company in Quebec that frequently issues invoices with 60-day payment terms. This company has a steady stream of orders but struggles with cash flow due to the delay in receiving payments. By using invoice factoring, the company can sell its outstanding invoices to a factoring company and receive immediate cash. This allows the business to purchase raw materials, pay employees, and cover other expenses without waiting for customer payments. While the company pays a fee for this service, the improved cash flow enables it to operate smoothly and take on more orders.

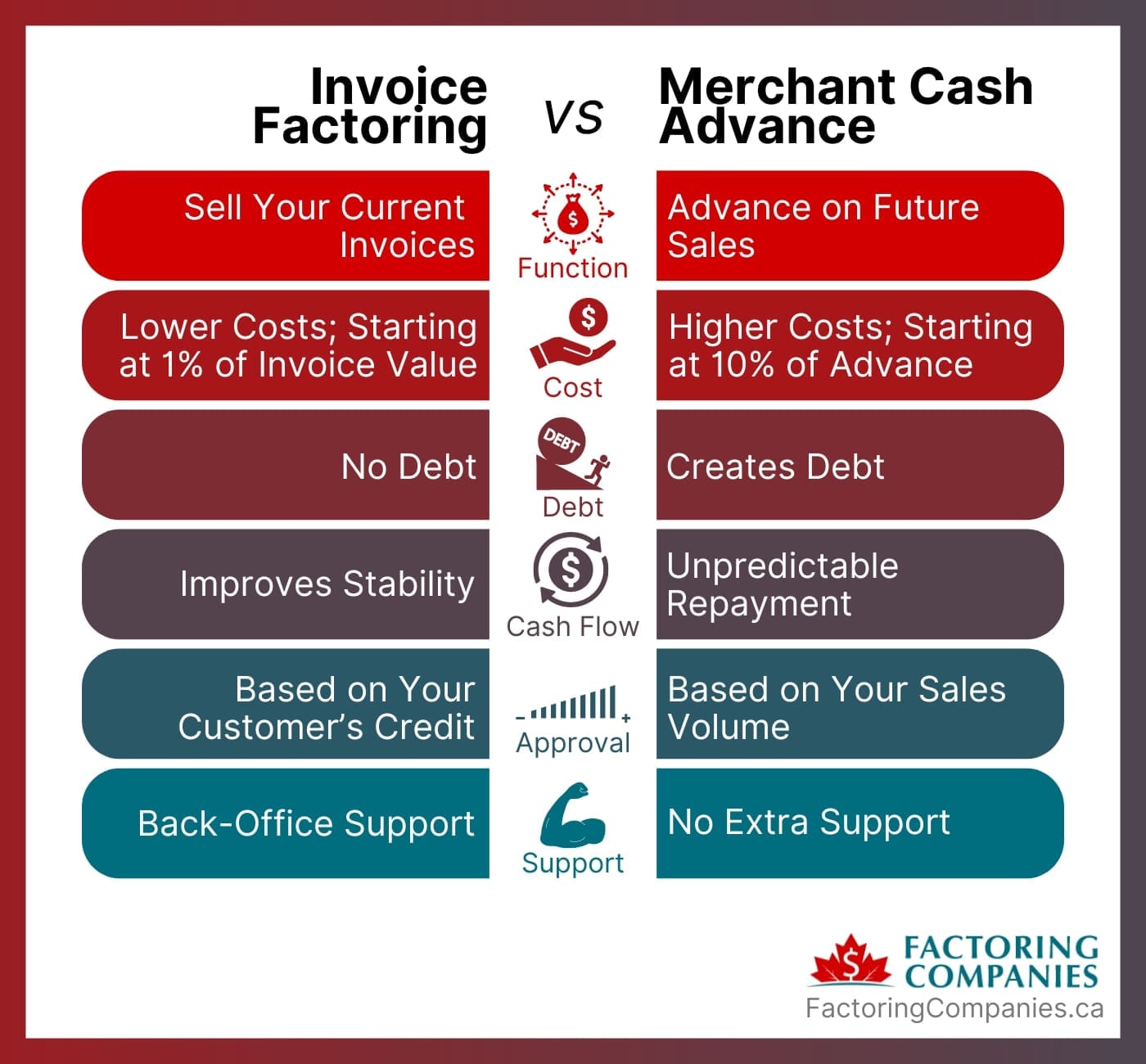

Merchant Cash Advances vs. Invoice Factoring

Comparing MCAs and invoice factoring can help businesses determine which funding option is better suited to their needs. Here’s a detailed comparison.

Funding Mechanism

Merchant Cash Advances

- Repayment Based on Sales: MCAs are repaid through a percentage of daily credit card sales or fixed daily/weekly withdrawals from the business’s bank account.

- Upfront Lump Sum: Businesses receive a lump sum upfront, which they repay through a portion of their future sales.

Invoice Factoring

- Selling Receivables: Factoring involves selling outstanding invoices to a factoring company at a discount. The business receives immediate cash based on the value of its receivables.

- Collections Handled by Factor: The factoring company takes over the collection of payments from the business’s customers.

Costs

Merchant Cash Advances

- Higher Costs: MCAs generally have higher costs and fees, leading to higher effective APRs compared to traditional loans and factoring.

- Variable Repayment: Since repayment is a percentage of sales, the total cost can vary depending on sales volume.

Invoice Factoring

- Lower Costs: Factoring fees are typically lower than MCA costs, although they can still be higher than traditional loans. The fee structure often depends on the creditworthiness of the business’s customers and the terms of the invoices.

- Discount Rate: Businesses receive a percentage of the invoice value upfront, with the remainder, minus fees, remitted after customer payment.

Cash Flow Impact

Merchant Cash Advances

- Daily/Weekly Deductions: The repayment structure of MCAs can strain cash flow, especially during periods of low sales. Fixed daily or weekly withdrawals can make it challenging to manage other expenses.

- Flexibility: If repayments are tied to sales, businesses with fluctuating revenue may benefit from variable payments that align with sales volume.

Invoice Factoring

- Immediate Cash: Factoring improves cash flow by providing immediate access to funds tied up in receivables. This helps businesses cover operating expenses without waiting for customer payments.

- Predictable Costs: Factoring provides a more predictable impact on cash flow, as the advances and fees are based on invoice amounts rather than daily sales.

Qualification and Accessibility

Merchant Cash Advances

- Easier Qualification: MCAs can be easier to qualify for, with less emphasis on credit scores and more on sales volume. This makes them accessible to businesses with poor credit or those that do not have significant assets to pledge as collateral.

- Fast Approval: The application and approval process is quick, often within a few days, making MCAs suitable for businesses needing urgent cash.

Invoice Factoring

- Based on Customer Credit: Factoring relies on the creditworthiness of the business’s customers rather than the business itself. This can be advantageous for businesses with strong customer bases but weak credit.

- Ongoing Relationship: Factoring can be an ongoing arrangement, providing continuous cash flow support as new invoices are generated.

Customer Relationships and Support

Merchant Cash Advances

- Direct Impact: MCAs do not directly involve customers in the repayment process. Repayments are handled internally by the business through its sales or bank account.

Invoice Factoring

- Third-Party Involvement: Factoring involves a third party in the collection process, which can affect customer relationships. This is often viewed positively because it reduces back-office strain for the business.

When Factoring May Be Best

Next, let’s take a look at some situations where invoice factoring might be the better solution for a business.

Seasonal Business with Long Payment Terms

Seasonal businesses experience significant fluctuations in demand. During peak seasons, they may generate a large number of invoices with long payment terms, leading to a cash flow gap. Factoring allows these businesses to access the cash tied up in invoices immediately, ensuring they can cover operational costs, stock up on inventory, and prepare for the off-season without financial strain.

High-Growth Business

High-growth businesses often face cash flow challenges because they need to invest heavily in expanding their operations, hiring staff, and purchasing inventory. Factoring provides these businesses with immediate funds from their outstanding invoices, supporting their rapid growth without waiting for customer payments. This allows them to seize new opportunities and scale quickly.

Business with Strong Customers but Poor Credit

A business may have reliable, creditworthy customers but still suffer from poor credit due to past financial difficulties or a lack of credit history. Traditional lenders might be reluctant to extend credit to such businesses. Factoring focuses on the creditworthiness of the business’s customers, not the business itself. This enables businesses to secure funding based on their customers’ credit profiles, providing them with necessary cash flow.

Cash Flow Issues Due to Late Payments

Businesses that experience late payments from customers often struggle to manage their cash flow. Factoring mitigates this issue by providing immediate cash for outstanding invoices, reducing the waiting period for payments. This helps businesses maintain smooth operations, pay suppliers on time, and avoid disruptions caused by delayed customer payments.

Expanding Product Lines or Entering New Markets

Launching new products or entering new markets requires significant production, marketing, and distribution investment. Factoring provides the necessary funds without waiting for customer payments from existing sales. This immediate cash flow supports the business in scaling its operations, investing in new initiatives, and capturing market share more effectively.

Reducing Administrative Burden

Managing accounts receivable and collections can be time-consuming and resource-intensive. Factoring companies handle the collections process, allowing businesses to outsource this administrative task. This enables the business to focus on core activities such as sales, production, and customer service, improving overall efficiency and productivity.

Project-Based Business

Businesses that operate on a project basis, such as construction firms or event planners, often have irregular cash flow due to staggered payment schedules. Factoring ensures a steady cash flow by providing immediate funds for completed project invoices. This allows these businesses to manage ongoing projects, pay subcontractors, and cover operational expenses without financial interruptions.

Avoiding Additional Debt

Some businesses prefer to avoid taking on additional debt to maintain a healthy balance sheet. Factoring is not a loan; it involves selling receivables for immediate cash. This means the business does not incur additional liabilities or interest payments, making it an attractive option for those looking to improve cash flow without increasing debt.

Navigating Economic Downturns

During economic downturns, businesses may face slower payment cycles as customers delay payments. Factoring provides a buffer against these delays by offering immediate cash for outstanding invoices. This helps businesses maintain liquidity, cover essential expenses, and navigate through challenging economic conditions without compromising their financial stability.

Improve Your Business Cash Flow with Factoring

Invoice factoring offers flexible and immediate cash flow solutions tailored to various business needs and scenarios. By leveraging outstanding invoices, you can improve liquidity, support growth, reduce administrative burdens, and navigate financial challenges without incurring additional debt. To kickstart your factoring journey, request a complimentary rate quote.

Merchant Cash Advance FAQs

How does a merchant cash advance differ from invoice factoring?

MCAs involve repaying a cash advance through future sales, while invoice factoring involves selling unpaid invoices to a factoring company for immediate cash.

What are the advantages of using a merchant cash advance?

MCAs offer quick access to cash, flexible repayments tied to sales, no collateral requirements, and easier qualification compared to traditional loans. However, factoring is often a better and more affordable alternative.

What are the disadvantages of merchant cash advances?

MCAs can be costly with high fees, may strain cash flow with daily/weekly deductions, have short repayment terms, and are less regulated than traditional loans.

When might a business prefer invoice factoring over a merchant cash advance?

Businesses with long payment terms, high-growth phases, strong customers but poor credit, or those looking to avoid additional debt might prefer invoice factoring for its cash flow benefits and lower costs.

How do repayment terms for MCAs impact cash flow?

MCAs require daily or weekly repayments based on sales, which can strain cash flow during periods of low sales, making it challenging to cover other expenses.

Is a merchant cash advance suitable for businesses with fluctuating sales?

MCAs can be suitable for a small or medium business with fluctuating sales as repayments adjust with sales volume, providing some flexibility. However, the overall cost can be high.

Can a small business with poor credit qualify for a merchant cash advance?

Yes, MCAs are often easier to qualify for than traditional loans, as lenders focus more on sales volume than credit scores. However, invoice factoring can also help businesses with poor credit, and it is often more affordable.

What types of businesses typically use merchant cash advances?

Businesses with strong daily credit card sales, such as retail stores, restaurants, and service providers, often use MCAs for quick access to cash.

How quickly can a business access funds through a merchant cash advance?

The approval and funding process for an MCA is typically fast, often within a few days, making it a suitable option for businesses needing urgent cash. However, the timeline for invoice factoring is similar and it is often a more affordable alternative.

How can a Merchant Cash Advance impact business financial health, and what should be considered when evaluating costs?

An MCA can provide quick access to cash, which can be crucial for maintaining business financial health during times of need. However, it's important to consider the high costs associated with MCAs, including fees and repayment terms. Evaluating costs thoroughly before committing to an MCA ensures that the benefits outweigh the potential financial strain on daily operations.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778