Have you ever tried communicating with someone who doesn’t speak your language? While getting your main point across is often possible, the conversation is rarely fluid, and essential details are easily lost. The same thing happens in business finance. From trucking to tech, each industry speaks its own financial language. While many funding solutions leverage a one-size-fits-all approach that doesn’t take this into account, invoice factoring is different. You can and should work with a factoring company that understands your industry. Give us a few minutes, and we’ll walk you through the benefits of working with an industry specialist and how to find one for your business.

How Invoice Factoring Works

Factoring can be a powerful tool because it provides you with instant access to working capital without creating debt or forcing you to give up equity. It’s particularly beneficial for businesses with long payment cycles or those that are growing quickly and need cash to manage their operations and capitalize on new opportunities. Moreover, because the factoring company’s primary concern is the creditworthiness of the invoiced customers rather than yours or your business’ credit, it can be a viable option for newer businesses or those with less established credit histories.

The Factoring Process

Let’s take a quick look at a typical factoring process so it’s easier to see where the unique facets of your industry come into play.

- Invoice Creation: Your business provides goods or services to its customers and issues invoices with net terms, often 30, 60, or 90 days.

- Selling the Invoice: Instead of waiting for the customer to pay, your business sells the outstanding invoices to a factoring company.

- Initial Payment: The factoring company provides your business with an advance, which is typically between 60 and 95 percent of the invoice’s value. Your cash arrives quickly—often within 24 to 48 hours.

- Customer Payment: Your customer pays the invoice factoring company according to the payment terms.

- Receipt of the Remainder: Once your customer pays the invoice in full, the factoring company releases the remaining balance to your business minus a small fee for the factoring service.

Industries That Benefit Most from Invoice Factoring

Invoice factoring is utilized across a wide array of industries, particularly those where long payment terms are standard practice or where businesses experience rapid growth and require consistent cash flow to meet operational needs.

Transportation and Logistics

Companies in this sector often face long payment terms but need immediate cash to cover fuel, maintenance, and driver salaries. Factoring helps maintain liquidity to meet these ongoing expenses.

Manufacturing

Significant upfront costs for materials and labor are a common issue for manufacturing businesses. They use factoring to bridge the gap between shipping products and receiving payment, ensuring they can continue production without interruption.

Wholesale

Wholesalers often purchase goods in bulk and may wait longer for retailers to pay invoices. Factoring provides the cash flow wholesalers need to replenish inventory and take advantage of bulk purchase discounts.

Staffing

Staffing agencies have to pay their workers weekly or bi-weekly, but their clients might not pay invoices for 30 to 90 days. Factoring allows staffing agencies to meet payroll and other operational costs without delay.

Construction

The construction industry deals with long project timelines and delayed payment cycles. Factoring helps construction companies manage expenses such as labor, materials, and equipment rental while waiting for payments.

Textiles and Apparel

Companies in this sector often need to fund production cycles well before receiving payments from retailers. Factoring can provide the necessary working capital to keep production lines running.

Technology and IT Services

While not as traditional as other industries, technology firms and IT service providers also use factoring to manage cash flow, especially when handling large projects or offering subscription-based services with payment terms.

Healthcare

Medical providers, including hospitals and clinics, can use factoring to quickly receive payments for their services instead of waiting for provincial healthcare programs to pay out. Sometimes, healthcare factoring is used by companies that supply medical practices with equipment and other needs too.

For businesses in Quebec, partnering with a Quebec factoring company can ensure industry-specific expertise and faster access to cash flow solutions tailored to the region’s economic landscape.

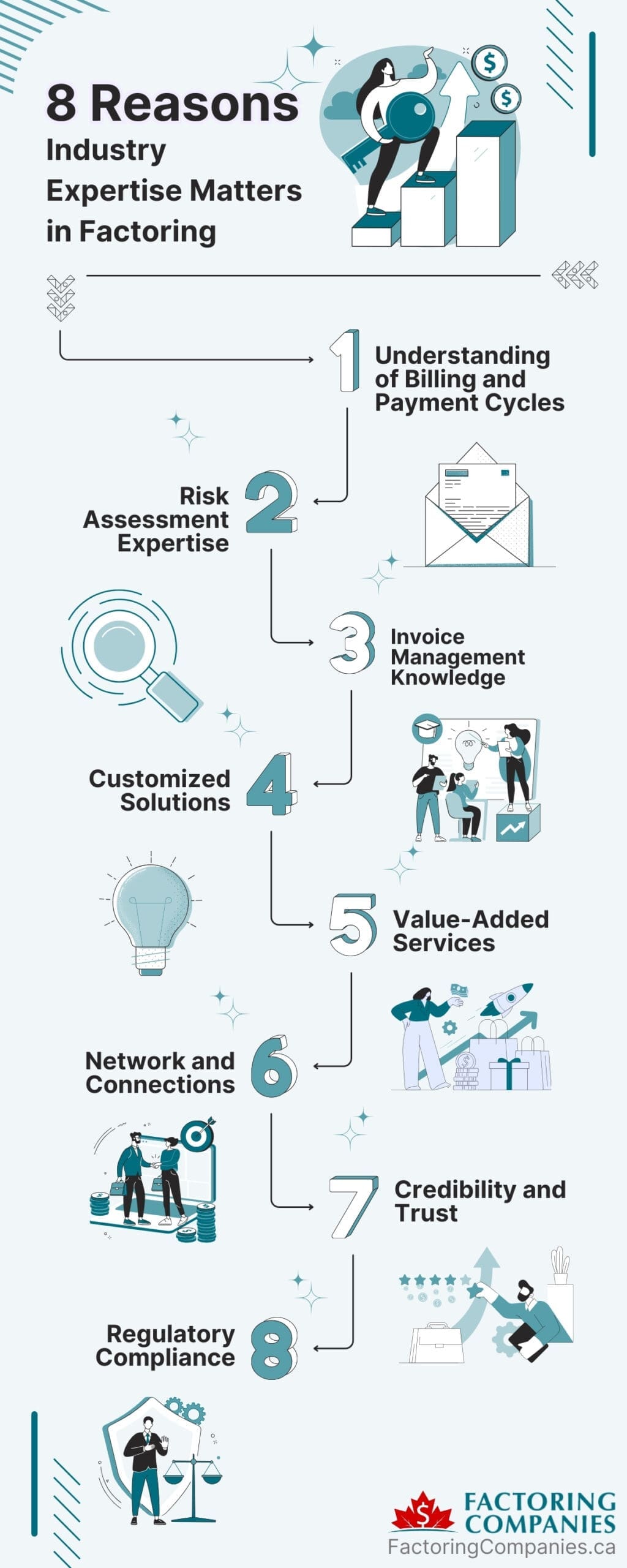

Why Industry Expertise Matters When Choosing a Factoring Company

Working with a factoring company with experience in your industry is crucial for several reasons, each contributing to the overall effectiveness, efficiency, and cost-effectiveness of the factoring arrangement.

Understanding of Payment Cycles

Different industries have varying standard payment terms and cycles. For instance, net 30 terms are common in most industries, but heavy construction companies wait around 66 days to be paid, while oil and gas extraction companies wait 111 days, Inc. reports. A factoring company familiar with an industry’s specific payment behaviors can offer terms and services that align closely with a business’s cash flow needs.

Risk Assessment Expertise

Industry-experienced factors are better equipped to assess the credit risk associated with clients in that sector. Their understanding of industry-specific risks and challenges enables them to offer more accurate pricing and more favorable advance rates.

Invoice Management Knowledge

Managing invoices and collections in some industries can be complicated. A factoring company with industry expertise will be more adept at handling these complexities, reducing the administrative burden on the business.

Customized Solutions

Industries have unique needs and challenges. A factor with relevant experience is more likely to provide tailored solutions that address a business’s specific operational and financial nuances within that industry.

For example, factors specializing in serving the transportation industry may offer fuel advance programs and understand the importance of quick payments to cover operational costs. In contrast, in the healthcare sector, a factor experienced in medical factoring will navigate the complexities of insurance claims and provincial healthcare payments.

Value-Added Services

Beyond purchasing invoices, some factors offer additional services such as credit checks, collections assistance, and supply chain financing. Factors with industry experience are better positioned to provide relevant value-added services that can further support a business’s operations.

Network and Connections

Factoring companies with a strong presence in an industry often have extensive networks and relationships that can benefit businesses. These connections can lead to new opportunities, partnerships, and insights to help a business grow.

Credibility and Trust

Working with a reputable and experienced factoring company can enhance a business’s credibility within its industry. Suppliers and customers are often more comfortable dealing with businesses that have strong financial partnerships.

Regulatory Compliance

Some industries are highly regulated, and non-compliance can result in significant penalties. An experienced factoring company will be familiar with industry-specific regulations and ensure financial arrangements comply with all legal requirements.

Get Matched with a Factoring Company That Knows Your Industry

Choosing a factoring company with industry experience can lead to a more beneficial partnership, offering immediate financial relief and long-term strategic advantages. This alignment helps businesses mitigate risks, improve cash flow, and focus on growth and operational excellence. However, finding someone who knows your industry can be difficult. That’s where Factoring Companies Canada comes in. We eliminate the guesswork by matching businesses with experienced factoring companies with industry expertise that can truly become partners in growth. To learn more or get started, request a complimentary rate quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778