Loans for SMEs are often denied or not approved in full. Knowing why SMEs are denied business loans can help you ensure yours is approved or improve the odds that you’ll be approved the next time if you’ve already gotten a denial.

On this page, we’ll go over some of the most common reasons small businesses are denied loans and some steps you can take if you’ve been turned down for a bank loan.

Top 10 Reasons Why SMEs Are Denied Business Loans

While bank rejections sting, most of the reasons why SMEs are denied business loans are within their control. That means you can correct the issue and get approved later.

1. You Have Too Many Recent Credit Inquiries

There are two types of credit checks: hard checks and soft checks. Both are logged in your credit history as they occur. However, soft credit checks are just reviews of your credit history; only you can see they’ve occurred. If you’re pre-qualifying for a loan or similar, you might have a soft inquiry.

Conversely, hard credit pulls signify you’re applying for credit. Anyone who checks your credit can see that they’ve occurred. They stay on your report for two years, and each one may drop your overall credit score a little.

People often shop around for loans, so banks don’t always worry about multiple checks within a very short timeframe. However, if it looks like you may be preparing to accept multiple loans and, therefore, will have reduced ability to repay any loan they might provide, you can be denied a loan.

How to Fix Having Too Many Recent Credit Inquiries

Don’t apply for other types of credit in the months before you plan to apply for your business loan, and hold off on applying for loans or allowing anyone to perform hard credit checks until you’re relatively confident you’ll qualify. That way, your score doesn’t take a hit, and you won’t have multiple inquiries.

Some lenders won’t provide you a loan until the credit checks drop off your report. However, some will consider providing you with a loan a few months after checks are performed. Give it time and discuss policies with each lender you’re considering applying with.

2. Your Operating History is Insufficient

Most traditional lenders only offer loans to SMEs that have been in business for at least two years. Businesses younger than this are often considered too risky.

How to Fix an Insufficient Operating History

Unfortunately, the only way to deal with insufficient operating history denials is to apply after you’ve met the minimum threshold. However, you may have luck applying for alternative funding options.

3. You Have Credit Issues Like No Credit, Bad Credit, Liens, Judgments, or Bankruptcy

Just as multiple credit bureaus track and report personal credit histories, three main bureaus provide business credit reporting: Equifax, Experian, and Dun & Bradstreet. Each one may have different information and will use its own algorithm to score your business on a scale of 0 to 100.

- 80 or Higher: Considered good or excellent credit and demonstrates that you’re a low-risk borrower.

- 50-79: Your business is medium risk. You might still qualify for a loan, but you aren’t likely to get the best terms.

- 49 or Lower: Considered bad credit. Traditional lenders see you as a high-risk borrower and are unlikely to offer you a loan.

If you run a newer business or have never applied for a line of credit before, you might not have a credit profile at all yet. Or, if you’ve failed to pay bills in the past, you may also have liens and judgments on your credit report.

How to Fix No Credit or Bad Credit

First, ensure each credit bureau has your business on file and pull your credit report from each. Contest any inaccurate information. Then, address individual concerns that are impacting your score as follows:

- Payment History: Try to pay your bills early. Some bureaus, like Dun & Bradstreet, only award top credit ratings to businesses that

- Credit Usage: Try to use 30 percent or less of your available revolving credit.

- Age of Credit: You appear more responsible when the average age of your accounts is older. You may want to hold off on applying for new credit lines before applying for a loan.

- Credit Mix: A mix of traditional term loans, credit cards, vendor credit, and other forms of credit is usually preferred.

How to Fix Liens

Not all liens are bad. A lien simply means that a third party claims the rights to one of your assets. For instance, you’ll have a lien on your home if you have a mortgage. The mortgage company has the right to sell your home if you default on the mortgage. This is called a “consensual lien,” and it’s not bad for your credit score.

A “statutory lien” is different. It’s not consensual and stays on your credit report for seven years. A tax lien is an example of this. If you fall behind on paying taxes, the IRS can file for a lien against all your company’s assets and potentially liquidate them to clear your debt. An organization should remove the lien automatically once your debt is cleared. It’s up to you to ensure that it happens and make arrangements to clear your debt if it’s still outstanding.

It’s worth noting that the lien may be removed from your credit report, but if there are late payments or other associated issues, those credit score reductions will remain for seven years.

How to Fix Judgments or Bankruptcy

A judgment usually stays on your report for seven years, while a bankruptcy can stay on your report for a decade or more. You usually can’t have them removed unless they’re an error, so it’s best to avoid them at all costs.

4. Poor Cash Flow

Banks want proof that you can keep up with payments even if you run into issues or sales decline. They look for a steady cash flow that allows you to cover your monthly payment and then some.

How to Fix Poor Cash Flow

If your business is profitable but doesn’t have consistent cash flow, you’ll need to address the issue causing your cash flow problem. For instance, you may need to invoice more often or change your policies to speed up client payments. Sometimes, invoice factoring can accelerate cash flow, too. Another approach is to reduce or slow your cash outflows. You can do this by finding ways to cut back on expenses or waiting until just before a payable is due to clear the balance.

5. Industry Restrictions

Sometimes, banks won’t lend to specific industries just because they’re not the bank’s area of expertise or don’t understand it well enough to assess the risk. Other times, they can perform a risk assessment, and they believe an industry is too risky, so they don’t lend within it. This is common in industries that fall within legal gray areas and those that are shrinking.

How to Fix Industry Restrictions

Unfortunately, you can’t do anything to fix a loan denial due to industry restrictions. However, you may still qualify if you find a funding specialist that serves your industry.

6. Lack of Collateral

Businesses with excellent credit scores are often awarded loans on their own merit. However, those that are less creditworthy and those that want to qualify for better rates can sometimes get an asset-based loan. In these cases, a business asset such as real estate or equipment is used to secure the loan.

How to Fix a Lack of Collateral

Look beyond physical assets. For instance, receivables factoring and receivables financing can provide you with cash based on your unpaid invoices. However, you’ll likely need to work with an alternative lender rather than a bank to qualify for these solutions.

7. Debt Ratio

Calculate your debt-to-income ratio by adding up all the money you have coming in each month and dividing it by your total monthly debt payments, then converting it to a percentage. For example, if your business brings in $100,000 monthly and pays $20,000 in debt payments, your debt ratio is 20 percent. Banks usually won’t lend to businesses with a debt ratio over 50 percent, though they prefer businesses to have a ratio of 36 percent or less.

How to Fix a High Debt Ratio

Avoid taking on new debts whenever possible. Invoice factoring can help in this respect because it provides debt-free funding. Then, pay off your debts as quickly as possible or take steps and increase your revenue.

8. Company Structure or Organization

You may have trouble getting a loan as a sole proprietor because all business assets are personal assets and vice versa. This increases risks for a lender. Banks usually look at your company leadership structure, too.

How to Fix Company Structure or Organizational Issues

Consider incorporating your business. It will help protect your personal assets if your business has a problem and can open more doors for financing. Also, draft a formal organizational chart that shows the key decision-makers and their titles.

9. Missing Documentation

From standard business reports to licenses and tax statements, banks require lots of documents when approving a loan.

How to Fix Missing Documents

Gather documents before you apply and watch for communication from your lender so you can supply any missing documents before your window closes.

10. Economic Issues

Banks lend less and increase their requirements for approval during times of economic uncertainty to reduce their risk. Unfortunately, there’s nothing you can do to improve your approval odds in these cases.

What to Do If You’re Denied a Bank Loan

You still have options if you’re denied a bank loan.

Correct the Reason for Your Denial

Use the tips above to correct any issues contributing to the denial and apply again.

Improve Cash Flow and Wait it Out

Try to accelerate or increase your cash inflows and slow or decrease your cash outflows. This may be enough to solve financial challenges for some businesses.

Explore Funding Alternatives for SMEs

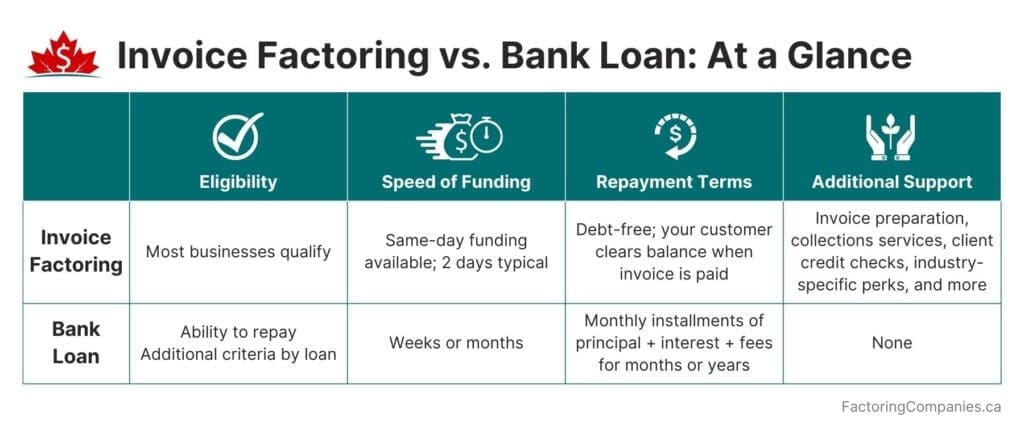

Try looking for alternatives such as grants or invoice factoring. When comparing factoring vs bank loans, one of the biggest benefits of invoice factoring is that your credit is not a major factor in approval, and you can qualify even if banks turn you down. Plus, factoring can help you improve your credit by enabling you to make payments on debt and keep your debt ratio low, which may help you qualify for a loan later.

Factoring as a Smart Financing Alternative for SMEs

Many small business owners encounter challenges when trying to secure funding through traditional bank loans. In such scenarios, invoice factoring offers a viable and beneficial alternative. Unlike conventional loans that rely heavily on credit scores and collateral, invoice factoring provides immediate working capital based on your outstanding invoices, thereby not only improving your cash flow but also minimizing debt accumulation. This method is particularly advantageous for businesses with a need for quick funding without the burden of long-term debt. By selling your unpaid invoices to a factoring company, you can receive a lump sum quickly, often within one business day. This can be especially crucial for maintaining operations and capitalizing on market opportunities without the waiting period typically associated with bank loans. Moreover, invoice factoring is right for your business if maintaining steady cash flow is a challenge, as it allows you to convert sales into immediate cash. It’s a strategic option for SMEs looking to grow without compromising their financial stability.

Small businesses find traditional financing options inadequate because they do not meet stringent loan approval criteria set by financial institutions. Reasons for a business loan rejection often include an unsatisfactory business credit score, insufficient business history, or a business model considered too risky by lenders. Factoring, however, evaluates the creditworthiness of your customers, not just your business, which can significantly increase your chances of obtaining finance swiftly. Additionally, this financing method strengthens your business’s cash position, enabling you to meet urgent financial needs such as payroll and inventory purchases without the typical stress of loan repayments. With the right factoring partner, your business can also avoid the common pitfalls of poor credit management while ensuring you have the funds to invest in growth initiatives like hiring new employees or expanding your customer base.

Request a Complimentary Factoring Quote

If your SME has been denied a bank loan or you’re trying to increase approval odds, invoice factoring can provide you with debt-free working capital. To learn more or get started, request a complimentary factoring quote.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778