Invoice Factoring vs. Bank Loan: What’s the Difference?

If you’re new to invoice factoring, comparing it to something you’re already familiar with, such as factoring vs. bank loan, can make the information easier to relate to and digest. We’ll use that approach on this page, walk you through how each works and quickly compare factoring vs. traditional bank loans so it’s easier to see how they fit into your business funding plans.

How Invoice Factoring Services Work

Invoice factoring is like getting a cash advance on your unpaid invoices. Instead of waiting weeks or months for your clients to pay their outstanding invoices, you sell them to your factoring company at a slight discount. The factoring company then sends you up to 95 percent of the invoice’s value right away, then sends the remaining balance minus a nominal factoring fee of one to five percent of the invoice’s value when your client pays.

The amount of your factoring advance largely depends on the size of your invoice. Some factoring companies work with businesses that have invoices worth just a few thousand dollars, while others can help even if your invoices reach $500,000. If you’re looking for invoice factoring services in Toronto, partnering with a local provider can ensure faster processing and personalized financial solutions tailored to your business needs

Invoice Factoring vs. Invoice Financing

Sometimes, invoice factoring is confused with invoice financing. However, an invoice financing company doesn’t purchase your invoices. Outstanding invoices are used as collateral on a loan that your business must pay back.

Invoice Factoring vs. Merchant Cash Advance (MCA)

Factoring is also sometimes lumped in with merchant cash advances (MCAs). Although an MCA also provides a cash advance on receivables, it leverages your future credit card sales. A portion of your credit card sales is held back each day until your balance is repaid.

How Traditional Loans Work

Traditional business loans are among the most common financing options. In these cases, you apply for the loan and, if approved, receive a lump sum of cash weeks or months later. You then pay the bank loan back over a period of months or years. Payments include a portion of the principal plus fees and interest.

A typical bank loan provides around $500,000 in funding, though some specialized funding solutions cover up to $10,000,000.

Key Differences: Invoice Factoring vs. Bank Loan

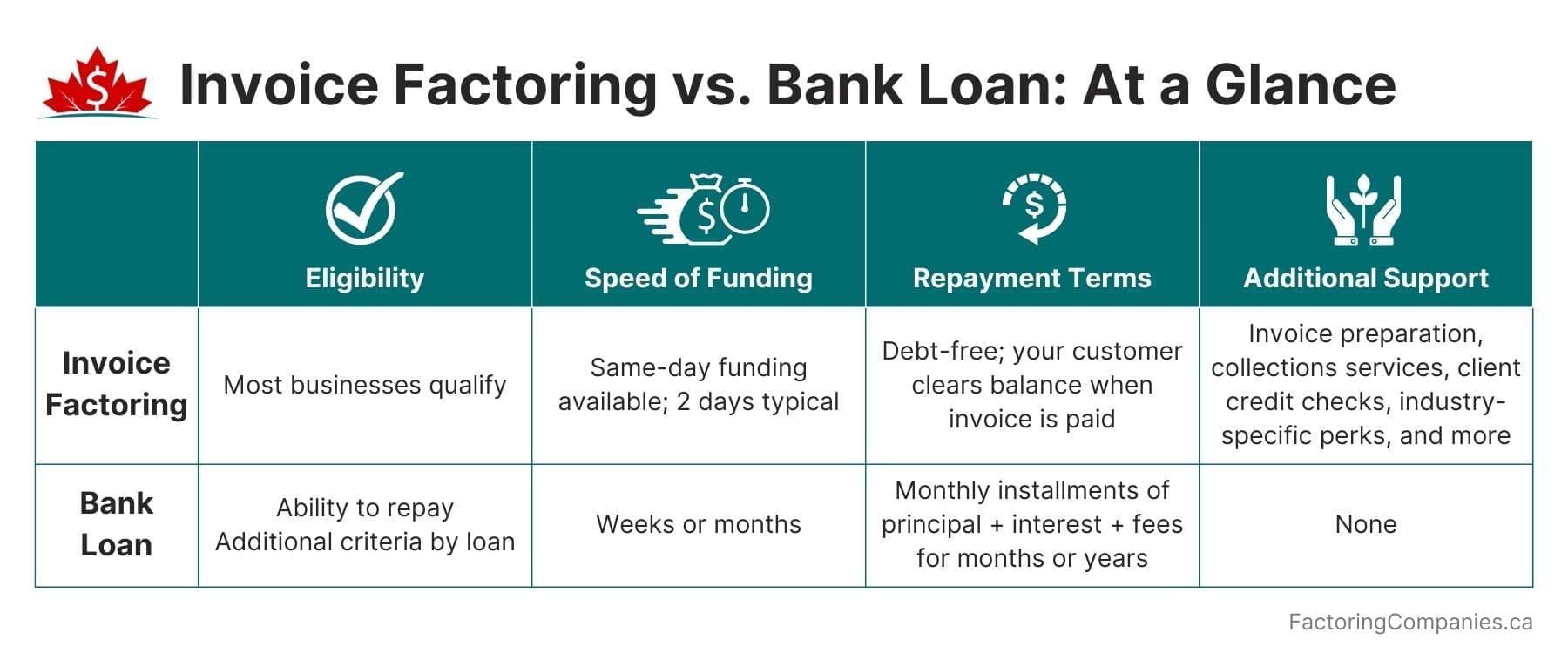

Now that you have the background, let’s dig into a factoring vs. bank loan comparison so it’s easier to see how they differ.

Eligibility Requirements

One of the key distinctions between factoring and bank financing is the eligibility requirements. Whereas a bank will look at your credit score, time in business, and other things that measure your creditworthiness, factoring companies aren’t concerned with this because your client is the one paying the balance when they pay their invoice. You can qualify for factoring even if you operate a startup or have bad credit.

Approval Process

Banks require a lot of documentation as part of their approval process, and it can take weeks or months before you know if you’re approved. Factoring companies only need a few standard financial documents and typically approve applicants within a day or two—some even process applications on the day they’re received.

Speed of Funding

An important consideration for most businesses is how quickly they’ll have access to cash. With a bank, you may wait weeks or months after applying before you receive your cash. Conversely, you’ll usually have your factoring cash in your bank account within two business days of submitting an invoice. Some factoring companies even offer same-day funding, which is incredibly helpful for businesses that need the cash for urgent expenses such as payroll and inventory.

Repayment Terms

There’s nothing for your business to pay back when you leverage invoice factoring. Your client takes care of it when they pay their invoice.

With bank loans, the principal and any interest and fees are typically paid back in monthly installments. Short-term loans usually have three to five-year repayment windows, while long-term loans usually max out at around ten years unless real estate is involved. Interest rates typically hover around 3.5 to four percent but climb over six percent at times, according to Statistics Canada.

Flexibility and Scalability

Because bank loans are paid out in a lump sum, you're limited to what you receive at the onset of your loan. Invoice factoring is flexible. You choose which invoices you want to factor. The amount you receive grows alongside your volume and invoice value.

Impact on Credit

Credit considerations are often overlooked when comparing invoice factoring and bank loans. Bank loans have a mostly positive impact on your credit rating, provided you pay your installments on time. However, your credit will take a hit when the initial credit check is performed, and you may see a decline in your score as your debt ratio increases.

With invoice factoring, your credit score doesn't take a hit at the onset. It also doesn't create debt, so your score doesn't decline due to a high debt ratio. Instead, many businesses see a credit score increase because they're better positioned to pay their existing debt.

Control Over Customer Relationships

Sometimes, business owners favour bank loans because they worry invoice factoring will impact customer relationships. In reality, you still have total control over which clients you work for and how much trade credit you extend to them. However, your factoring company may not factor specific invoices if your client is likely to default because you've exceeded guidelines designed to minimize risk.

The other time this concern comes into play is during the collections process because the clients send their invoice payments to the factoring company rather than the business. It's important to note that factoring companies are not collection agencies. Therefore, they approach collecting balances from a customer service standpoint. They want your customers to be happy and to keep working with your business, so you continue to work with them. That means they'll go the extra mile to ensure your clients are taken care of and often offer services like online payments that make managing their accounts easier.

Additional Services and Support

It's very uncommon for banks to provide any kind of support services beyond helping you keep up with your loan payments after they've provided you with a loan. Invoice factoring companies don't see it the same way. They're more likely to become invested in your growth and help as much as they can. In addition to collecting on invoices, factoring companies sometimes prepare invoices. May offer additional funding solutions, such as asset-based loans, commercial credit cards, and equipment financing, to help as your business needs change. Many factoring companies offer industry-specific perks that cater to unique business needs. For instance, construction factoring companies provide solutions tailored to address cash flow gaps caused by delayed project payments and upfront material costs. You may also qualify for additional industry-specific perks. For instance, freight factoring companies sometimes provide fuel discount cards and access to load boards.

Invoice Factoring vs Bank Loan: Choosing the Right Funding Option

Bank loans can work for some businesses that need long-term funding and qualify, but invoice factoring may be better for you if you:

- Need flexible or short-term funding.

- Have occasional cash flow shortfalls.

- Need cash quicker than a loan can provide.

- Don't have strong credit.

- Haven't been in operation long.

- Don't qualify for a loan.

- Want a funding partner that offers additional solutions and services.

Get a Free Factoring Quote

If invoice factoring sounds like it might be your ideal funding solution, we're happy to match you with a factoring company specializing in your industry that offers competitive rates. Request a free factoring quote to get started.

About Factoring Companies Canada

Related Articles

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK?

You can reach us at

1-866-477-1778

Get an instant factoring estimate

Factoring results estimation is based on the total dollar value of your invoices.

The actual rates may differ.

CLAIM YOUR FREE FACTORING QUOTE TODAY!

PREFER TO TALK? You can reach us at 1-866-477-1778